Thanks!

What's the difference btw opex, capex and fixed costs?

CAPEX = Capital Expenditures - expenditures aimed, for example, at obtaining Fixed Assets (investments in building assets which willl be used as core for operations)

OPEX = Operational Expenditures - expenditures aimed to sustain company operations (example: raw materials, electricity, insuranse, taxes, rents, payrolls etc.)

Fixed costs are different dimension, for example:

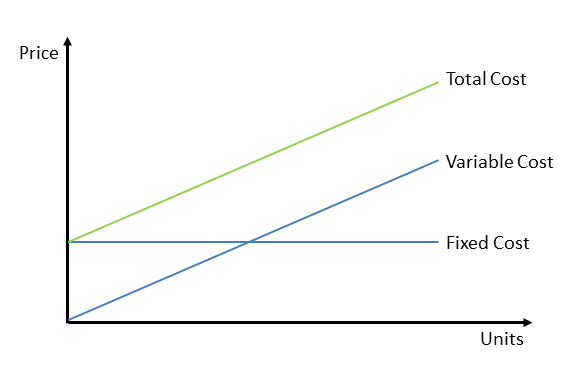

Rent of your office cost 1000$/year (which is OPEX - because sustain entity operations), but called FIXED, because independent of entity activity (doesn't matter how much company sold - it will still pay 1000$/year). If we produce 100 or 1000 cans of Coke - office rent will not change.

In opposite to FC, we have:

Variable Costs, for example:

- raw materials to produce company products, or provide services: they are inline with business activity. If we produce 100 we will pay 1$ per can of raw materials, -> then cost will be equal to 100$. But if we produce 1000 -> we will pay 1000$. Thus - those are VARIABLE.

... however, in long-term -> Fixed Costs considered Variable (or semi-variable!),which just means that office cost will be increased to 1200$ in 5 years (to compensate inflation).