This is from a casebook on whether a zoo should buy a zebra. below is info on revenue and cost.

Revenue:

•300K people visit the zoo annually; admission is $15 per person

•Benefits from zebra acquisition could lead to increased attendance. Another zoo that acquired a similar zebra had an 8% increase.

Costs from zebra acquisition:

•Immediate costs: Acquisition cost ($235K), new facilities ($850K), transportation ($110K)

•Annual maintenances: Food, health costs, and additional trainers ($90K)

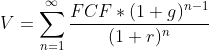

•Discount rate = 20%, Assume that the immediate costs are paid today, and annual costs and benefits are realized beginning next year and sustained into perpetuity, even though the Zebra will not live on to perpetuity.

The answer is this:

Annual benefits = (300K)*($15)*(0.08) = $360K

•Upfront costs = $235K + $850K + $110K = $1.195M

•Annual costs = $90K

•NPV = -$1,195K + (($360K -$90K)/0.20) = $155K

My question: shouldn't the NPV = -$1,195k + (($360k-$90k)/1.2)=-970k if the zebra will not live on to perpetuity?