Your client is the CEO of Wiehle, a major household appliance manufacturer. It has been decided that a coffee machine should be added to the product line. The question is how this coffee machine should be designed: either to exclusively use Wiehle pads or to be compatible with the pads of existing third-party providers as well?

Case Prompt:

Sample Structure

The structure should be clear and non-redundant. Customers, the product, and competition (both for coffee machines and pads) are relevant factors, all considered against the backdrop of profit, which necessitates calculating revenue and costs.

I. Structure

How would you structure the query?

Information that can be provided to the candidate upon request:

- The goal is to maximize profit over 2 years.

- A patent cannot be obtained for the type of pads used in our machine.

- Third-party providers are very aggressive and proactive in adapting.

- Machines typically last for 5 years on average and are rarely replaced before then.

- Expertise for both products is available.

- There is an ample supply of third-party pads; scarcity is not an issue for customers.

- Geographically, the focus is on the German market.

- Sales are conducted both through retail stores and our own online shop.

- In both cases, it's essentially the same machine; the difference lies only in the pad holder.

- It can be assumed that we only sell pads to customers who use our machine.

By this point, the interviewee should inquire about the client's objective (maximizing profit over 2 years).

The structure should be clear and non-redundant. Customers, the product, and competition (for coffee machines and pads) are relevant factors, all considered against the backdrop of profit, for which revenue and costs must be calculated.

II. Explain forecast

What explanations do you have for the tables provided?

It's important that the interviewee has understood the situation. The client manufactures both the coffee machine and the pads. The question is whether to design the coffee machine so that initially only the client's own Wiehle pads can be used or those from other manufacturers as well.

