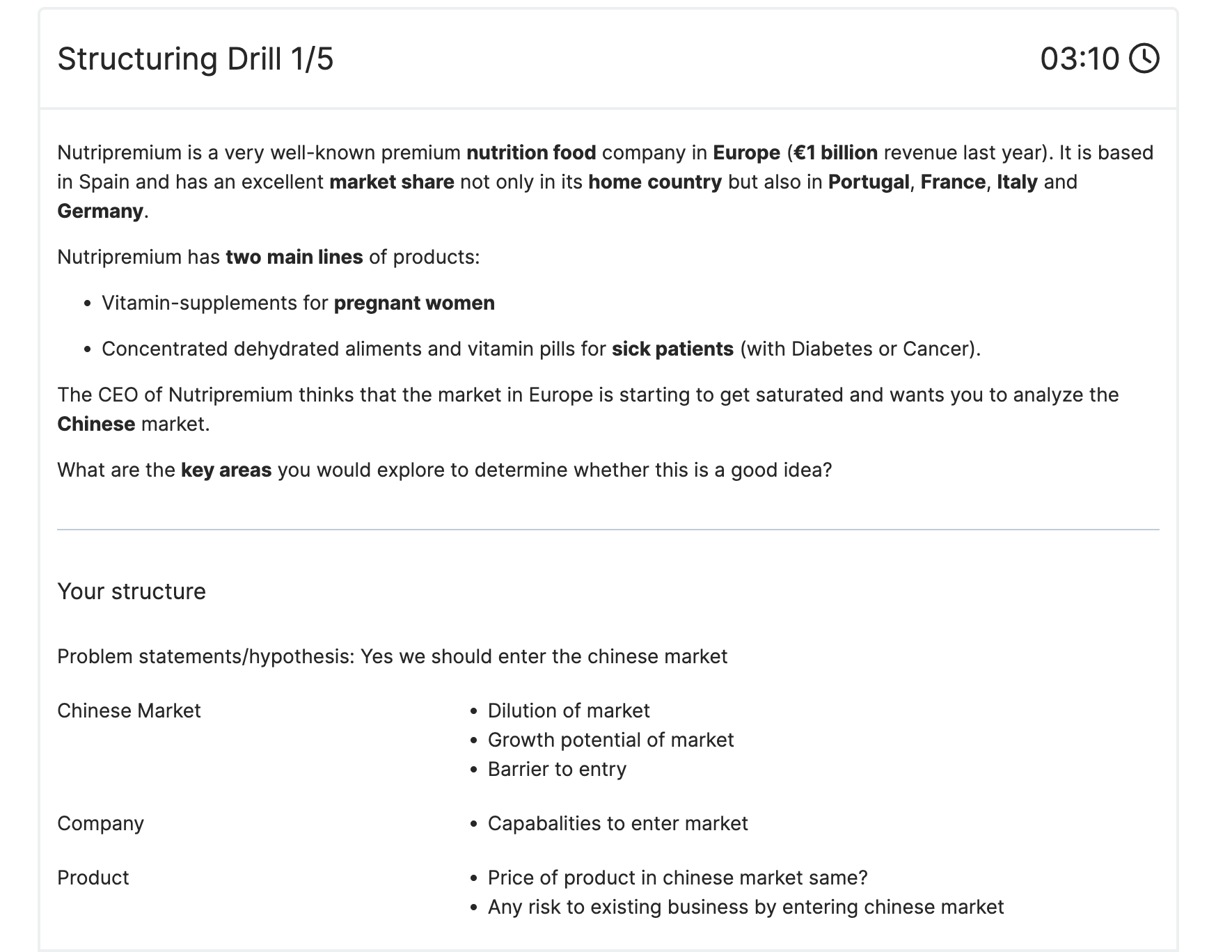

And yes, I did notice that risk to company should've been in the company bucket, I kinda ran out of time while writing it down.

And yes, I did notice that risk to company should've been in the company bucket, I kinda ran out of time while writing it down.

Hi there,

First of all, before we go deeper into the areas, I would push back against your use of these areas to begin with.

Market - Company - Product, or Internal / External, or the 3Cs, the 4Ps, Porter's 5, etc, all these structures that are easily recognisable by interviewers and have already been overused can lead you at most to a mediocre performance. Most interviewers will label you immediately once they notice you employing them.

Consulting interviews try to get a sense of your thinking, so if you bring in template-like structures, they feel almost as if you are refusing to share your actual thinking. Which is why in the last few years, most consulting firms have started coming up with 'unusual' cases, just so they can force candidates outside of the templates that they are learning.

