Your client, a private equity fund, is considering entry into the wine business through the acquisition of a vineyard called “Piumarolo” in Italy's renowned Piedmont region. Since this marks the fund's initial foray into this specific sector, they have engaged our team to conduct a preliminary market analysis and determine the feasibility of this prospective transaction.

Case Prompt:

Sample Structure

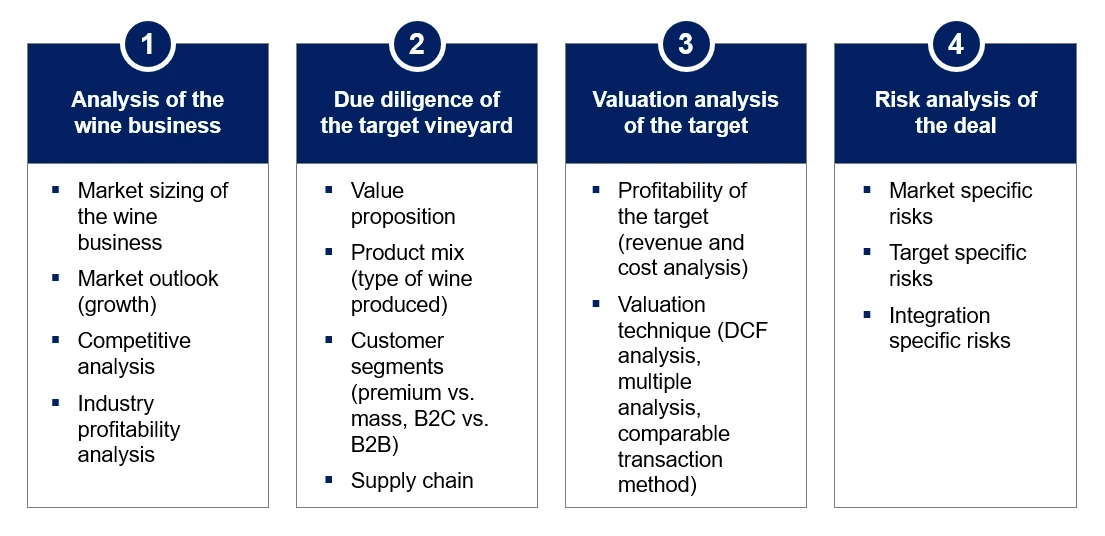

How would you approach this problem?

Ensure that the candidate effectively addresses the core components typical for a Private Equity (PE) firm case structure. This includes a comprehensive analysis of external factors such as the target's market size, growth rate, and competitive landscape. Additionally, the candidate should demonstrate a keen understanding of the target's business model, delving into aspects such as customer segments and product offerings. Lastly, they should perform a rigorous financial analysis encompassing valuation and an assessment of the target company's profitability.

Additionally, a great candidate also points out the risk component, a paramount aspect when evaluating M&A deals.

Question 2

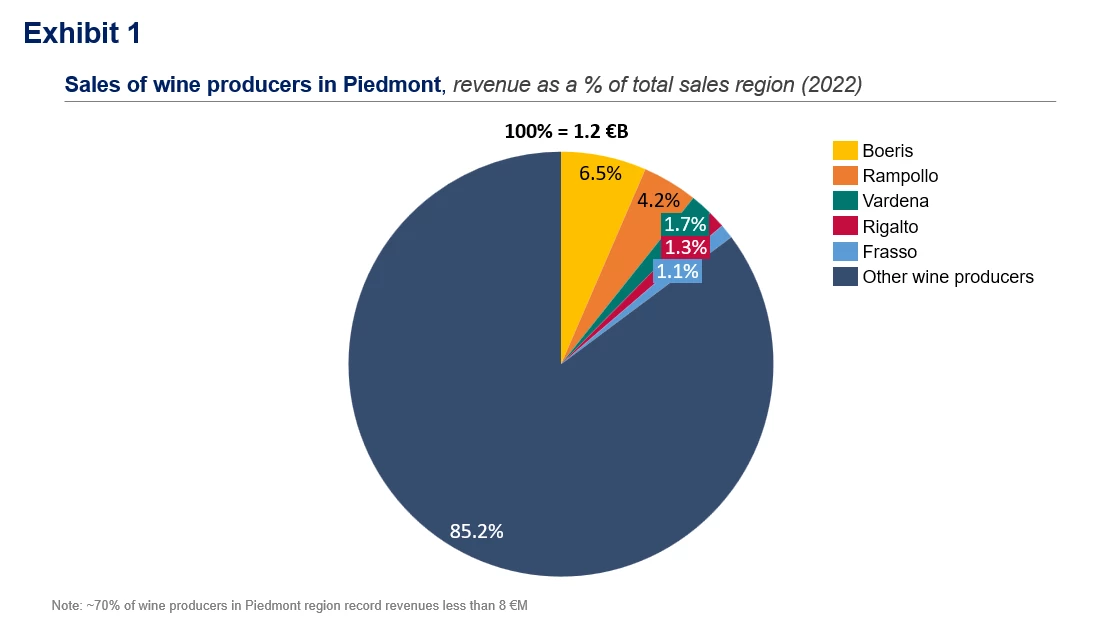

Your team has conducted a more in-depth analysis of the competitive landscape within the wine business, and your analyst has shared a chart via email. What does it tell you?