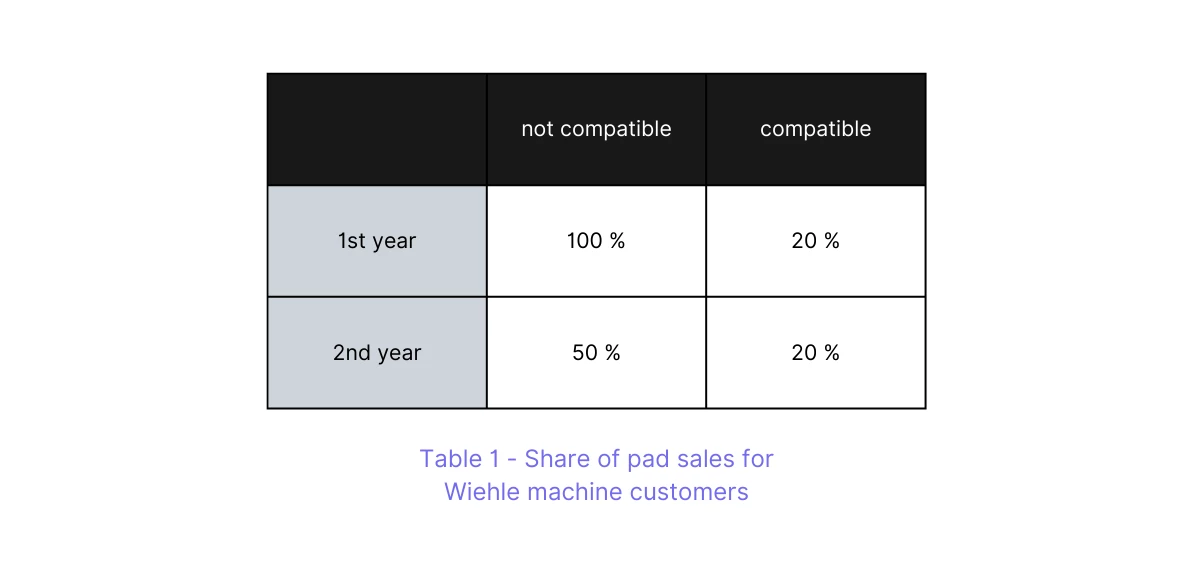

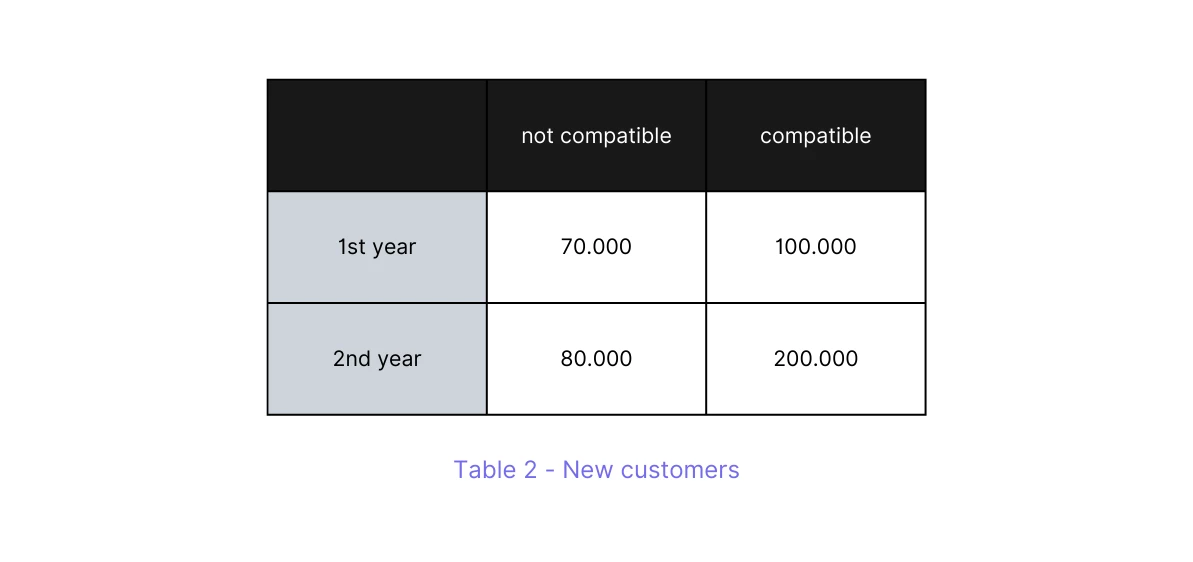

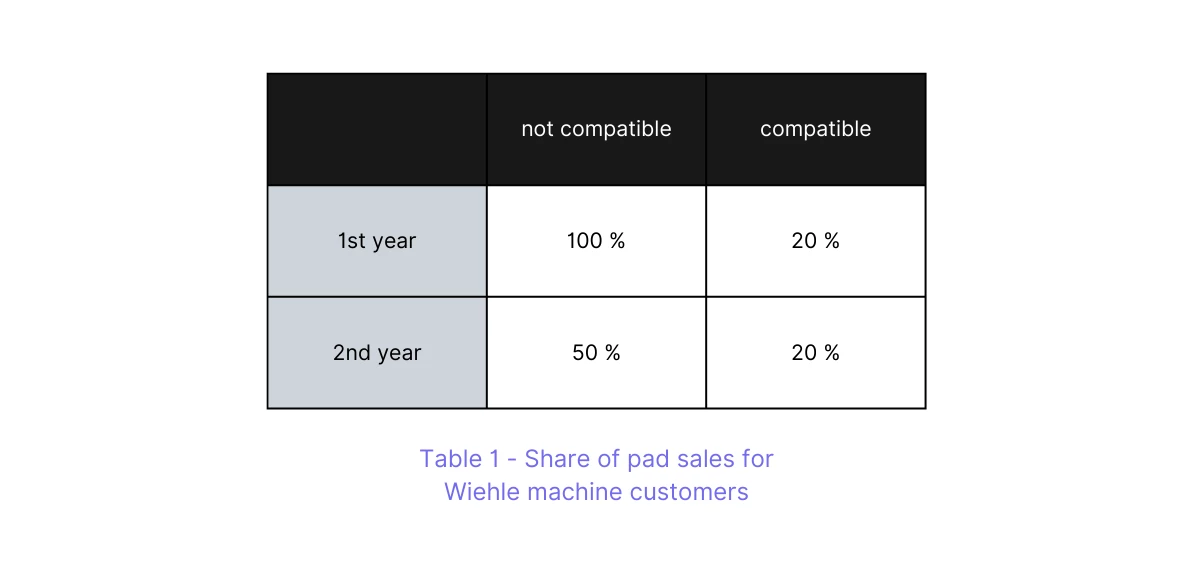

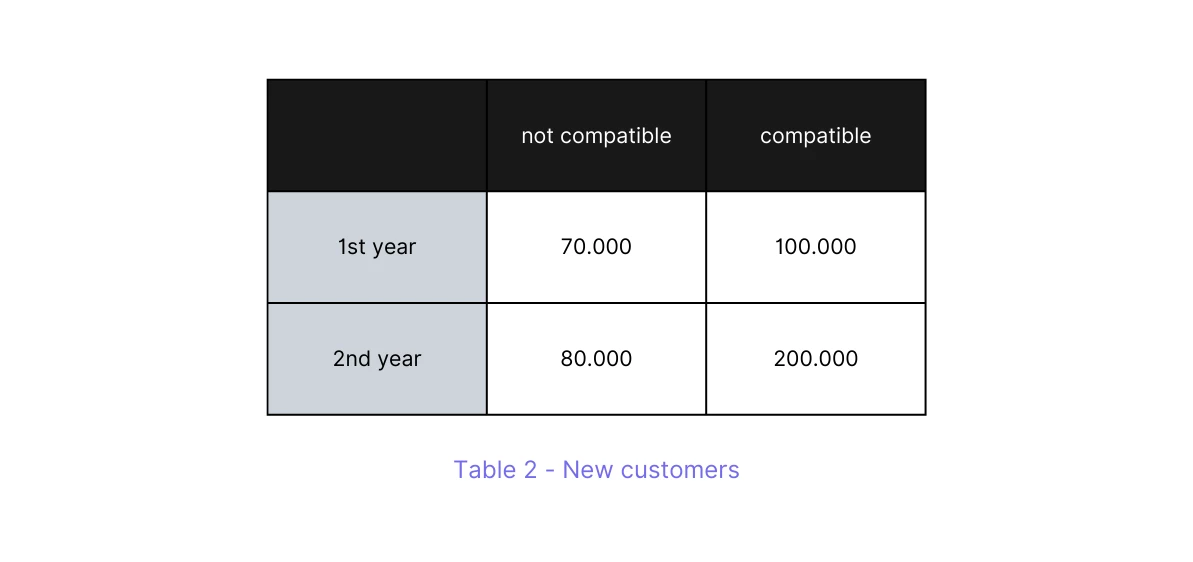

Share Table 1 and Table 2 with the candidate.

Regarding the number of new customers, it can be observed that the compatible variant sells twice as much during the considered period. Since the machines do not differ except for compatibility, this aspect seems to be important to customers.

Regarding the forecasted share of pad sales, it is noted that in the first scenario, it halves from 100% to 50%. This can only be explained by the fact that in the second year, pads are also offered by other providers. In the compatible scenario, a constant share of 20% can probably be achieved over both years.

III. Profit comparison

In which scenario will the client make more profit?