In short, go for more creative structures that actually enable you as the consultant to work with them with the client and arrive together at an answer.

You can read more about structuring and brainstorming here:

I also offer a first principles structuring masterclass that candidates seem to be finding very useful:

Best,

Cristian

Hi there,

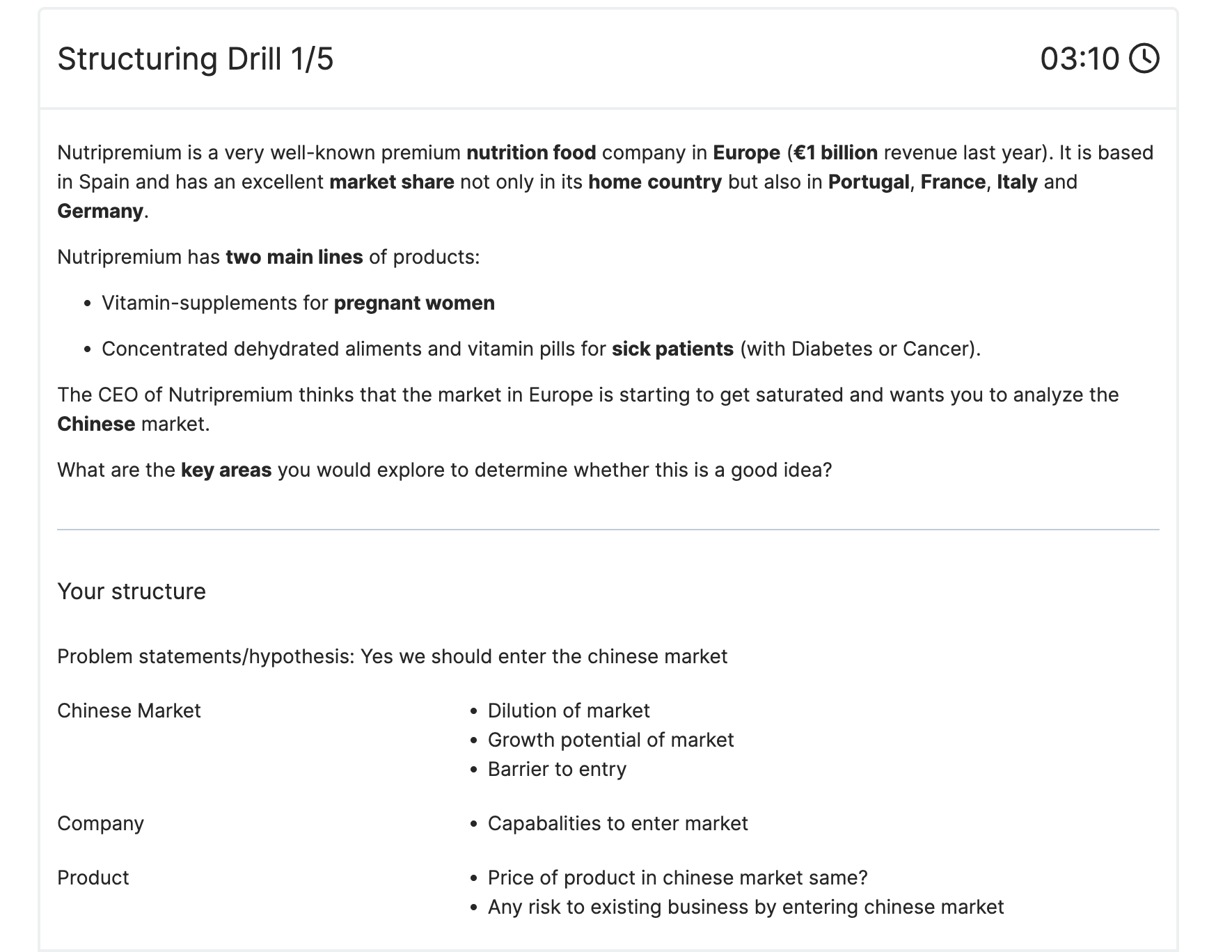

Thanks for sharing your structure. You’re already focusing on the right themes like market potential and company readiness. A few suggestions to refine your approach:

From my experience, one way to think about it could look somewhat like this:

1. Market Attractiveness – Market size, competition, customer needs, regulations

2. Company’s Readiness – Brand fit, supply chain, regulatory readiness, execution resources

3. Financial Case – Revenue/margins, investment required, financial risks

4. Strategic Fit – Alignment with global strategy, impact on core business, long-term potential

Happy to help if you'd like to work through this together!

Best regards,

Kevin