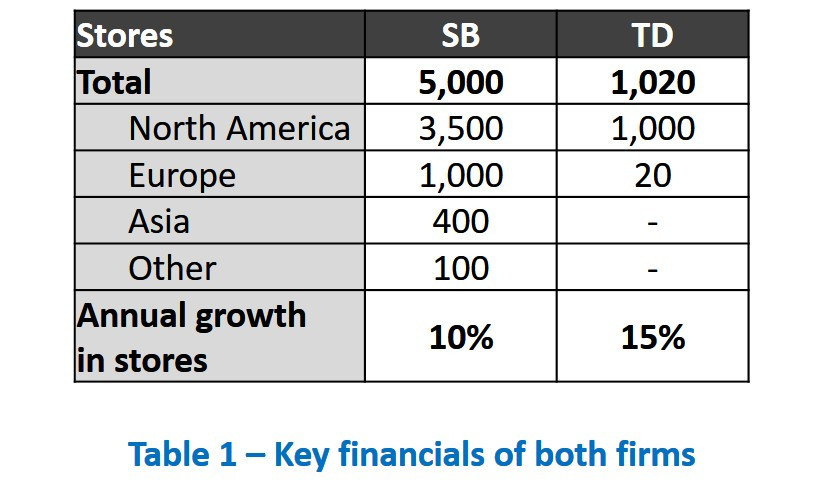

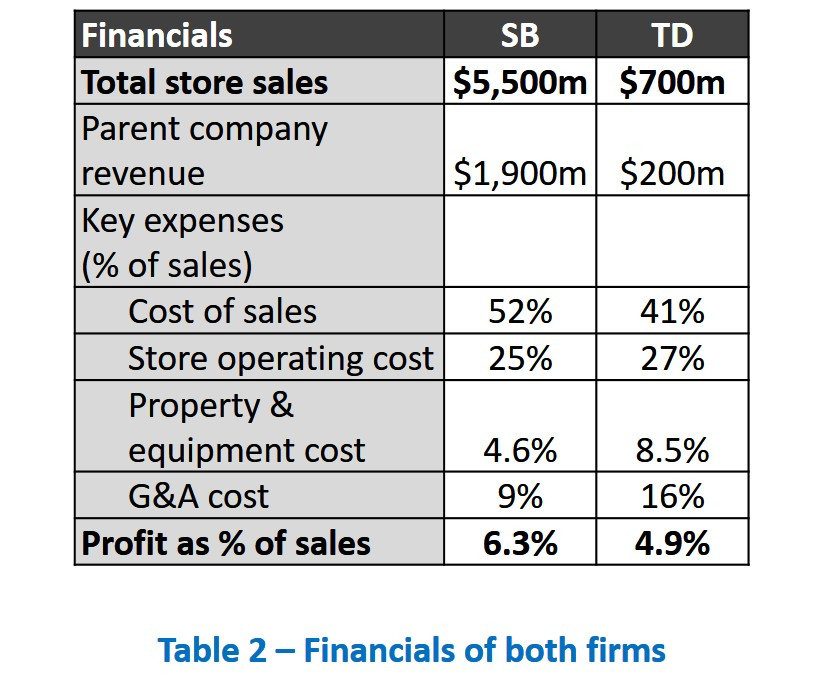

Our client is SuperBurger, a fast food chain that operates in the same class as McDonalds, Wendy's, Burger King and so on. They're the fourth largest fast food chain worldwide in terms of number of stores in operations. SuperBurger owns some of its stores, but 85% of its stores are owned by franchisees. As part of its growth strategy, the company has analyzed some potential acquisition targets including Tasty Donuts which is a growing doughnut producer active in the US and internationally.

The client asked us to help him decide whether he should acquire the company or not.

SuperBurger

i