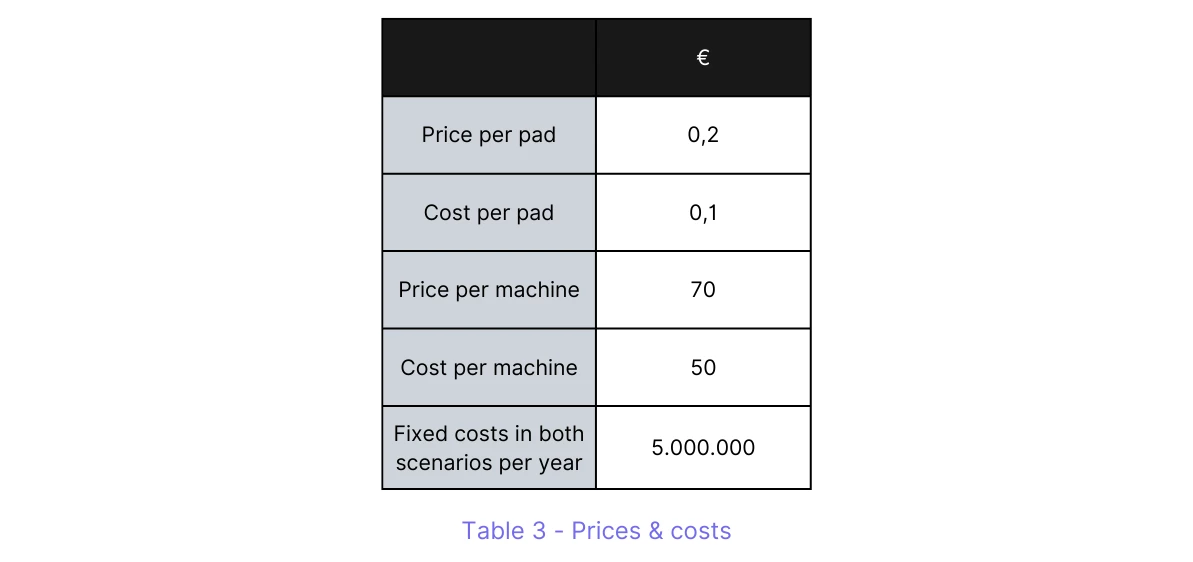

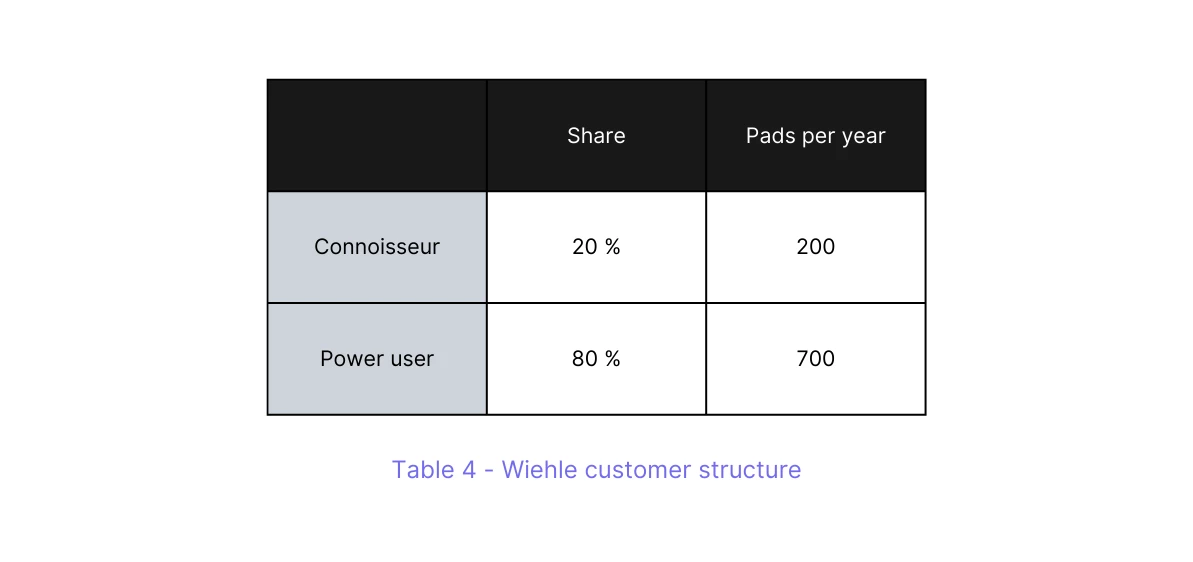

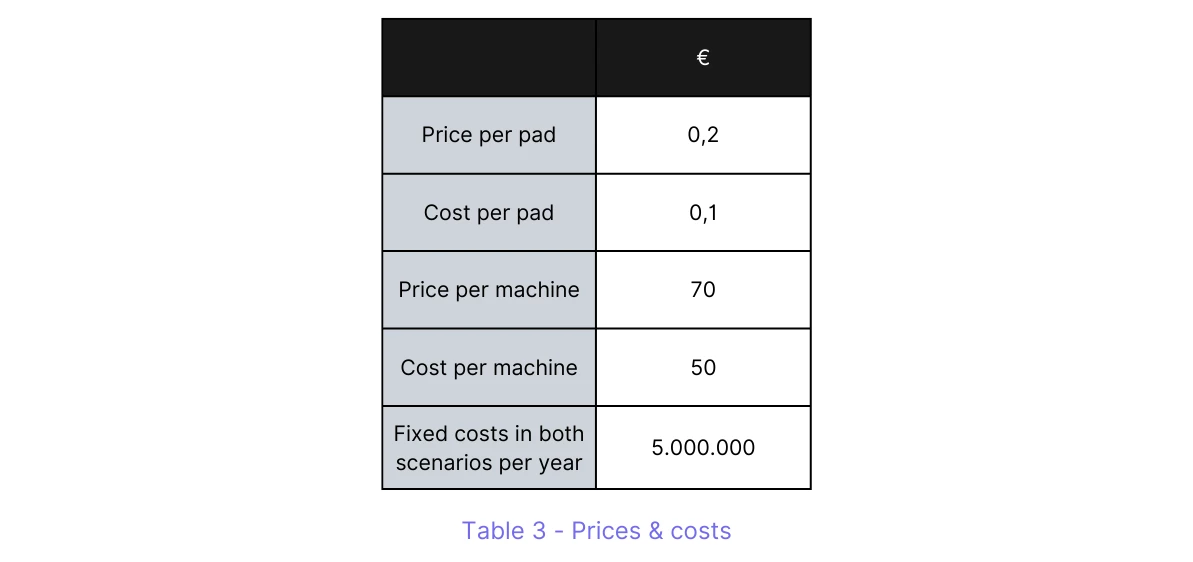

