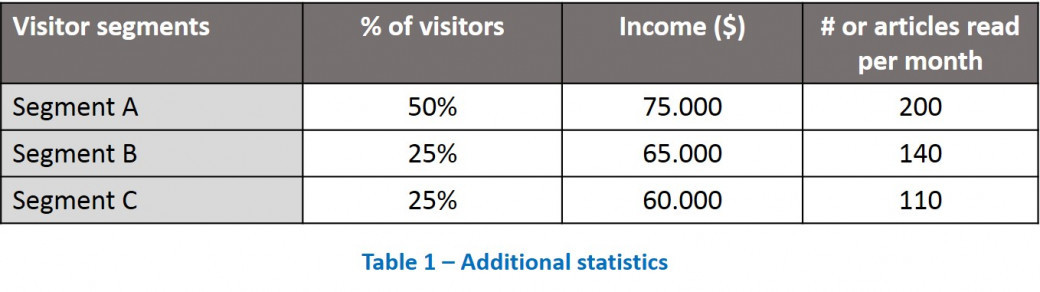

Our client, Daily Journal is a highly respected & upscale newspaper which is read widely in the UK. The paper is positioned between the Wall Street Journal and the New York Times. Recently, the newspaper added an online segment which is a spin-off from the motherfirm. Dailyjournal.com is currently just an online version of the newspaper, but work is underway to structure the online version into a consumer-appealing website.

Their main goal is to earn revenue from the website and that's where you come in. The client wants to know how to generate revenue from the website?

Daily Journal

i