I want to ask a question about a diagram I was shown regarding mergers & acquisitions.

I have so far practiced around 50 cases on PrepLounge and have largely been consistent with being able to assess the following areas for an M&A case:

- Market Appeal

- What is the market size?

- Is the market growing or declining?

- Is this market profitable (on average)?

- Company Situation

- Is the company profitable at the moment?

- What is its market share? i.e. what is its competitive landscape with respect to a fragmented or consolidated market?

- What is the company's USP?

- Synergies

- Are there any revenue synergies?

- Are there any cost synergies?

- Transactional Assessment

- What are the projected revenues?

- What are the projected costs?

- What is the time to break-even i.e. payback period?

- Risks

- Financial: can we afford this transaction with the current level of capital?

- Capacity + Technicality: do we have the capabilities to perform this acquisition?

- Branding: will this be detrimental to the company brand and growth prospects?

Of course, this framework is adapted to suit the case needs as required.

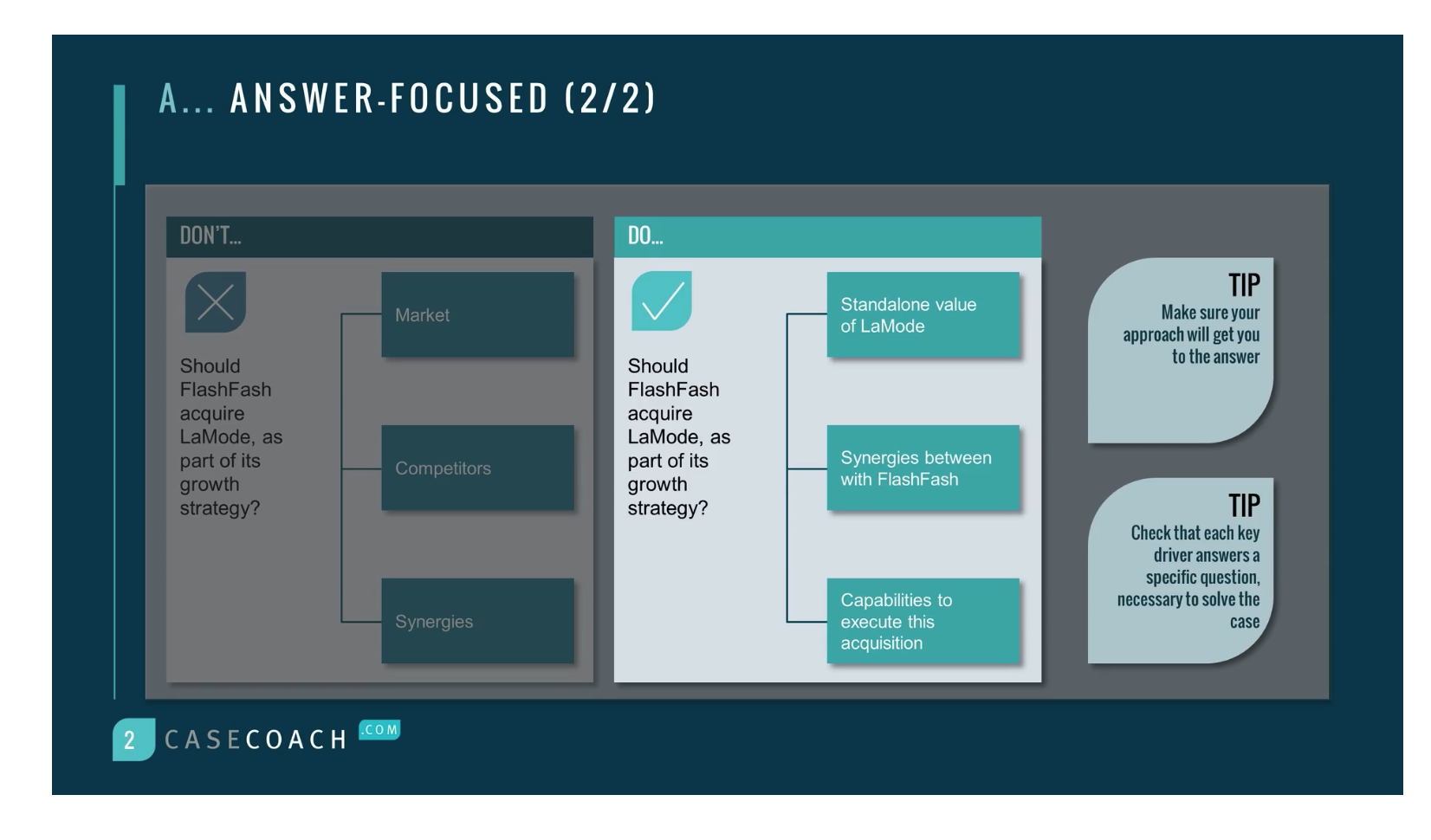

However, I then accessed CaseCoach's tutorials, which speaks about the AIM framework: Answer-focused, Insightful and MECE.

