Our client, Vets2U, a well-established organization that runs ten Mobile Veterinary Clinics (MVC) in the US, has witnessed a concerning trend of stagnant revenues of $100M over the past few years. In light of this issue, the CEO of Vets2U has brought us in with the goal of increasing revenues by 25%.

Case Prompt:

Sample Structure

An optimal framework here is as follows:

Launch Additional Clinics – Offer the same services as we currently do, but launch more clinics. This could be within the West Coast or elsewhere (Rest of US, Canada, etc.)

Grow Revenues from Existing Clinics/Offering – Find ways to optimize what we currently do. This could be by charging more/less, driving more customers in, more optimally locating our centers, etc.

Introduce New Products/Services – With the clinics we currently have, we can offer additional services within the Vet centers (surgeries, treatments, animals served, etc) or additional products (pet food, post-surgery care, etc.) or even parallel services (virtual consultations, consulting services to other clinics, etc.)

Inorganic Growth – We can buy a competitor or buy a player in a related field. Here, we can essentially pay for growth

Section One – Additional Centers

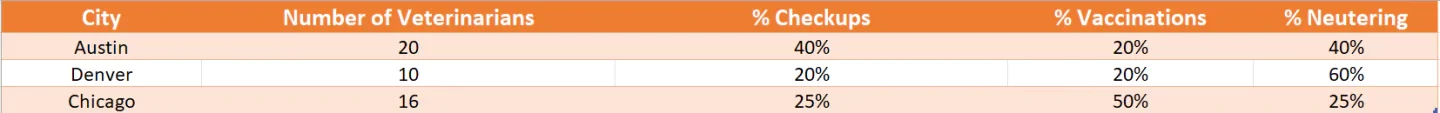

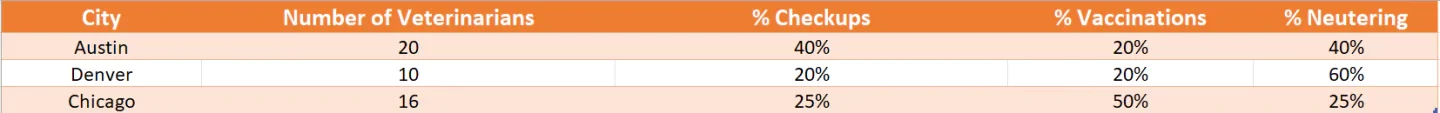

If the candidate asks about the option to launch additional mobile clinics, inform them that we are indeed thinking about launching 1 additional clinic. We are debating between three clinic options: Austin, Denver, and Chicago.

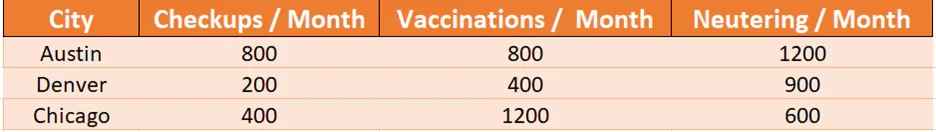

In these centers we offer checkups, vaccinations, and neutering services. Each veterinarian on site specializes in a particular offering. If we launched in Austin, we would have 20 veterinarians. In Denver we would have 12. In Chicago we would have 16.

Next:

The candidate should recognize that there is no point in calculating anything at the moment, as they would not get revenues from these numbers.

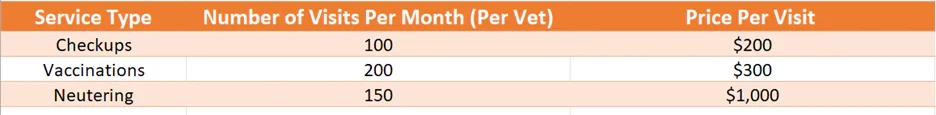

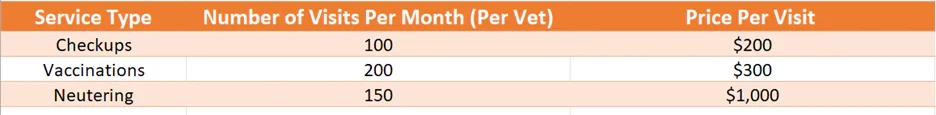

An optimal candidate would ask for data helping them to calculate revenues, in particular any information around how much revenue each service/veterinarian type would bring in. Once they have asked for this information in the right way you can provide them with the following information.

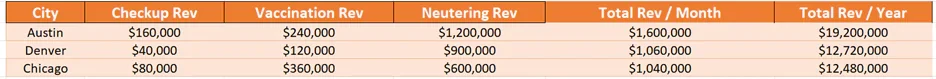

The candidate should set up a formula to calculate the revenue per center. This can be done by calculating the annual revenues for each service type in each city.

For a service type + city combo, the formula is: Number of Veterinarians * % service type * number of visits per month * price per visit * 12 months.

The candidate should note that the city center with the highest revenues is Austin, and therefore we should look to launch there.

Section Two – Additional Centers

An optimal candidate with recognize two things:

- Revenues of $19.2M falls short of our target of $25M

- We can neither conclude the case nor leave the topic of “additional centers” until we have exhausted all options

The true test of case leadership will be that the candidate understands both of the points above.

If the candidate does not understand the above, hint/prompt them to this understanding.

An optimal candidate needs to ask the following questions before moving on in the case.

Question 1: Given we are just under $6M short of our target with Austin, is there anything we can do to drive revenues a bit higher for Austin? This could be by, for example, bring in more vets, running more services per month, or similar?

Answer: No

Question 2: Are we only able to launch 1 additional vet clinic?

Answer: Yes

Question 3: Are there any other city options available to us?

Answer: No

An excellent candidate will ask all 3 of the above (or combine them) before moving forward in the case.

Section Three – New Products / Services

Since the candidate recognizes that only launching an additional service center is not sufficient, they should drive towards additional solutions/options for driving revenue forward. If they ask for additional services and/or products that we could launch, inform them that we are considering implementing radiology and imaging services at our existing clinics.

Inform the candidate that each clinic would have 2 radiology vets running 50 imaging services per month at a rate of $500 per service.

The candidate should remember from the case prompt that we have 10 clinics currently.

As such, to calculate the revenues, they should do as follows:

2 radiology vets per clinic * 10 clinics * 50 imaging services/month * $500 per service * 12 months = $6M in annual revenue

Final Recommendation

Recommendation

The candidate should recommend that we launch an additional vet clinic in Austin and also launch a radiology service at our existing 10 clinics. This would bring in $19.2M and $6M in annual revenues, respectively, bringing us to $25.2M, passing our target of $25M.

Risks

One major risk is that we would be launching this clinic outside of our current regional expertise (Austin = Southern US). Another is that we run the risk of over-crowding/overwhelming existing clinics.

Next Steps

To mitigate these risks, we should conduct due diligence in Austin to ensure we know the customer + competitive landscape are favorable to our launch. We should also run a radiology trial in one of our clinics first, and ensure our processes and operations are sufficiently set up to handle the additional clinic load.

Without your consent we cannot embed YouTube videos. Click the button below and accept the marketing cookies to allow YouTube videos to be embedded.

By allowing this service, you consent, in accordance with article 49 paragraph 1 sentence 1 lit. a GDPR, to your data being processed in the USA. The USA is not considered to have adequate data protection legislation. Your data could be accessed by law enforcement without prior public trial in court. You can change your settings regarding consent to external services at any time in our Cookie and Privacy Settings.

BCG + Bain - Vets2U - Healthcare Based Case WITH VIDEO SOLUTION

i