Your client is a big bank that issues credit cards with a €100 annual fee. Recently, a supermarket entered the credit card business. The supermarket’s credit cards do NOT have an annual fee. Your client wants to know how they should react to this new competitor.

Case Prompt:

Sample Structure

The following structure provides an overview of the case:

I. Background – Question 1: What areas would you like to further investigate?

The interviewee may suggest other analyses such as comparisons from a customer’s point of view. However, push the interviewee to compare products.

Information to be shared if inquired by the interviewee:

- The only difference between both credit cards is the annual fee.

- No other information is available.

The interviewee should first outline a structure that can be used to derive potential solutions. At this point, details are NOT recommended.

The general structure could be the 4P framework (Product, Price, Place, and Promotion). The candidate’s structure (eg: the 4P framework - product, price, placement, promotion) should compare the difference between our client’s product and the competitor’s product.

II. Analysis – Question 2: First, we should focus on the revenue. What are the credit card’s main revenue streams?

First, let the interviewee come up with assumptions to estimate revenue!

Information that can be shared after the interviewee has completed the first estimates:

- Annual fee for the client is €100

- Average interchange fee is 1% of the total amount paid

- The average annual income of our client’s customers is about €30,000

- The average interest on credit card balances is 10%

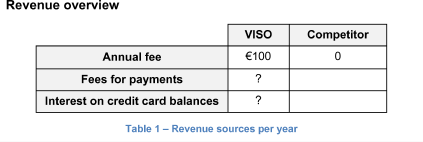

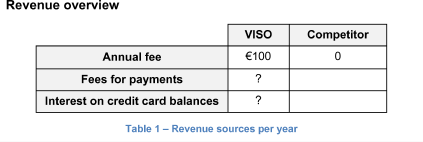

Share Table 1 and ask the next question.

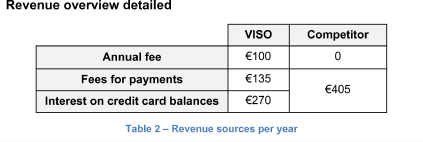

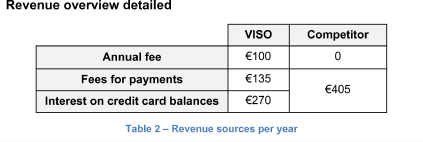

Table 2 shows an overview.

The interviewee should identify three main revenue streams:

- Annual fees

- Interchange fees for retailers (when a customer uses their credit card at a retailer, the retailer pays the bank a percentage of the transaction)

- Interest on credit card balances

For this case, we can ignore all other revenue sources (e.g. cross-currency payment fees, cash withdrawal fees and lost card fees)

Annual fee

The annual fee is €100.

Interchange fee for retailers

The interchange fee per customer is the average amount paid via credit card multiplied by the interchange fee percentage.

The average amount paid via credit card is equal to the percentage paid by card of the customer’s average income per year.

This excludes amounts not paid by credit card such as taxes and rent. Assume a customer spends 45% of his/her income via credit card.

= Average income * 45%

= €30,000 * 45% = €13,500

= Average amount paid via credit card * % of transaction

= €13,500 * 1% = €135

Interest on negative credit card balances

This is equal to the value of a loan multiplied by the interest rate. The interest rate is 10%. Negative credit card balances are 20% of the average amount paid via credit card.

= average amount paid via credit card * interest rate

= (€13,500 * 20%) * 10 = €270

The average yearly revenue per credit card is €505 for VISO and €405 for the supermarket. (The €100 annual fee is the only difference.)

= Activation fee + Payment fees + Interest

= €100 + €135 + €270 = €505 per year

= €505 – activation fee

= €505 – €100 = €405 per year

Removing the €100 annual fee results in a huge (20%) revenue loss for VISO.

III. Conclusion – Question 3: Can you give VISO three different recommendations?

The candidate does not need to further analyze each recommendation. However, the candidate should state the assumptions that must be true in order for a recommendation to be reasonable.

Suggested recommendations:

- Do nothing. The new competitor targets a different customer segment. Alternatively, customers do not price sensitive.

- Remove the annual fee. Increase other revenue streams to compensate for the loss in revenue.

- Other methods

Bundle the credit card with other products such as savings accounts.

Waive the annual fee after the customer has paid a certain amount each year via the credit card.

III. Conclusion – Question 4: If VISO removes the activation fee, how would you compensate for the loss in revenue? Mention possible drawbacks.

Possible answers:

Amount paid

Encourage customers to use VISO more often (e.g. increase the number of retailers accepting VISO cards or introduce a rewards system)

Increase the interchange fee percentage

A higher fee percentage may cause fewer retailers to accept VISO. This will decrease the total amount paid via VISO.

Increase interest rate on credit card balances

Since not many customers know about the interest rate on credit card balances, they should not be price sensitive to the interest rate. However, high-interest rates may negatively impact VISO’s image.

Increase the amount customers owe on their credit card balance

This is risky because customers with higher debt levels are more likely to default.

Further Questions

What problems does a bank face when non-banks compete in the credit card industry?

What problems does a bank face when non-banks compete in the credit card industry?

Possible answers:

- Reduced profits

- Less customer information due to lack of payment data

- Current accounts and payments are the starting products for customers

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

VISO

i