Please provide Appendix 1 to the candidate

Additional question (optional):

- How much is the value of Boeris sales in millions? [Solution: 78 €M]

Beginner-Level Comments:

- The top 5 wine producers in Piedmont hold approximately 15% of the market share in terms of sales

Advanced-Level Comments:

- The wine industry in this region is notably fragmented, which enhances its appeal because the target company won't need to compete against industry giants

- It appears that no player, when compared to others, possesses significant market power, extensive marketing budgets, or a robust distribution network

- Due to this fragmentation, there may be pricing pressures, especially in certain sub-segments of the business, particularly for competitively priced wines. This could potentially impact profit margins negatively. Nevertheless, economies of scale might emerge as a critical success factor. Therefore, it's reasonable to anticipate industry consolidation, particularly in the affordable wine sub-segment, over the long term

- In this context, our PE firm is presented with a favorable investment environment. The industry features low barriers to entry in terms of competition, and there's an opportunity to consolidate selected vineyards. This consolidation could leverage economies of scale, optimize processes, and generate synergies in terms of revenue and cost, enhancing the investment's potential.

Note: Candidates aren't expected to cover all advanced comments, but including some demonstrates the ability to delve deeper, connect concepts, provide insights, and analyze the industry effectively, even when not intimately familiar with the subject matter.

Question 3

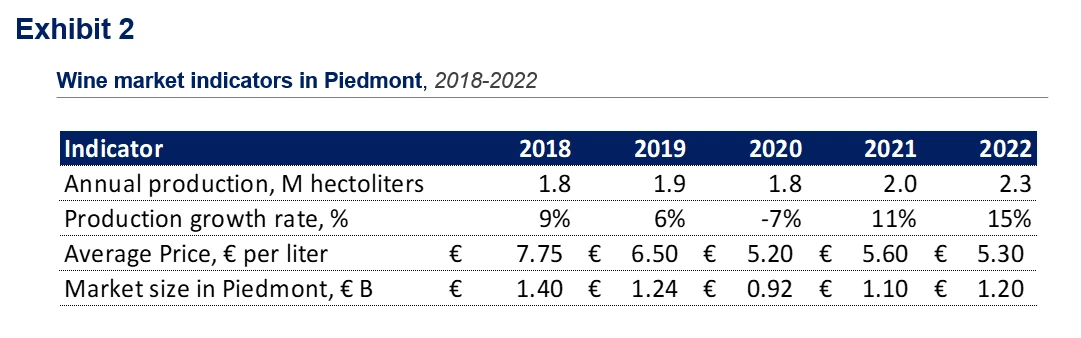

What is the wine market size going to be in Piedmont in 2024?

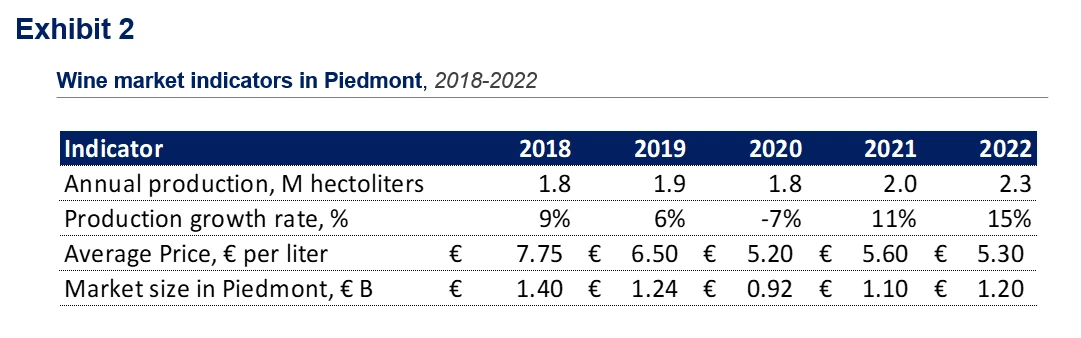

Please provide Appendix 2 to the candidate.

Please provide this information only upon request:

- We anticipate a 20% annual growth rate in the wine business for the 2023-2024 period

- The conservative scenario indicates that the average price is projected to decline to €5 per liter by 2024

To determine the market size of wine in Piedmont, we need 2 main components: (1) annual production and (2) the average price

1. Projection of the annual production

- From historical data, we know that in 2022 the Piedmont region produced 2.3 M hectoliters of wine

- Based on the additional information provided in the case, we assume that the 2022 annual production will grow at 20% per year

- Hence, in 2023 the expected volume of wine produced is 2.8 M hectoliters

- Using the same approach, we can estimate the annual production of wine in 2024 that is expected to be almost 3.3 M hectoliters

2. Average price per liter

- That's easy as it's plug-and-play information provided by the interviewer: €5 per liter

With these two pieces of information in mind, we can obtain the projected market size in 2024 (being careful about the units of measurement!). Particularly, in 2024 we expect to have a 1.7 €B wine market.

