Bain Case Style - Growth offensive at ChemCorp [NEW]

Your client is the Performance Chemicals division (revenues of $500 million) of a Specialty Chemicals Company with total revenues of $14 billion. The CEO wants the company to become the fastest-growing specialty chemicals company and has therefore asked all the divisions to present growth strategies to him.

Accordingly, the client would like us to help them develop their division’s growth strategy.

Case Comments

Part 1 - Case Opening

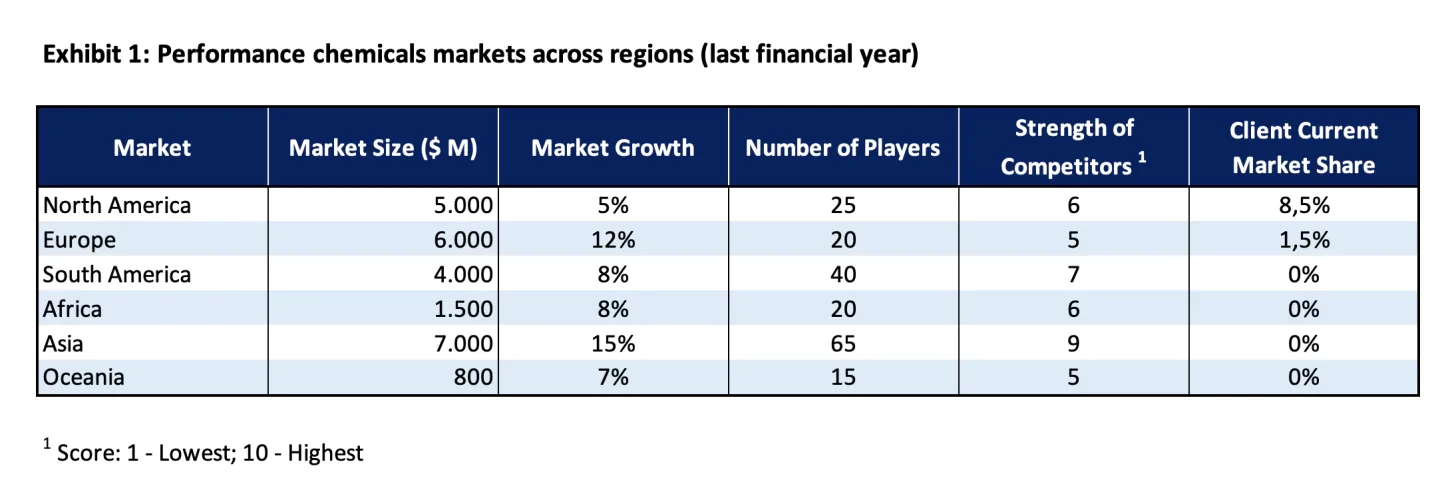

Part 2 – Analysis of Industry/Segment Potential

Part 3 – Growth Strategy

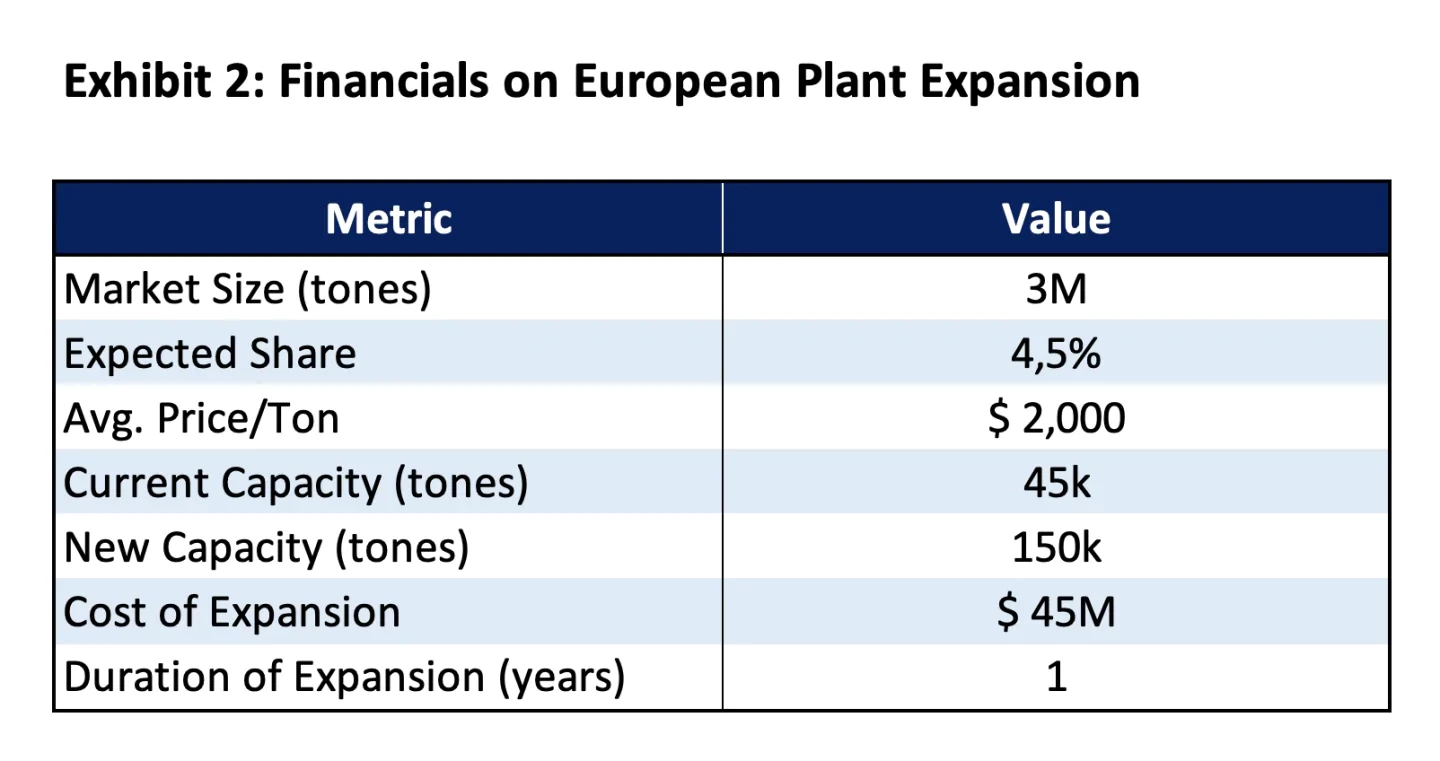

Part 4 – Opportunity Assessment

Part 5 – Recommendation

Final Remarks

Thanks for completing the case!

------------------------------------------------------------------------------------------------------------------------

Looking for free tips? Click on the links below to find more information about some of the most common topics in consulting:

- 11 New Consulting Trends You Should Know

- 4 Ways to Land an MBB Interview

- Making $ in the Middle East - 16+ Data Points on Consulting Salaries in Dubai and Co

- How to Make $1M+ by Working in Consulting

- Top 15 Consulting Firms by Revenues and Prestige

- How to Master the 6 Games of the McKinsey Problem Solving Game

- 10 Must-Know Tips to Master the BCG Online Case

- Consulting Firms in Singapore - Learn Everything About 18 Top Consulting Firms in the Lion City

- Revealed: The Real 32 MBB Target Schools for US Applicants

- Salaries of the Best 16 Consulting Firms in Singapore - Everything You Need to Know

- BCG Potential Test - 9 Exclusive Tips

------------------------------------------------------------------------------------------------------------------------

For any questions, please drop me a message here, happy to help.

Best,

Francesco