Your client is ‘Muse 19’, a Museum in Paris with a large collection of 19th century artifacts, predominantly paintings and sculptures. The museum is run by a non-profit organization based in France. The museum is quite popular amongst students, artists and tourists. Last year the museum attracted almost 2 million visitors. Despite this, the museum’s revenue has been declining for the last three years. Surprisingly, other museums of similar nature have been doing much better than Muse 19. The museum director has approached you for advice.

Case Prompt:

Part 1 – Case Opening

After communicating the case narrative, wait for the candidate to ask clarifying questions.

Information to be share upon request:

Success criteria – Ensuring breakeven at annual level. Annual cost of operating the Muse 19 is $7m

Implications of being non-profit – The museum cannot sell the artifacts, they can only display them. Being non-profit allows them to attract donations, grants, endowments etc.

Ask clarifying questions

Part 2 – Identification of revenue sources

How will you identify why the revenue is declining?

A good candidate should include the following revenue areas in his analysis:

Sales

Tickets

Students

Volume

Price

Tourists

Volume

Price

Memberships (Mostly Art Enthusiasts)

Purchases in gift shops

Donations

Donor base

Donation frequency

Average donation size

Grants

A good candidate will lay out the structure above and will communicate his hypothesis viz.

Grants by the government are distributed to all non-profit museums. Given the other museums are doing fine, I would not look into this as first priority. I would rather look into:

Whether visitor demographics or ticket pricings have changed

Whether we are not able to attract donors that we used to

Do we have any data on visitors e.g. tickets/gifts purchased etc.?

Part 3 – Identification of revenue decline in Sales

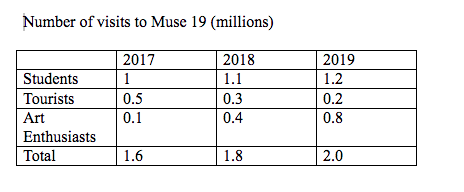

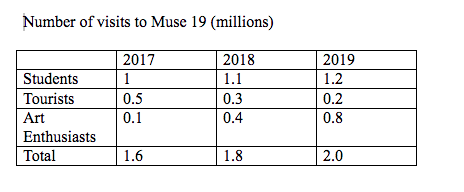

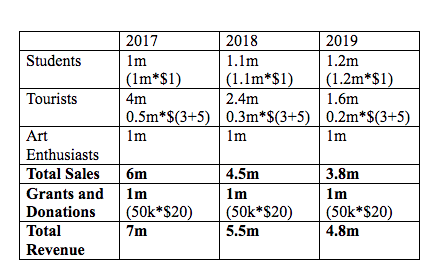

Share Exhibit 1 with the candidate.

What insights can you draw out of this exhibit?

After studying this exhibit, the candidate should clarify/ask for data on pricing for each segment.

Information to be share upon request:

Ticket Pricing – Has remained constant over the last 3 years. $1/student $3/Tourist

Art Enthusiasts – Art enthusiasts buy annual membership pass at $20/year. Every year 50,000 memberships are sold. Once the membership is purchased, the member can visit the museum any number of times

Gift purchases – Students and art enthusiasts do not purchase anything. Tourists purchase on an average $5 worth of gifts/services per visit

Grants and donations – Grants and donations amount to $1m. They have remained constant over the last 3 years

Analysing this information, a good candidate should make the following revenue table

A good candidate should state:

The revenue decline can be predominantly attributed to reduction in tourist visits

Client should explore possibilities to attract more tourists or increase spending per tourist

Other area that can be explored is annual membership pricing. The pricing should be in such a way that we are able to sell maximum memberships.

In 2019, on an average every art enthusiast has visited the museum 16 times, making their per visit fees almost equal to the student pricing.

