What are some of the equations or formulas I can use to solve this question?

What are some of the equations or formulas I can use to solve this question?

Hi there,

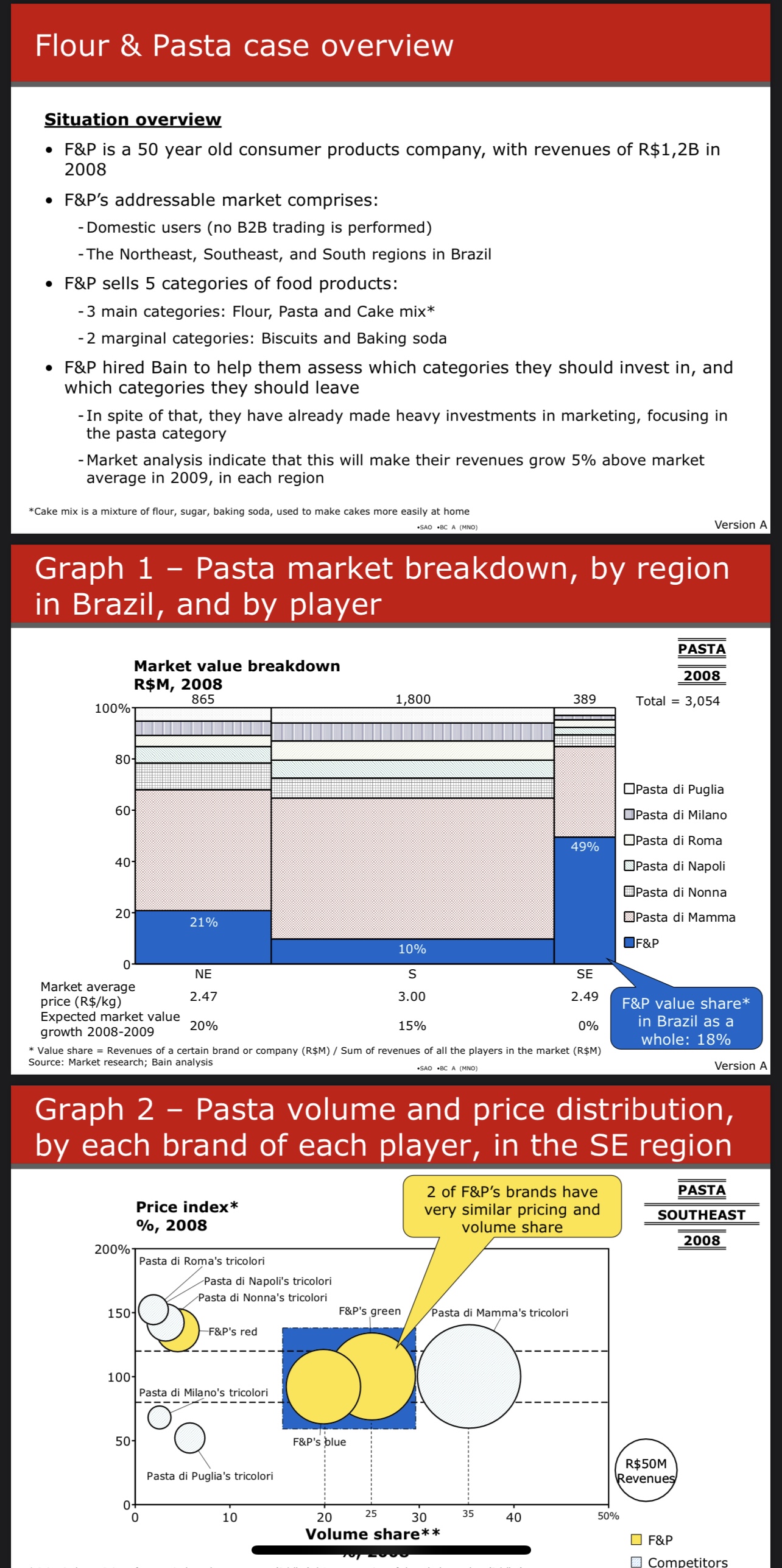

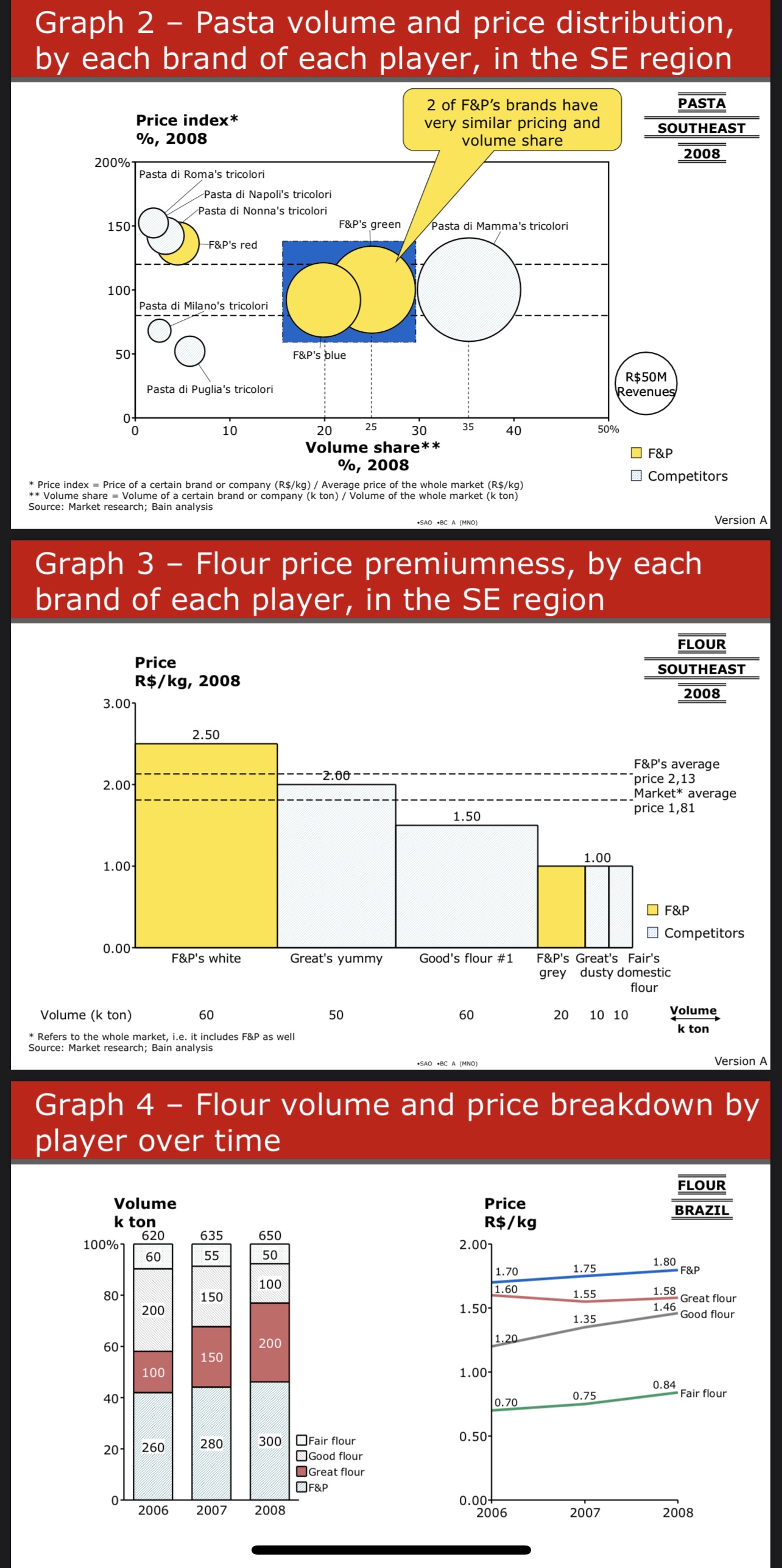

You can stick to the formulae provided in the prompt.

