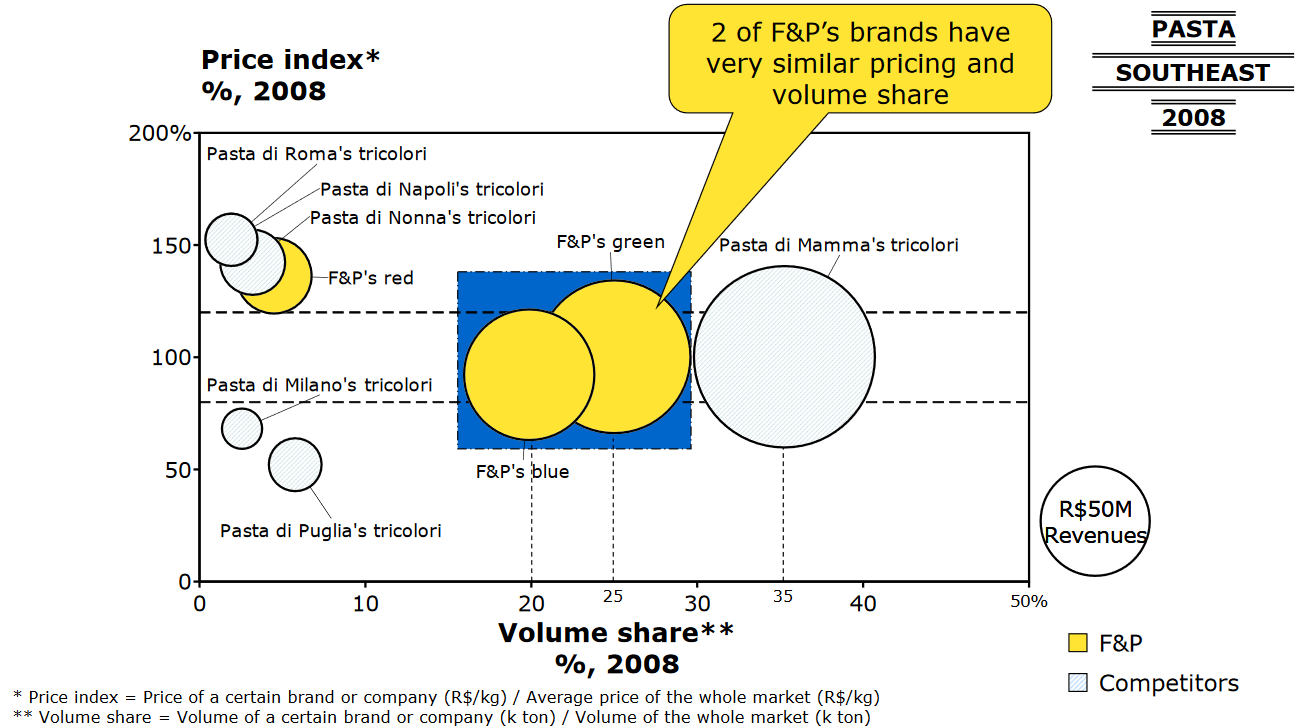

Hi! I'm doing a sample case and I'm not quite sure how to find the volume after the merge of F&P's green and blue.

I know the correct answer is 70 but how do I get there?

My guess is that it will be the sum of both areas but I'm don't know what is the best way of getting this.

Any help would be great!