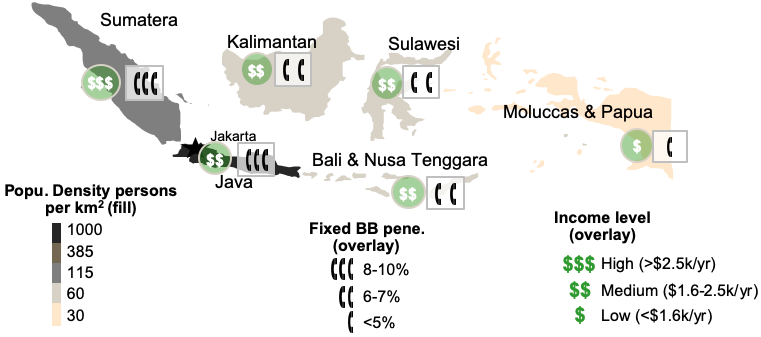

Your client is the CSO of LightFast, a Middle-Eastern telecoms and media player. They are a national incumbent player who expanded operations into South-East Asia and North Africa in late 2010s. Their operations in Indonesia include pay-TV and fibre-optic broadband. However, the broadband business has flat-lined since launch.

LightFast is now looking to reset its Indonesian subsidiary and has asked you to advise them on whether they should re-launch or close operations.

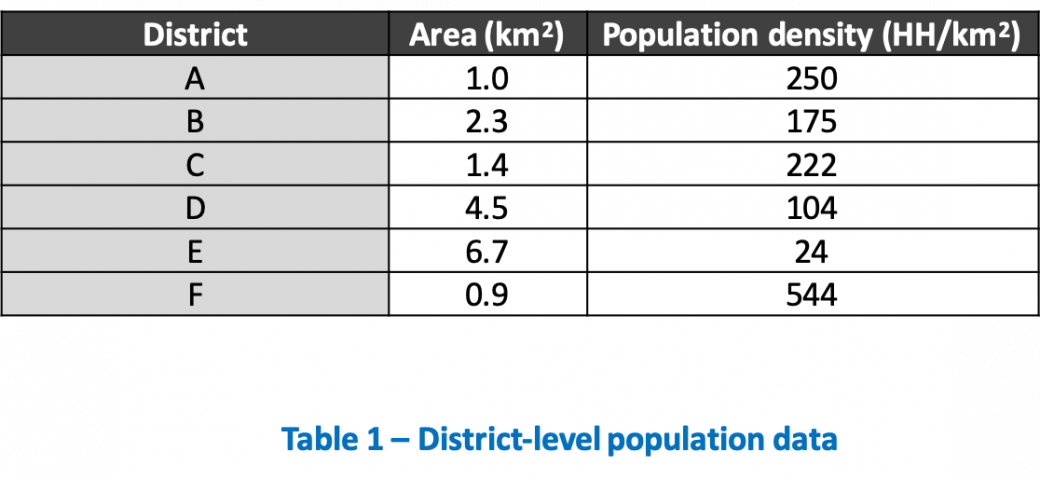

They would like you to advice on the size of the opportunity if they were to re-launch in Y1, estimate the expected payback period and then highlight key considerations to make a go/no-go decision.

LightFast - Launching high-speed broadband in Indonesia

i