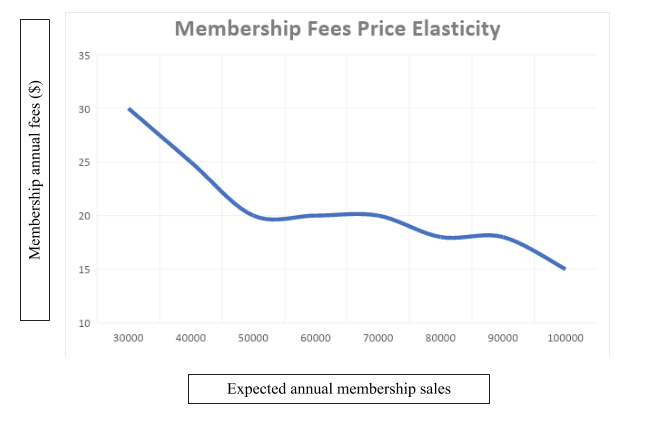

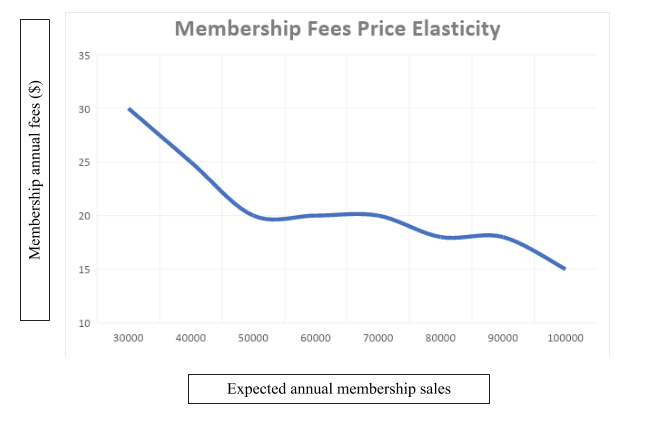

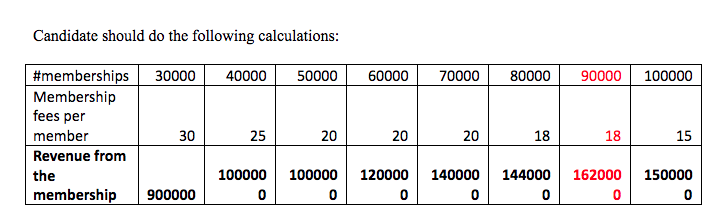

Part 4 – Best membership price point

Share Exhibit 2 with the candidate.

What should be the membership price for optimal revenue?

For optimal revenue, the membership price should be set at $18. At this price the Muse 19 can expect to increase their annual revenue by almost $0.6m

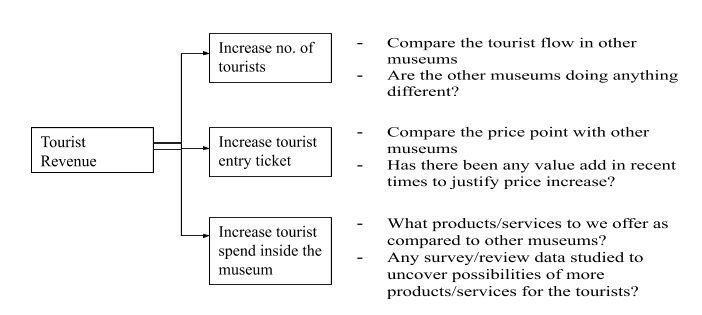

Part 5 – More revenue from the tourists

What should be done to increase the revenue from the tourists?

Information to be share upon request:

- No. of tourists in Paris have declined significantly in last 3 years due to various reasons. Drop in number of tourists is consistent with that at other tourists attractions

- Entry ticket price point is consistent with other museums in Paris

What ideas can you think of that can be implemented in Muse 19 using latest technologies?

This is a brainstorming question. Let the candidate’s imagination go wild. In case of out of the box ideas, push the candidate to discuss the feasibility of implementation.

A good candidate should put together the thinking framework like this:

Our preliminary analysis suggests that Muse 19 has not kept pace with technological innovations. The Museum operations, features and services are low tech. Implementation of high tech features can help in 2 ways. It will justify the price increase and it will also enable launching a few more paid services for the visitors.

A good candidate can come up with several ideas. Some of the ideas can be:

- Introducing ‘Virtual Reality’ goggles and creating theme-wise tours of the museum. These VR tours can be sold separately and at a premium.

- Creating 19th century landscapes in different museum rooms using laser beams. Laser shows can be conducted at particular hours in a day and can have a separate ticket.

- Using AR/VR cameras to make the tourists see themselves wearing 19th century clothes/weapons etc. This feature can be sold as a separate attraction. Visitors can see how they would look in say ‘Gladiator’ outfit. Pictures/videos of visitors in these outfits can be sold to them.

Part 6 – Conclusion

You have a minute to present your findings to the Muse 19 director. What are you going to say?

In order to increase the Muse 19 revenue and achieve breakeven, we would recommend decreasing the annual membership fees to $18 and implementing features and services using the latest technology. We say so, because:

- Annual membership decrease from $20 to $18 will attract 40,000 more memberships, as a result adding $0.6m to the revenue

- Technological innovations can help the museum increase its entry fee, and at the same time add several new services that can be sold at premium

We suggest the following next steps:

- Put together a detailed business case for the technological features and services implementation

- Conduct a deep stick analysis to understand whether we can get more grants and donations

MBB Final Round Case – Non-Profit Museum Revenue Increase

i