Strong candidates will not limit themselves to mere number crunching to project wine market size up to 2024. They will also consider whether the obtained value aligns with reason and what qualitative factors can bolster the analysis.

Advanced-Level Comments:

- In 2020, the wine industry faced a significant decline (-25% compared to 2019). This decline can be largely attributed to the impact of the COVID-19 pandemic, which slowed down the economy and led to reduced consumption of goods, including wine

- From 2022 to 2024, the market is expected to witness remarkable growth, exceeding 40% (an additional €0.5 billion). This growth is intriguing, especially when considering a recent history of decline. Several underlying factors may contribute to this increase, including (i) an expansion in acreage dedicated to wine production, (ii) the adoption of new technologies that enhance production or reduce waste, and (iii) favorable weather conditions

- Furthermore, the price of wine is projected to continue its downward trajectory, following a trend that has persisted over the past five years. Multiple factors might be driving this trend, such as intense competitive pressure within the region. Market fragmentation may encourage wine producers to sacrifice some of their margins to capture additional revenue. Additionally, a shift in consumer demand towards more affordable wine options might be prompting producers to reconsider their pricing strategies, further impacting their margins. This price trend is likely to have a negative effect on the target company's valuation

- The rapid growth in annual production implies that the target may need to expand its capacity by increasing wine acreage, harvest yield per acre, and possibly adopting new technologies to boost production. These expansion efforts are likely to require additional investments, which would affect future cash flows and, consequently, the payback period for the PE fund.

Note: Candidates aren't expected to cover all advanced comments, but including some demonstrates the ability to delve deeper, connect concepts, provide insights, and analyze the industry effectively, even when not intimately familiar with the subject matter.

Question 4

What can be causing prices to decrease?

To address this question effectively, a valuable approach or framework involves examining both the supply and demand aspects of the equation to identify qualitative considerations. Ultimately, the price is determined by the market, which represents the equilibrium between these two driving forces: supply and demand.

Consequently, several factors can contribute to a drop in the price of wine:

1. Rapid Growth of Supply/Production

- The emergence of new wine producers introducing fresh brands can exert competitive pressure on existing market players

- An expansion in the acreage dedicated to wine production across the Piedmont region may result in an oversupply relative to market demand, leading to price reductions

- Favorable weather conditions might boost the yield per acre, increasing the overall production volume

- The adoption of new technologies and equipment, such as fertilizers and irrigation systems, can enhance yield per acre

- The development or cultivation of higher-yield grape varieties may contribute to increased production.

2. Decline in Demand for Wine Produced in Piedmont

- Other regions or countries may gain popularity over Piedmont, capturing the interest of a broader audience

- Consumer preferences may shift towards alternative alcoholic beverages

- Regulatory changes may impose strict limitations on price increases

These factors collectively illustrate how market dynamics can influence wine prices, showcasing the interplay between supply and demand in shaping pricing trends.

Note: This is just one of many potential ways to tackle the question. Even a structured list of potential considerations is acceptable. On average, great candidates provide 4-6 ideas

Question 5

What could possibly happen that might cause prices of wine in Piedmont to increase in the future?

For this question, the framework employed in the previous question aligns well and can be applied effectively here as well. Specifically, considering both demand and supply factors is crucial when exploring elements that could potentially drive an increase in wine prices in the future.

1. Decrease in Supply/Production

- Bankruptcy of Selected Wine Producers: The financial difficulties or insolvency of specific wine producers may lead to reduced production, thereby limiting supply and potentially raising prices

- Impact of Extreme Weather Conditions: Adverse weather conditions that threaten a portion of the grape yield can diminish overall production, resulting in a shortage and potential price increases

- Regulatory Restrictions on Fertilizers: If regulatory changes impose limitations on the use of specific fertilizers that enhance yield per acre, this could constrain production and contribute to price growth.

2. Increase in Demand

- Recognition of Piedmont Region's Excellence: If the Piedmont region gains international acclaim as one of the world's premier wine production areas, it may create opportunities for price appreciation

- Shifting Consumer Preferences to Premium Grapes: A shift in consumer preferences towards premium grape varieties can drive up prices, especially if these grapes are in high demand

- Macro Trend of Dining Out: A broader trend of consumers dining out, whether for lunch or dinner, can stimulate global wine consumption and, consequently, prices

- Growing International Demand and Exports: An increase in international demand, particularly through expanded exports, can elevate prices as wines from the Piedmont region gain popularity on the global stage.

Note: This is just one of many potential ways to tackle the question. Even a structured list of potential considerations is acceptable. On average, great candidates provide 4-6 ideas

Acquiring a vineyard in the Piedmont region (Italy)