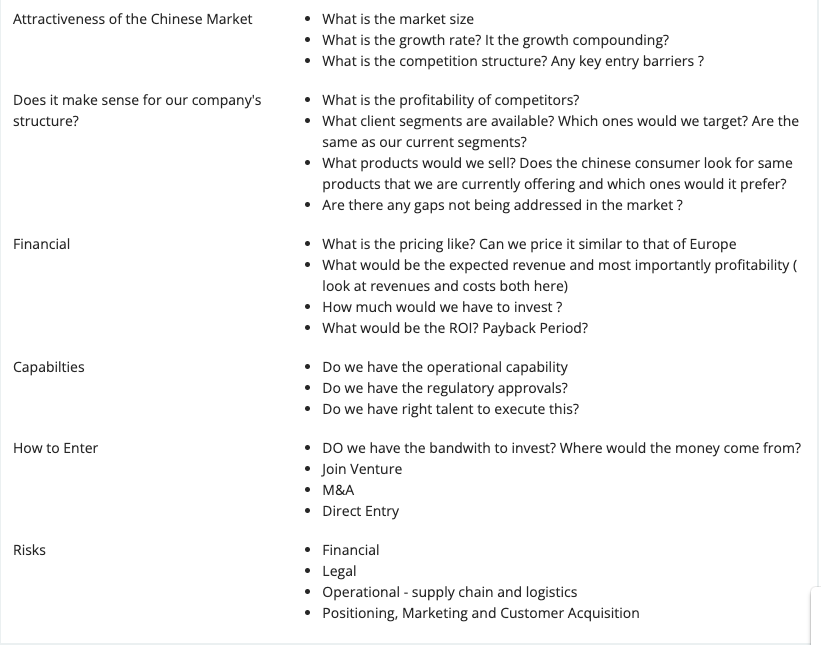

I was working on a market entry case for a European Company to enter the Chinese Market due to saturation in Europe - is this structure strong?

What changes should I make? Also, I have not been using frameworks but trying to create my own - but I was wondering if the Company, Customer, Product and Competition would be more mutually exclusive here?

Any suggestions/feedback are welcome!