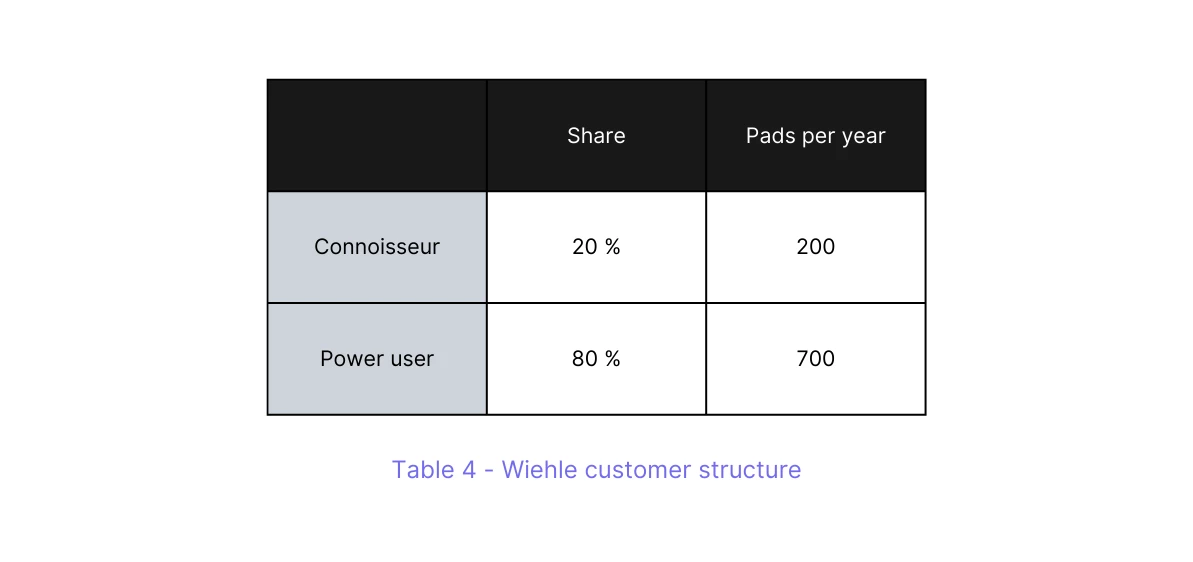

Share Table 3 and Table 4 with the candidate.

