Our client is a mid-sized health insurance provider called SureHealth with annual revenues of $2.4 billion. The company has experienced a steady rise in administrative claims processing costs and has seen a recent uptick in fraudulent claims. Senior leadership believes that leveraging AI in the claims assessment process could have significant benefits.

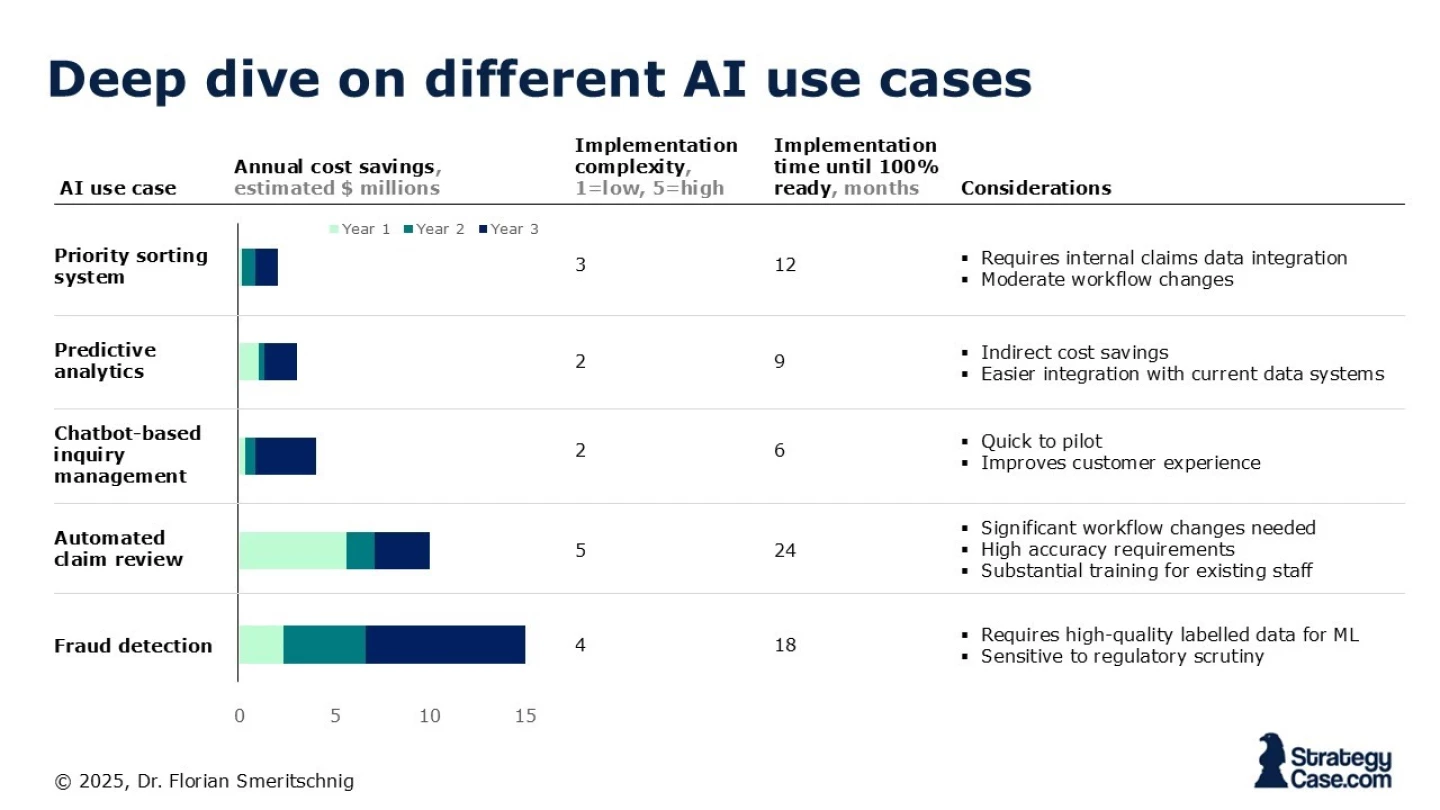

They have allocated a budget of $10 million over the next three years to implement AI solutions, but they are uncertain how to prioritize to reduce fraudulent claims and administrative processing costs.

ClaimSmart: AI for Next-Gen Health Insurance

i