Picture 1 (fireproof)

Picture 2 (Big Shot 2020)

Picture 1 (fireproof)

Picture 2 (Big Shot 2020)

Hi,

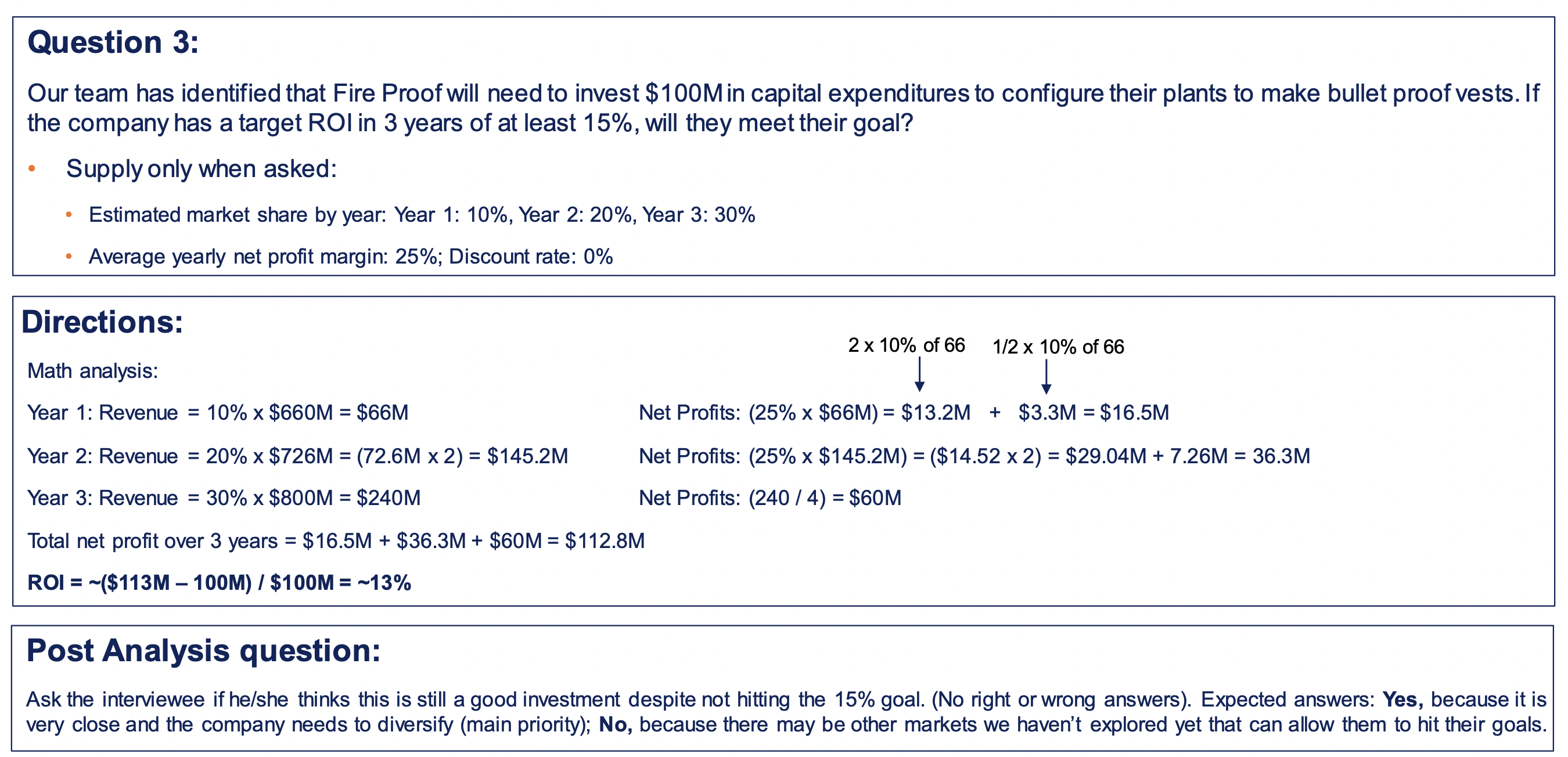

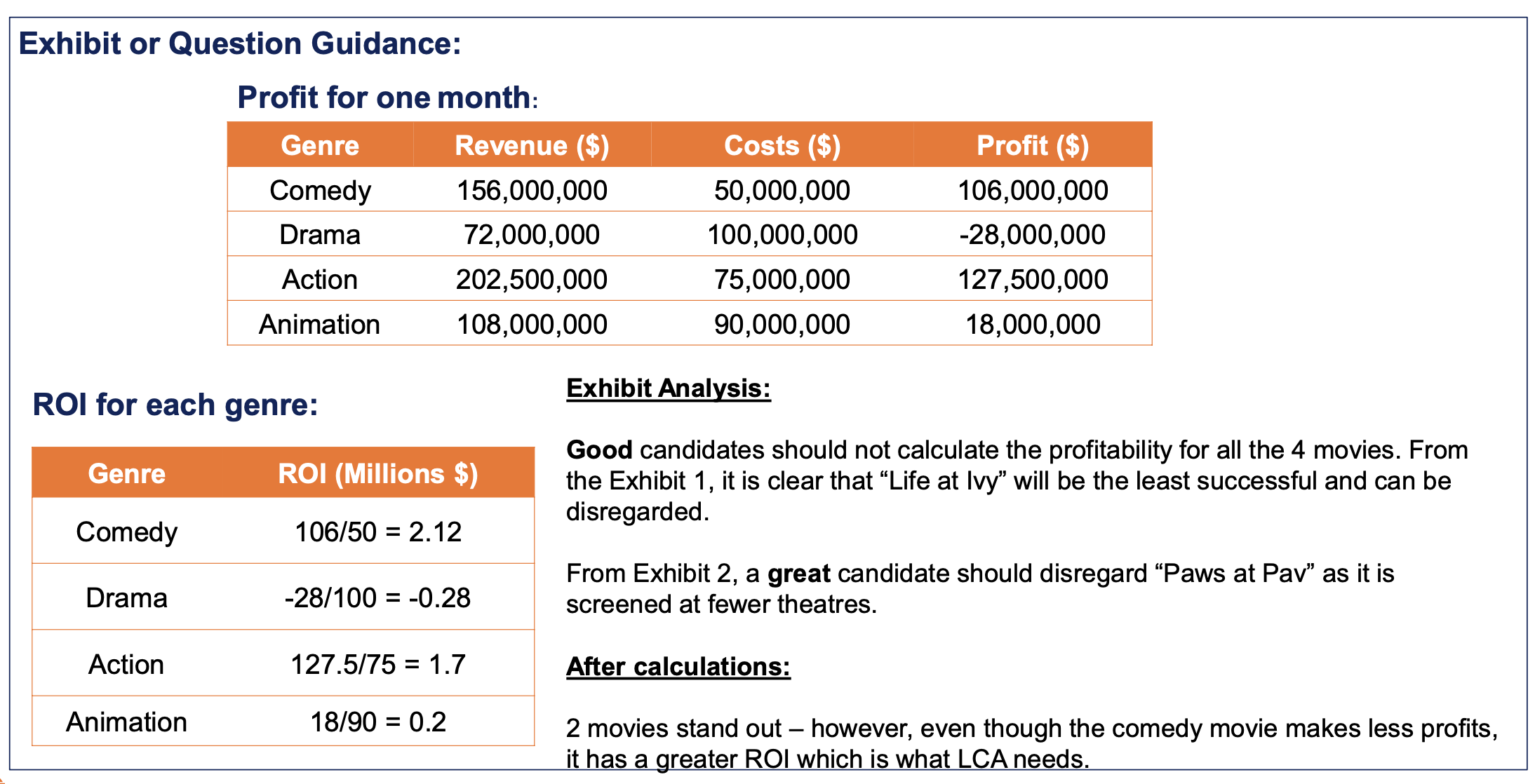

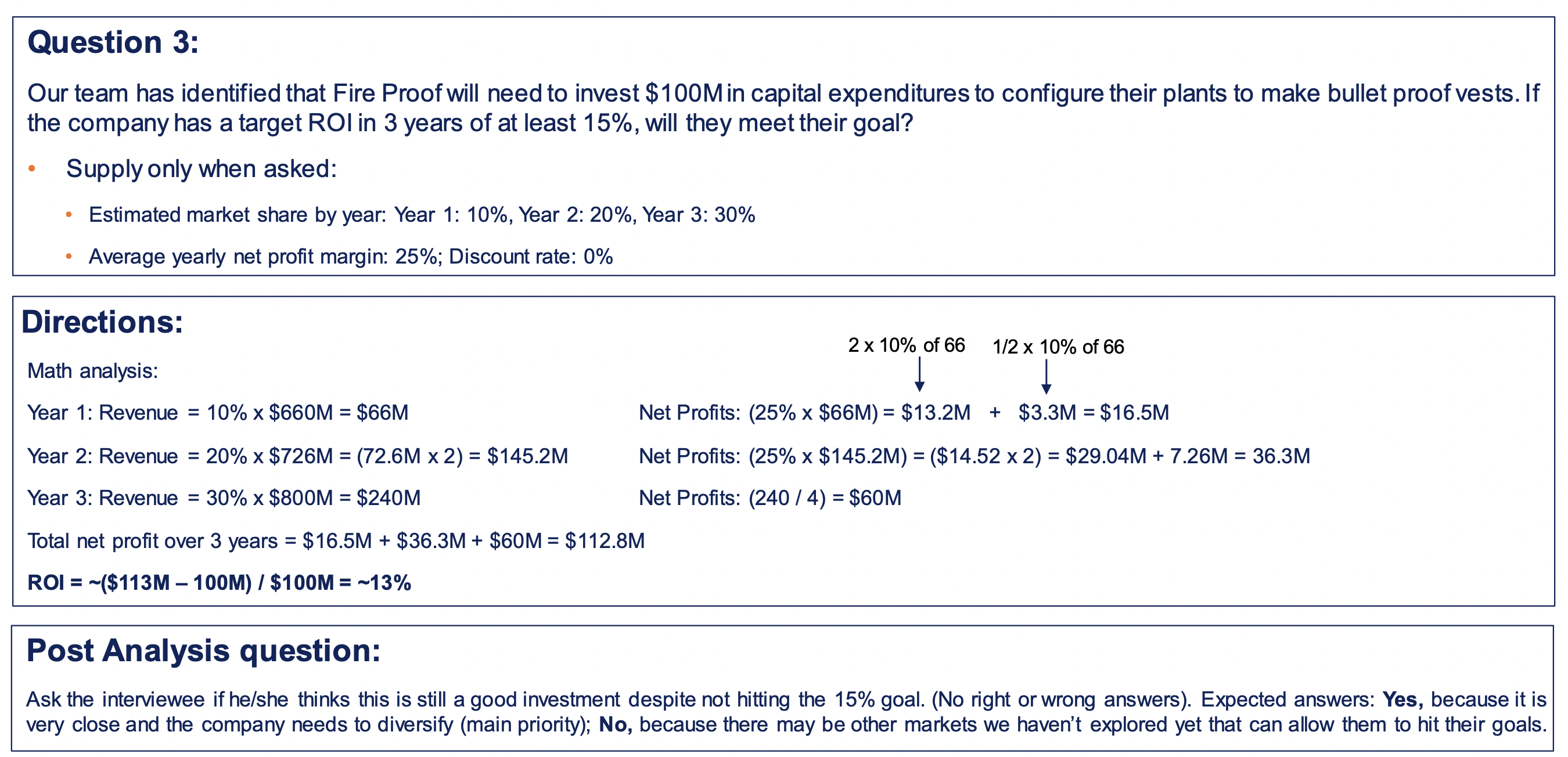

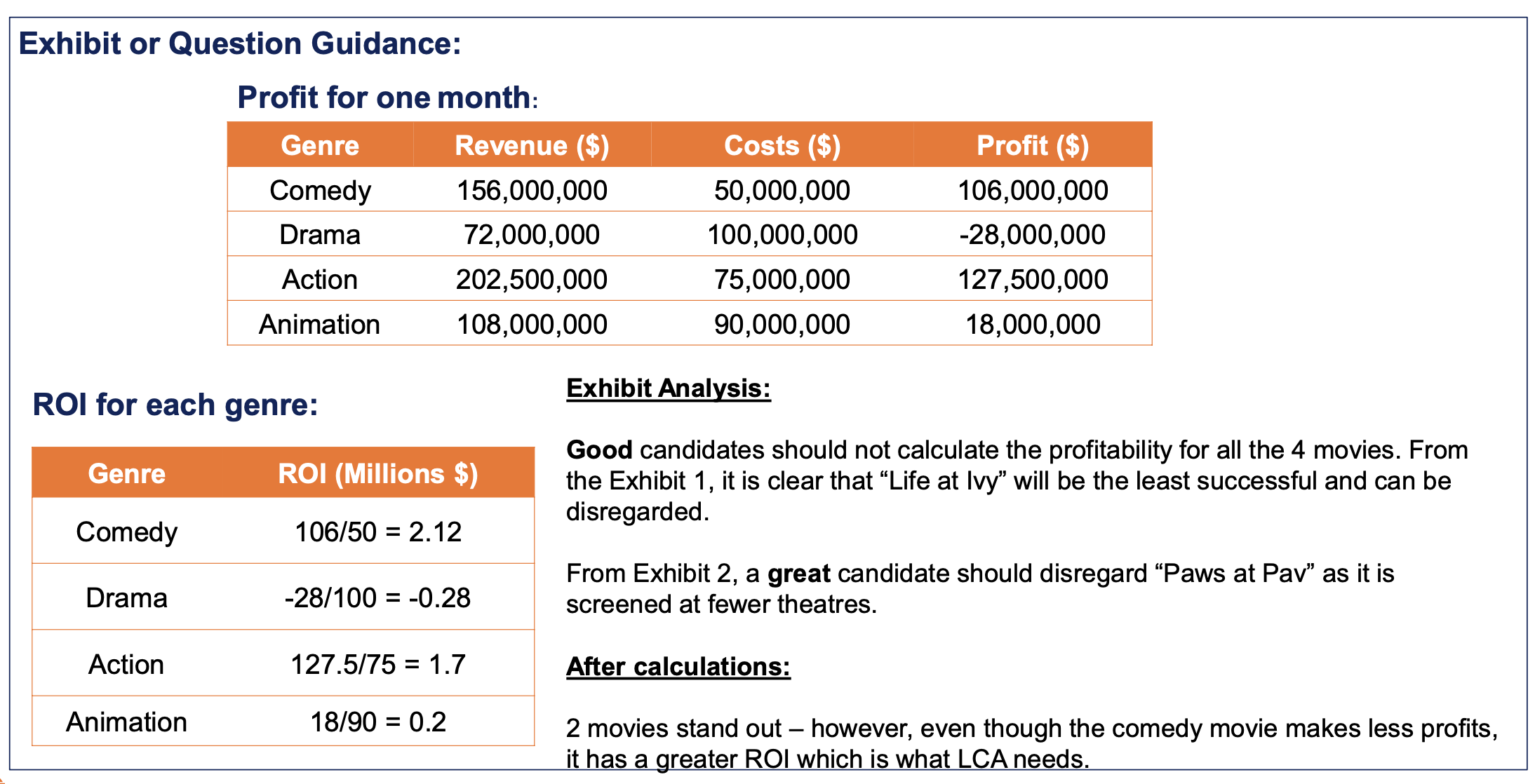

ROI is the return on investment, so the gains (profit) over the investment (cost). The ROI does not have a unit (so no dollar value). The ROI is positive if the number is higher than 1 (meaning you have more gains vs. costs).

Some books use the alternative definition of ROI (profit/cost -1). In that case, a ROI is positive if the outcome is >0. Let me know if you have other questions.

Mattijs

hey!

The correct formula for ROI in the context you're looking at is Profit / Cost (as shown in Picture 2). This is a common approach in financial analysis to assess how much profit is generated for each dollar of cost. The formula you mentioned from Picture 1, (Profit - Cost) / Cost, is another variation but is less commonly used in the industry.

Alessa

Hey there,

The technically correct answer is the second one there, where ROI is the Profit / Investment Cost

The name "Return on Investment" can be used as a guide to help you remember or know what you should be looking for.

The challenge is when the question wants a net cashflow impact instead of profit. That is when you get number 1 (which is not technically correct). And for this reason, clarifying your approach is critical and is what can help you not get into a sticky situation

All the best

It should be: Profit / Investment

In this case: (Annual Revenue - Annual Cost) / Initial or Upfront Cost