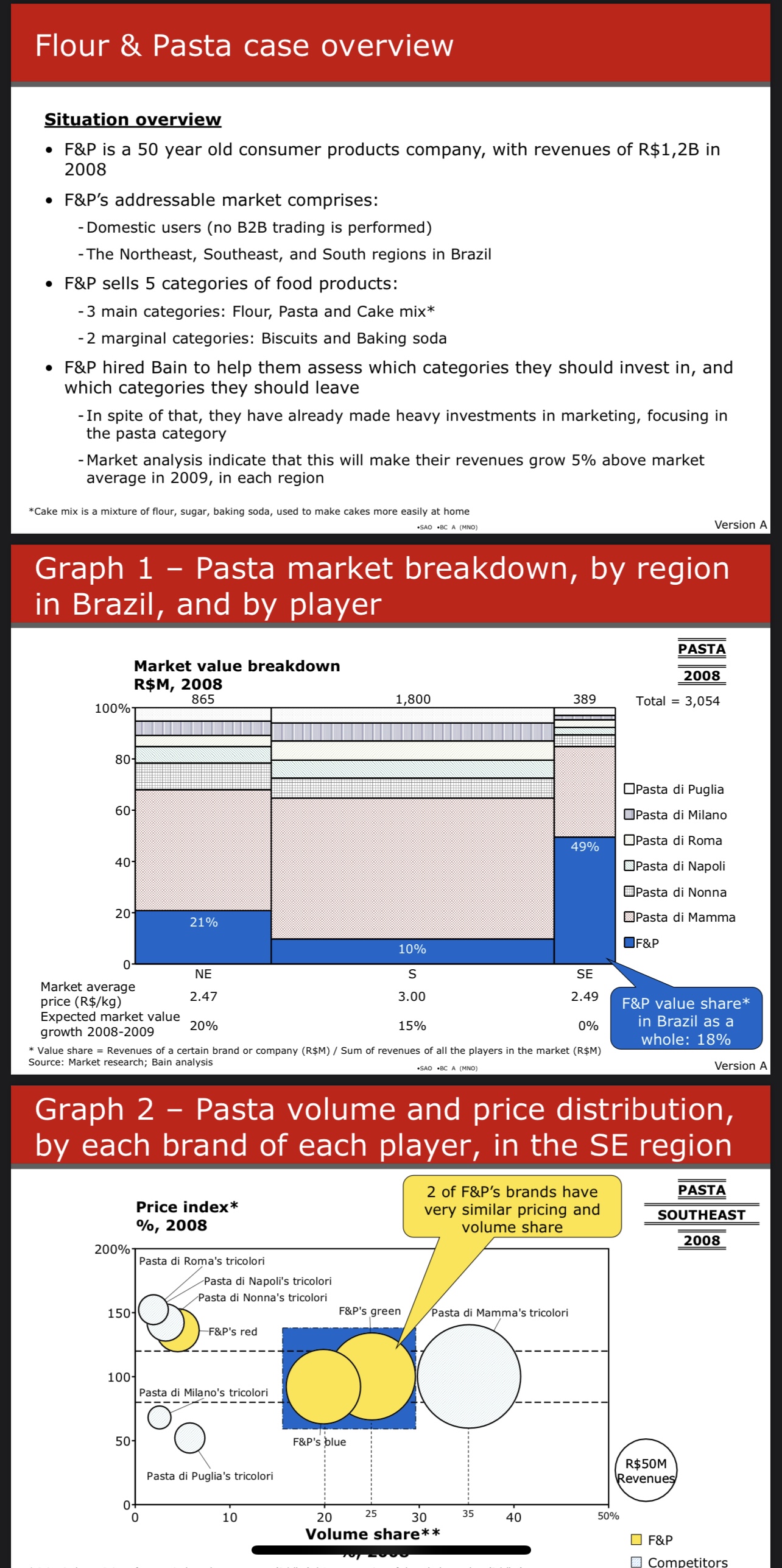

Here's how you can solve the problem, based on these formulae and the data provided in Graph 4:

As a short cut, you can simply also divide revenue of Market Leader / revenue of 2nd player to get the same result.

Hope this helps. Let me know in case you have further questions.

Regards, Andi

Hello!

Precisely for the high amount of questions (1) asked by my coachees and students and (2) present in this Q&A, I created the “Economic and Financial concepts for MBB interviews”, recently published in PrepLounge’s shop (https://www.preplounge.com/en/shop/prep-guide/economic_and_financial_concepts_for_mbb_interviews).

After +5 years of candidate coaching and university teaching, and after having seen hundreds of cases, I realized that the economic-related knowledge needed to master case interviews is not much, and not complex. However, you need to know where to focus! Hence, I created the guide that I wish I could have had, summarizing the most important economic and financial concepts needed to solve consulting cases, combining key concepts theorical reviews and a hands-on methodology with examples and ad-hoc practice cases.

It focuses on 4 core topics, divided in chapters (each of them ranked in scale of importance, to help you maximize your time in short preparations):

Feel free to PM me for disccount codes for the guide, and I hope it helps you rock your interviews!

Dear candidate,

I would stick to calculating RMS in their suggested way, as this seems to be there accepted definition. Please feel free to specify your question further.

Best regards