Note in the following calculation: Machine buyers in the first year purchase pads in the first and second year.

From Table 3, the interviewee can calculate the contribution margins (CM) per pad and per machine as follows:

CM per machine = €70 - €50 = €20

CM per pad = €0.2 - €0.1 = €0.1

From Table 4, the interviewee can calculate the average annual pad consumption of our coffee machine customers as follows:

20% * 200 Pads + 80% * 700 Pads = 600 Pads are consumed on average per year per coffee machine customer.

€20 * (70,000 + 80,000) = €3 million

… From new customers in the 1st year: 70.000 * 600 * 100% * €0.1 = €4.2 million

… From new customers in the 2nd year: 80.000 * 600 * 50% * €0.1 = €2.4 million

… From existing customers in the 2nd year: 70.000 * 600 * 50% * €0.1 = €2.1 million

= CM from machines + CM from pads

= €3 million + (€4.2 million + €2.4 million + €2.1 million)

= €3 million + €8.7 million

= €11.7 million

To obtain the profit, fixed costs still need to be subtracted.

2-year profit = 2-year CM - 2 * fixed costs per year

= €11.7 million - 2 * €5 million

= €1.7 million Projected profit over 2 years when starting with Wiehle coffee pads only.

It would be highly desirable if the candidate recognizes and emphasizes that the majority of the profit is generated through the sale of the pads, not the sale of the machines.

€20 * (100,000 + 200,000) = €6 million

… From new customers in the 1st year: 100.000 * 600 * 20% * €0.1 = €1.2 million

… From new customers in the 2nd year: 200.000 * 600 * 20% * €0.1 = €2.4 million

… From existing customers in the 2nd year: 100.000 * 600 * 20% * €0.1 = €1.2 million

= CM from machines + CM from pads

= €6 million + (€1.2 million + €2.4 million + €1.2 million)

= €6 million + €4.8 million

= €10.8 million

To obtain the profit, fixed costs still need to be subtracted.

2-year profit = 2-year CM - 2 * fixed costs per year

= €10.8 million - 2 * €5 million

= €0.8 million Projected profit over 2 years with compatible variant.

Over a period of 2 years, "Scenario 1: Starting only with Wiehle coffee pads" forecasts a profit of €1.7 million, thus €0.9 million more than the compatible variant. The lower number of machine sales is offset by the high revenues from pad sales.

IV. Risks

How many risks does the decision for the non-compatible option entail?

- The adaptation of external pad providers could happen faster than anticipated.

- Sales figures might be lower than planned, as compatibility may be more important to customers than estimated. This would impact both machine and pad sales.

- Reduced market power due to fewer customers.

- Less potential for economies of scale in machine manufacturing.

- …

V. Third year

Without making precise calculations: What outcomes do you expect for the two scenarios in the third year?

The question does not call for quantified answers; rather, it is about the candidate demonstrating an understanding of the current trends. For instance, the accumulation of existing customers.

The sales of the pads will gain weight over time as the number of existing customers increases with each year, at least in the first 5 years. Of these, the compatible variant already has twice as many in the 3rd year.

The percentage share of pad sales in Scenario 1 will most likely converge towards 20%, at least there is no indication to think otherwise.

Also, concerning new customers, the compatible variant is ahead. Both the growth rate and the absolute numbers suggest that the number of new customers in the 3rd year will be larger again in Scenario 2. If market saturation were foreseeable, this forecast could change.

In summary, it can be said that in the medium term, the compatible variant (Scenario 2) will economically dominate.

VI. Concluding Recommendation

What is your recommendation regarding the original question?

The client's objective is to maximize profit over 2 years. In this context, the candidate should recommend the non-compatible variant and justify it. Additionally, it can be pointed out that there are risks and/or the presumed dominance of the compatible variant from the 3rd year onwards.

Further Questions

What is the profit margin of scenario 1 in the first year?

What is the profit margin of scenario 1 in the first year?

Coffee pads

i