It showed the following figure:

The tutorial (of which I've provided a screenshot above) claimed that the bucket of “market” is not specific to the answer.

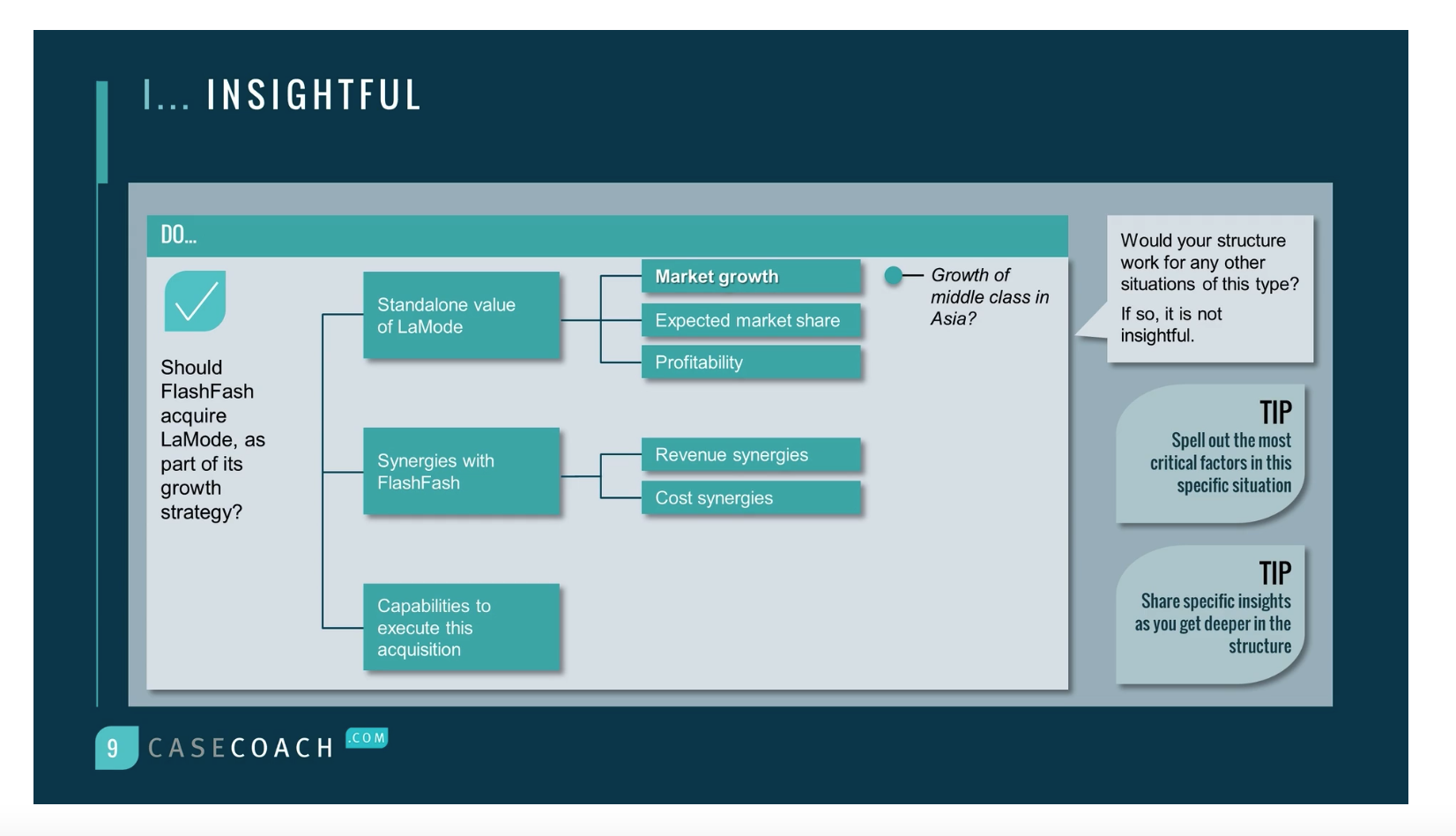

Later, it showed the following breakdown of the sub-levels in each bucket:

Some of these buckets were already covered in my original framework above.

I've been left confused here. I felt that the “markets” bucket was specific since if you don't know whether the market is growing or not, nor if you take into consideration the competitive landscape of the target company, you would not be able to solve the case effectively.

I wanted to ask for secondary thoughts here on who appears to be correct in this situation: myself or the authors of the tutorial?

In addition, I'd like to query whether the suggestion of market under the bucket “standalone value of LaMode” is even appropriate because it appears completely flawed since the value of a company is based on future projections of profitability through cash flows.