Our client is a French holding company with annual revenues of about €1 billion.

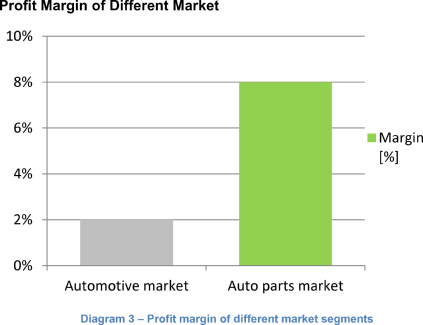

Their portfolio consists of different companies that are mostly in manufacturing industries such as the oil & gas industry and the automotive industry.They do not have a specific investment focus. They prefer to buy the best companies available that are also related to their existing businesses.

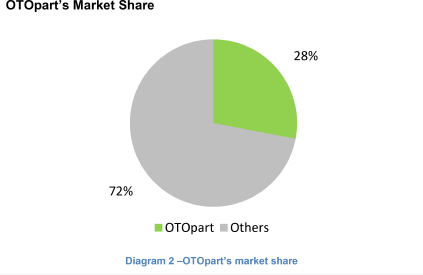

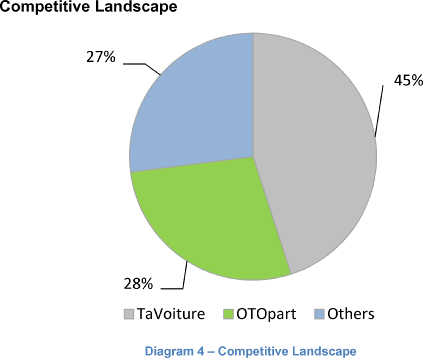

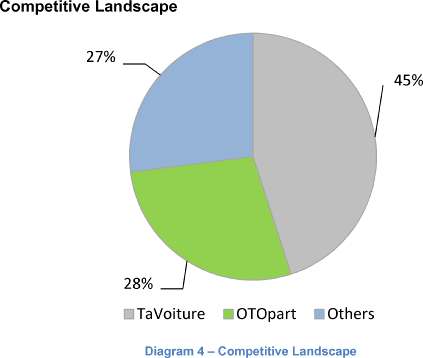

They are thinking about acquiring an auto parts dealer, OTOpart, and want to know whether you think it is a good idea.

General Holding

i