Advising on ESG Compliance

Advising on ESG Compliance is another component of ESG consulting, where the focus is on assisting companies to not only align with but excel in meeting ESG standards and improving their ESG ratings. This intricate process involves navigating through a maze of ESG standards, frameworks, and regulations, ensuring companies not only comprehend these requirements but also implement them in a way that meets or exceeds stakeholder expectations. This includes investors, customers, and regulatory bodies, all of whom are increasingly scrutinizing companies' ESG performances.

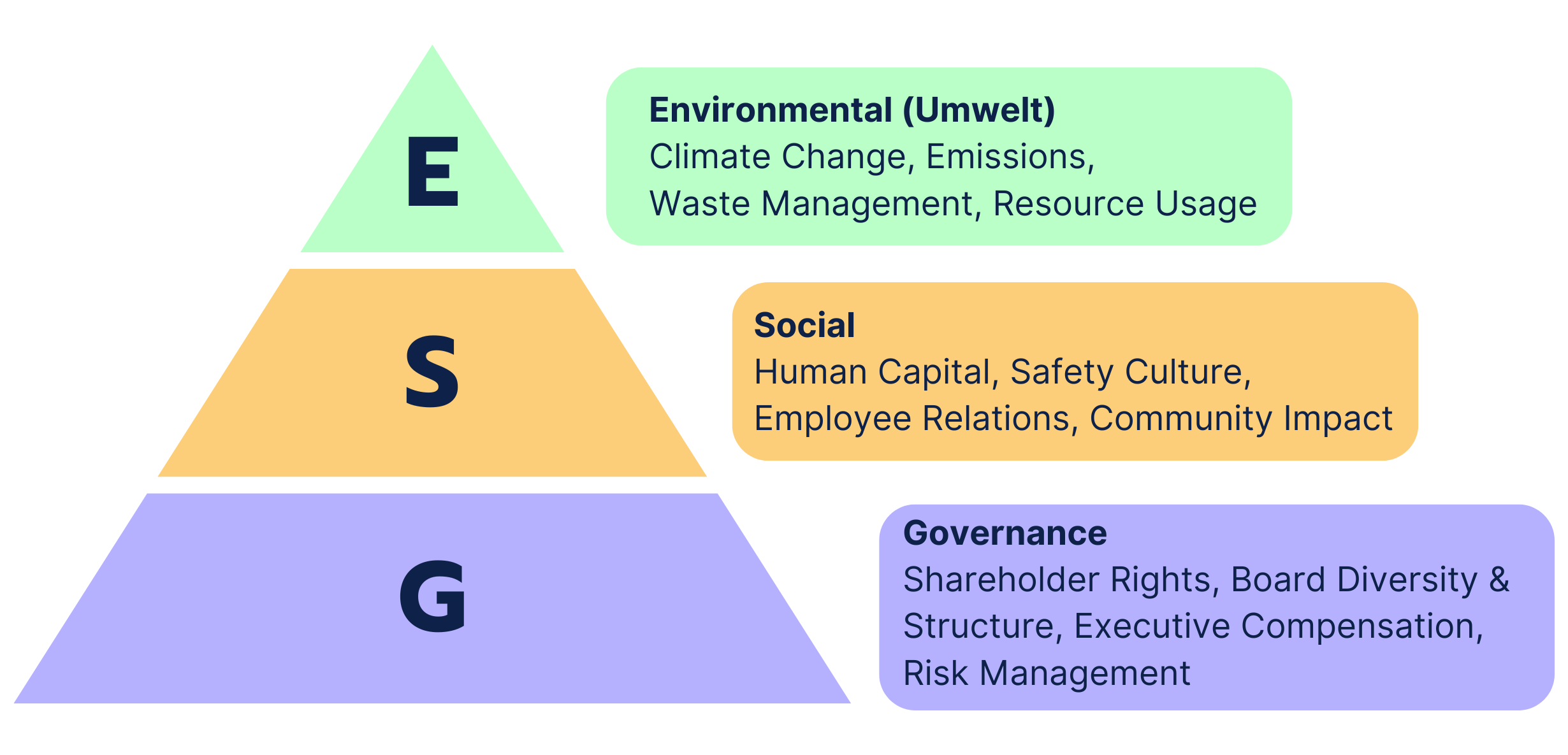

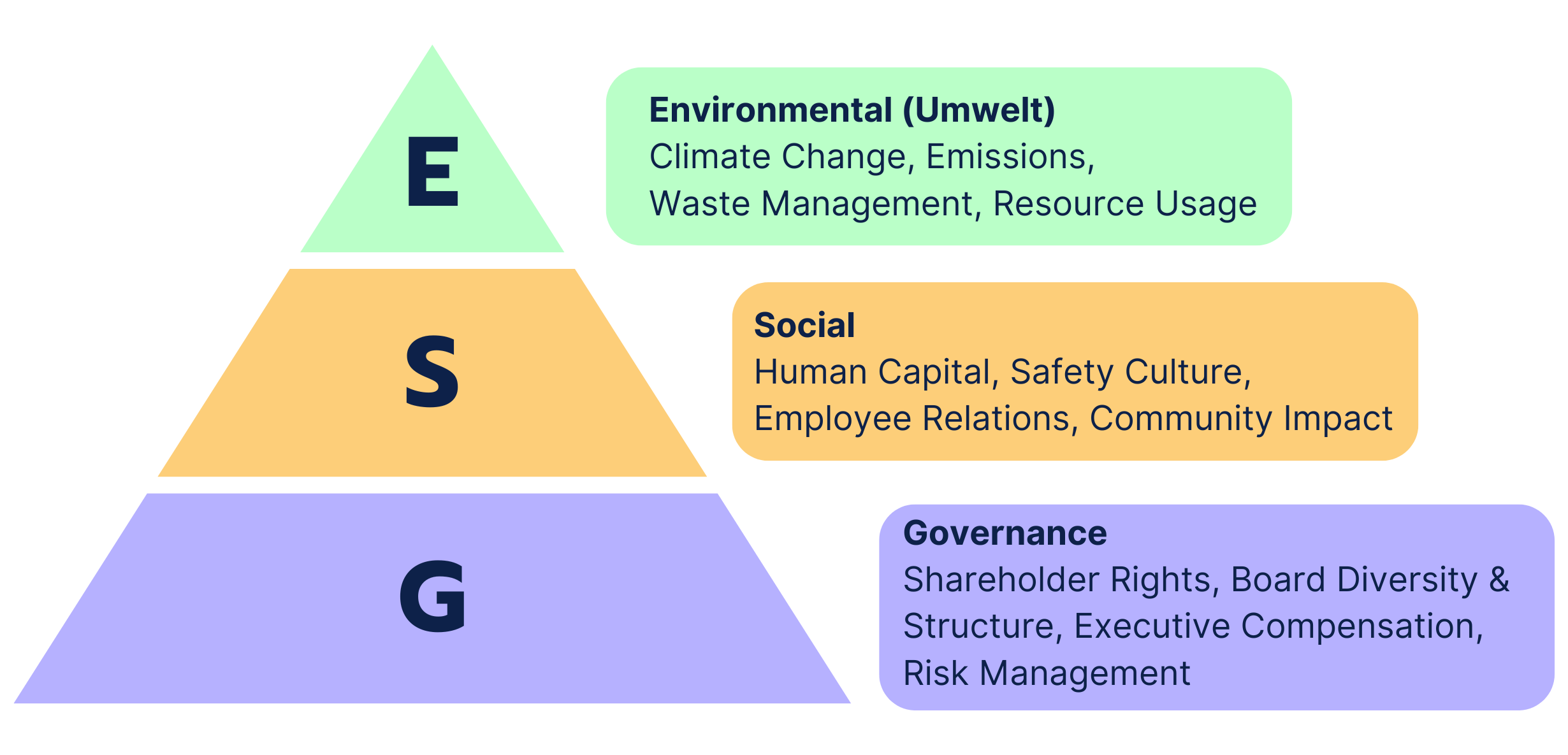

A significant part of ESG compliance consulting is conducting thorough gap analyzes for companies, pinpointing specific areas where enhancements are necessary to boost ESG scores. This can encompass a wide range of initiatives. For instance, consultants might recommend operational improvements to reduce energy consumption and greenhouse gas emissions, such as upgrading to more energy-efficient machinery or shifting to renewable energy sources. Such changes not only reduce environmental impact but also contribute positively to a company's ESG rating. This is an overlap with sustainability consulting – but with a specific focus on improving the ESG score.

Moreover, improving supply chain sustainability is another critical area. Consultants may work with companies to support the transition of second and third-tier suppliers towards more sustainable operations. This could involve developing and implementing supplier sustainability standards, conducting audits to ensure compliance with these standards, and providing support and resources to help suppliers improve their practices. By enhancing the sustainability of their supply chains, companies can significantly improve their overall ESG performance.

Another example includes advising companies on enhancing labor practices and promoting diversity and inclusion within the workplace. This could involve revising hiring practices, implementing training programs to combat workplace discrimination, and establishing clear policies and channels for reporting grievances. Such initiatives not only contribute to a more inclusive and equitable workplace, but also positively impact the social component of a company's ESG score.

Lastly, ESG consultants might assist companies in strengthening their governance structures to improve their ESG rating. This could include advising on the adoption of transparent reporting practices, the implementation of ethical business practices, and ensuring the board of directors has adequate representation of diverse groups, including women and minorities. Strengthening governance practices helps build investor and stakeholder confidence, enhancing the company's reputation and its ESG performance.

Through these and other tailored strategies, ESG consultants play a pivotal role in translating the principles of ESG into actionable business strategies. By doing so, they enable companies to effectively navigate the growing demands for sustainability and corporate responsibility, ensuring not only compliance but also a competitive edge in the marketplace. This comprehensive approach to ESG compliance underscores the invaluable role of ESG consulting in fostering a more sustainable and responsible business landscape.