Client goal

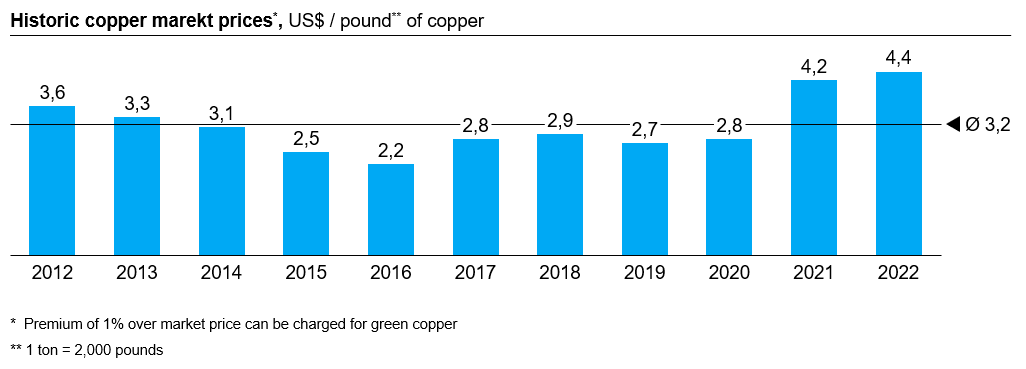

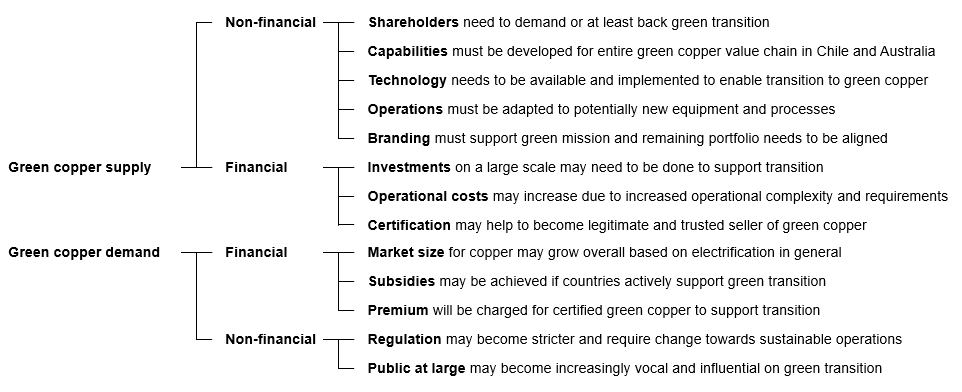

Our client is an international mining company Global Mining Corp (GMC) that focuses on copper mining and is interested in the possibility of producing and selling “green copper”, which is the same product as normal copper but with a certified zero carbon footprint for its entire life cycle until sale. The client engaged your team to help determine the prospects for achieving net zero for their Chilean and Australian copper mines in the next 10 years and decide whether they should pursue this path.

Description of situation

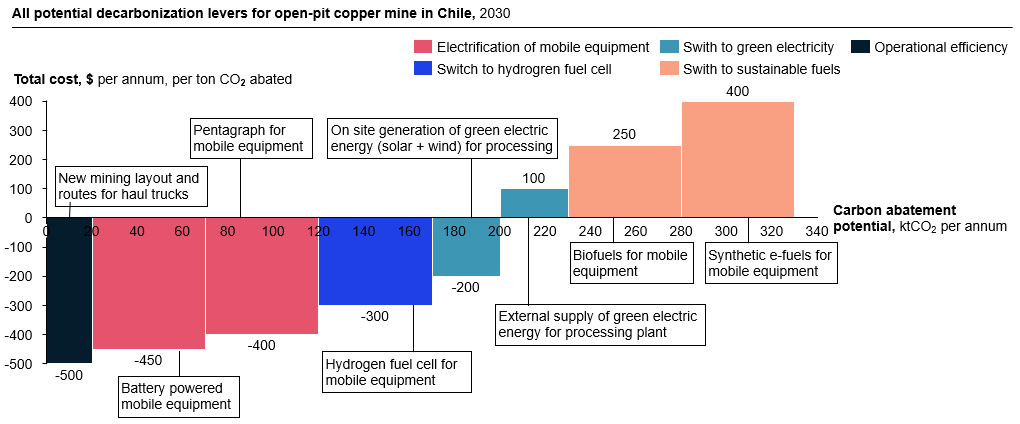

The client operates open pit copper mines mostly in remote areas of Chile and Australia. In most cases, the copper ore is blasted with explosives and turned into rubble, which is then collected by heavy bulldozers in big piles, loaded by power shovels onto haul trucks, which transport the material over several kilometers to the processing site. Mobile equipment is diesel operated and very heavy, up to 400 tons for a fully loaded haul truck. During processing, a series of mechanical operations take place to break down the rubble further before chemical processes like acidic leaching are used to produce the final product: copper cathodes. This material is then transported by trucks and rail to the nearest port where it can be shipped to its final destination, depending on the customer.

Zero Carbon Mine (McKinsey 1st & 2nd round)

i