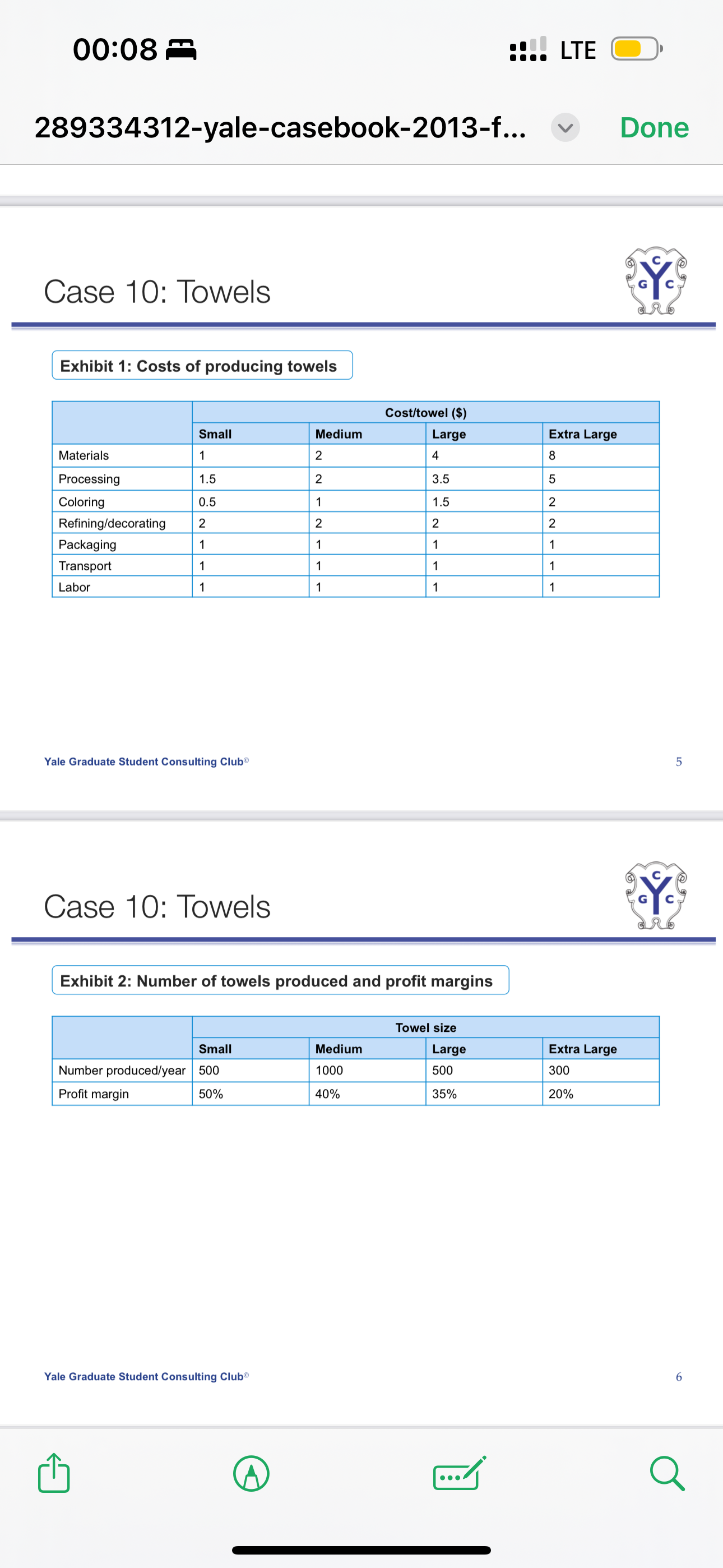

So in the last question they’re asking to calculate the net benefit of taking out their least profitable product (XL towels at 20% profit margin and costs of 20USD). Said net benefit is calculated as 300 (quantity) * 20USD (cost per towel) = 6k cost savings minus profit loss of 1.5k at a 20% margin.

HOWEVER: in the overview of the cost items they’re all VARIABLE costs. So aren’t they accounting for variable costs twice? Like: yes these are cost savings if the product is cut. But adding the profit loss (which already accounted for the variable costs) to the cost savings counts variable costs double?

It would be different if additional overhead hence fixed costs could be cut, eg FC reduction by 400USD, then total net gain could be 400usd - profit loss of 1.5K. In this case would be a net loss actually and not advised

Or am I mixing something up?