what does this mean? if 5 yr cagr = 9%, does this mean the growth rate for 5 years is going to stay at 9%?

5 yr compound annual growth rate

CAGR is Compounded Annual Growth Rate. It means:

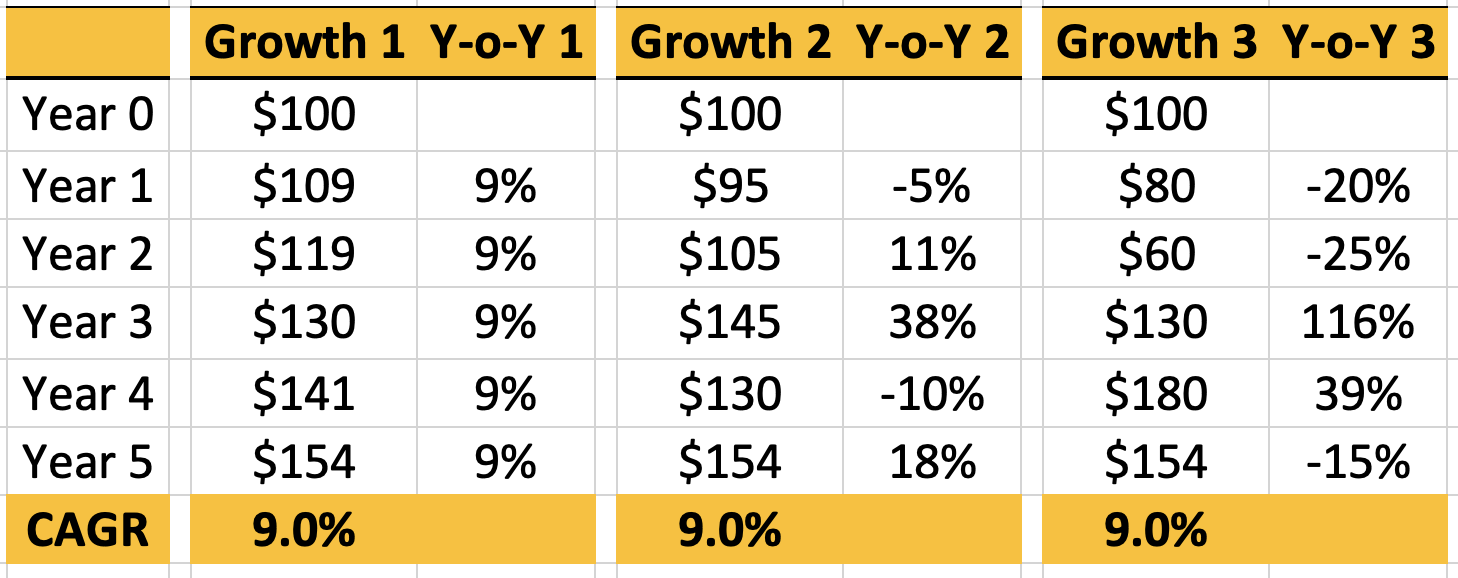

“what was the equivalent rate of growth G across X years, if the value grew by G% consistently across all X years”

Hence - CAGR only depends on the start and end points.

Here is an image showing 3 different types of growth - each with the same CAGR - but completely different growth pattern.

Hi there,

It means that each year, it will grow by 9%.

So, if I have $100 today, next year it will be $109. The following year it will be $118.81 (9% growth on the $109).

Make sense?

Hi there,

This is indeed an interesting question which is probably relevant for quite a lot of users, so I am happy to provide my perspective on it:

- First of all, I would advise you to read the articles on PrepLounge on the CAGR to understand the general concept.

- In your specific situation, it means that over the course of the last/ next 5 years, on average, the metric has increased/ will increase by 9% p.a. Still, the metric might increase by more or less than 9% - the CAGR simply helps you get a better feeling if volatility is high and you study a long period of time.

In case you want a more detailed discussion on what other mathematical concepts to know in preparation for your upcoming consulting interviews, please feel free to contact me directly.

I hope this helps,

Hagen

It means that the “average” rate in those 5 years will be 9%, but the rate in each year within those 5 years may be different (ex. 11%-11%-9%-9%-5.107%)

Hi!

Interesting question!

Have a look at the articles here on PrepLounge that give you more information about CAGR and other common mathematical/financial knowledge to have for your interview.

Best,

Anto

.