Hi!

I would appreciate if someone could help me with this question. (it's from a Bain sample case)

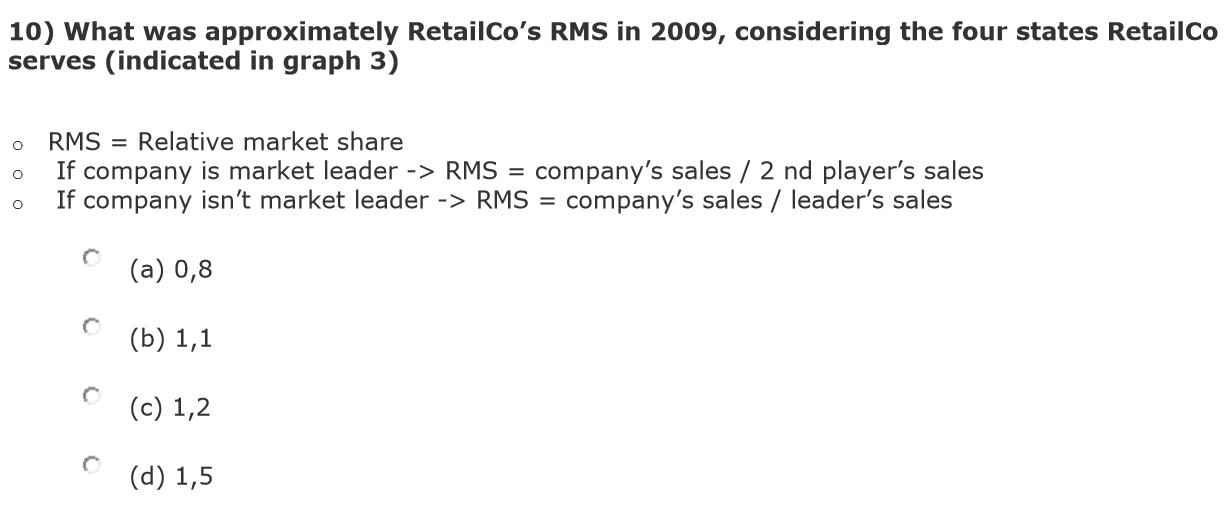

I've attached the chart (which has all the info needed) and the question.

The answer is 1,2 but I can not come up with that number! if anyone could give me a hint..

Thanks!!!