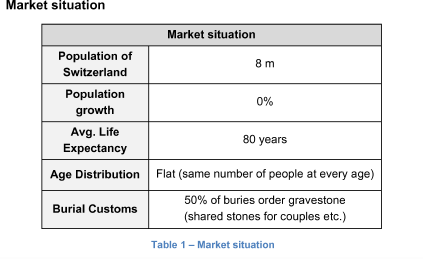

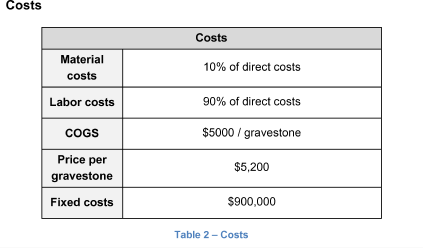

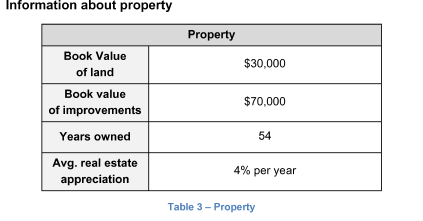

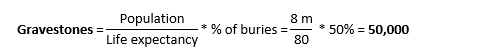

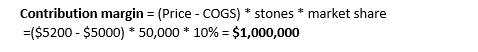

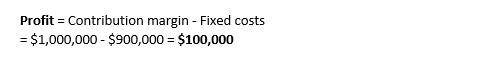

Your client, Gravestone Inc., is a mason producing gravestones situated in Switzerland. He is producing high-quality, hand-crafted gravestones with very skilled labour-force.

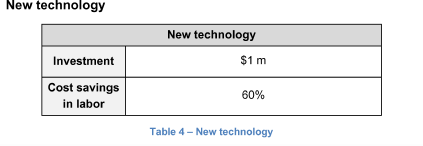

In the recent past a technology was developed that would allow him to produce his gravestones with much less labour.

He is contacting us to make a decision if he should invest in this new technology and if he even should remain in the business itself.

Gravestone Inc.

i