McKinsey Case: Digital & Vegan Restaurant Franchise

Our client is a European venture capital firm. They are potentially interested in investing into a new restaurant franchise player from Austria, called “VegDigi”. VegDigi has just 3 corporate restaurants in Vienna and no franchisees, yet, but their business model is considered innovative for a restaurant industry, and is based on 3 pillars:

- Proprietary IT system – VegDigi’s team has developed their own IT system (which manages all restaurant processes – from cashier desk and employee schedules to inventory management and delivery).

- Innovative vegan menu – VegDigi offers fresh, whole-foods vegan menu, which differentiates itself from the rest of the fast food offering in taste and quality. VegDigi puts a lot of focus on its foods being healthy.

- Transparent business practices and processes – VegDigi prouds itself to be a transparent business, meaning they publish all their data and talk about their success and failures openly online.

Our client has engaged us to help them to determine whether or not to make an investment into the VegDigi.

Case Comments

Question 1 – Structuring

What do you think are key factors which would influence how VegDigi will perform economically in the next 5 years?

Question 2 – Exhibit

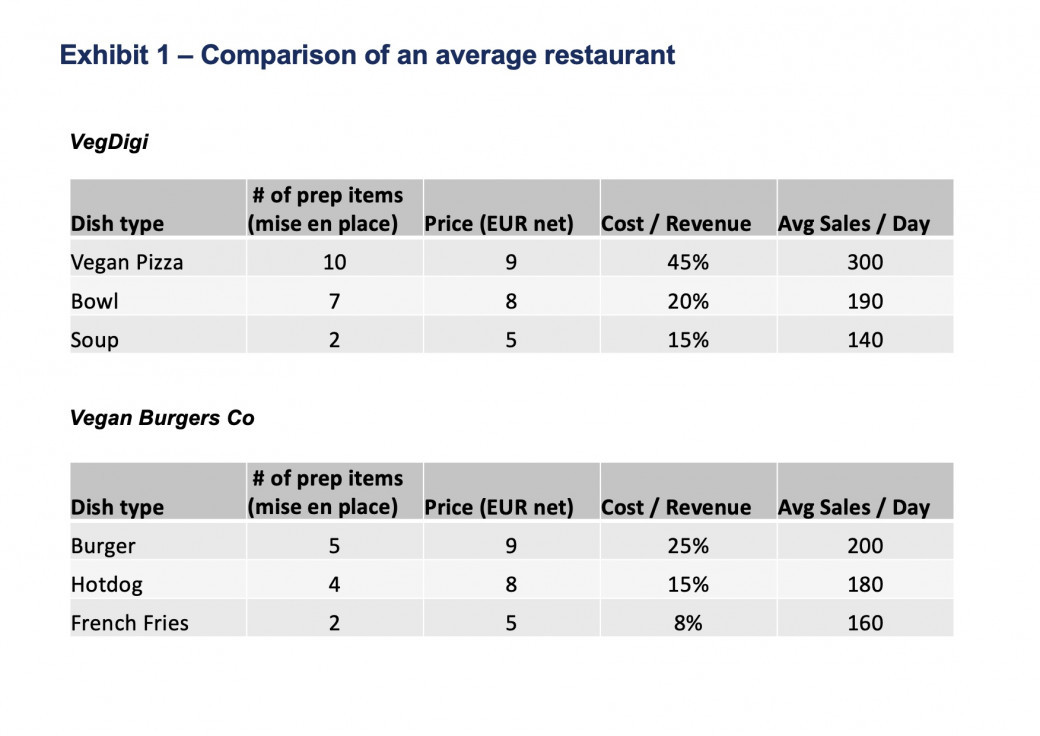

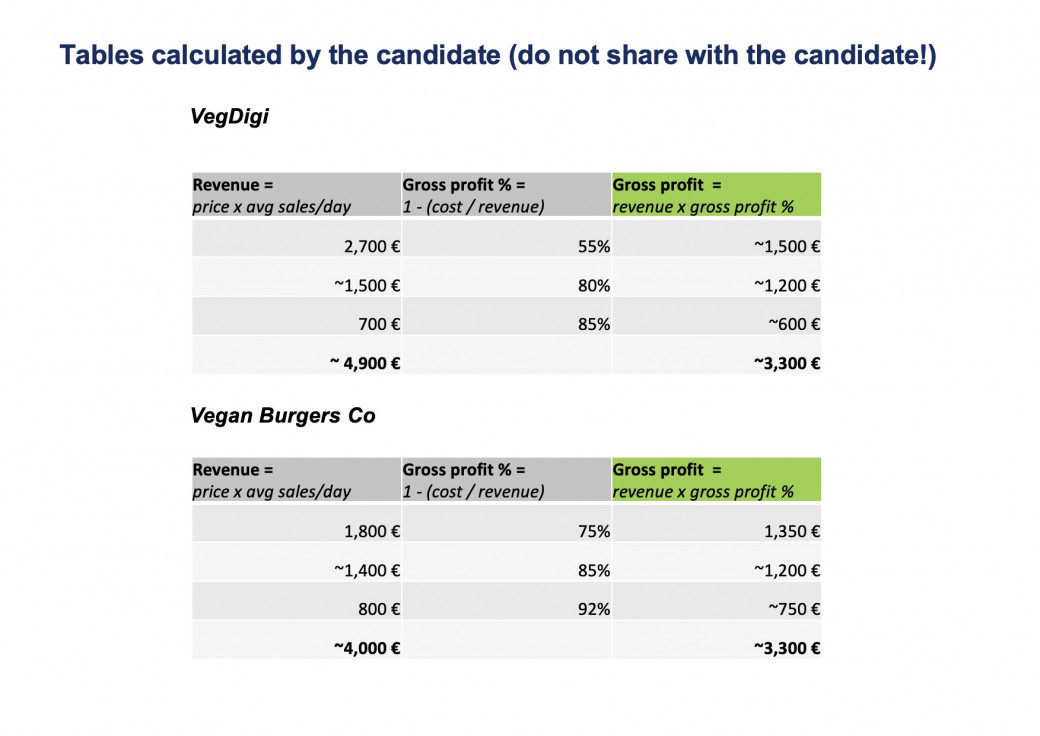

Here is some data we got from the client about our target and the target’s competitor. Can you take a look at the table and tell me which insights you can draw from it?

Question 3 – Math

Final question – Summary

Imagine this was your first day on the project. Your client, the CEO of the venture capital firm comes into the room, can you please summarize your interim results?

Further Questions

How shall VegDigi organize its franchising model? Shall it organize a "factory kitchen" and sell ingredients (e.g. pizza dough, sauces) and drinks to franchisees or shall it play a role of an intermediary between its franchisees and suppliers of ingredients? What are the benefits and the drawbacks of both models?