Learn the case interview basics, practice with 200+ cases, and benefit from extensive test materials, and interactive self-study tools.

ConsumerPackagingCo is a small, US-based consumer products packaging company that develops, produces, and sells plastic bags for storing sandwiches. The client currently owns one production line.

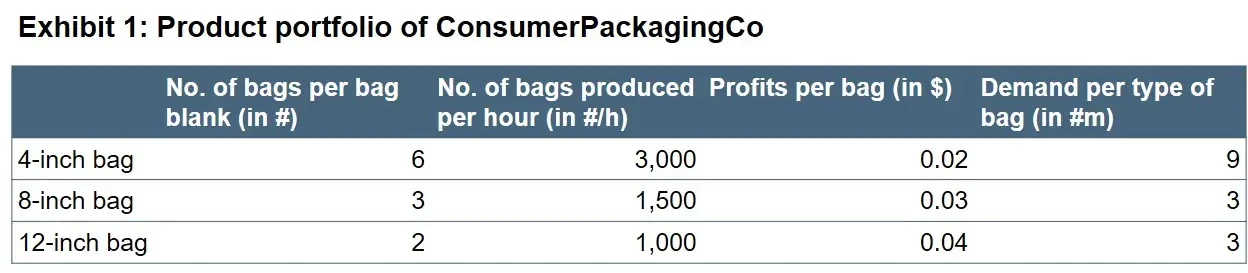

Since demand for their plastic bags exceeds production capacity, ConsumerPackagingCo wants to determine how they can best utilize their current production capacity to maximize profits, and whether investing in a second production line would be economically viable.

2. How can we optimize ConsumerPackagingCo's production capacity to maximize profits?

3. Is it economically viable to invest in a second production line?

4. What are some reasons that might still make investing in a second production line meaningful?

5. What annual profit is required from a new plastic bag to justify investing in a new production line, and how can this be achieved?

6. How can we visually represent the different profits/volume combinations that justify investing in a new production line, including identifying any endpoints for the curve?

7. Based on your analysis, what would you recommend the client to do regarding production capacity optimization and investing in a second production line?

10.8k

Times solved

Intermediate

Difficulty

Do you have questions on this case? Ask our community!