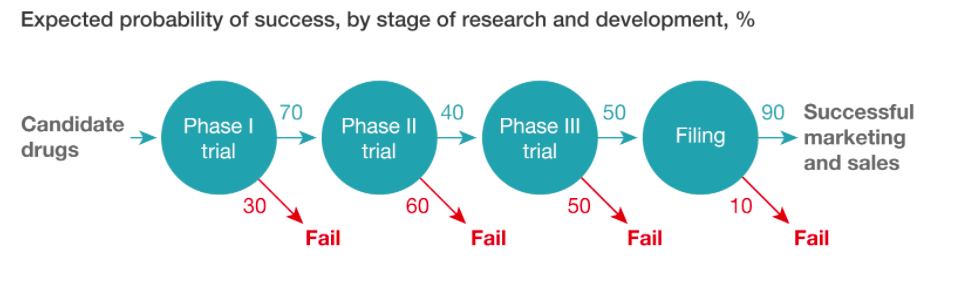

GlobaPharm (the client) believes that the likelihood of success of the new drug candidate can be improved by investing an additional $150 million in a larger Phase II trial. The hope is that this investment would raise the success rate in Phase II, meaning that more candidate drugs successfully make it to Phase III and beyond. By how much would the Phase II success rate need to increase in order for this investment to break even? assume that if the drug is successfully marketed and sold, it would be worth $1.2 billion (that is, the present value of all future profits from selling the drug is $1.2 billion).

Answer: Probability of success should increase by 40 percentage point (i.e change from 40% currently, to 80% )

How can you get this answer? I didn't find the solution very intuitive to follow.