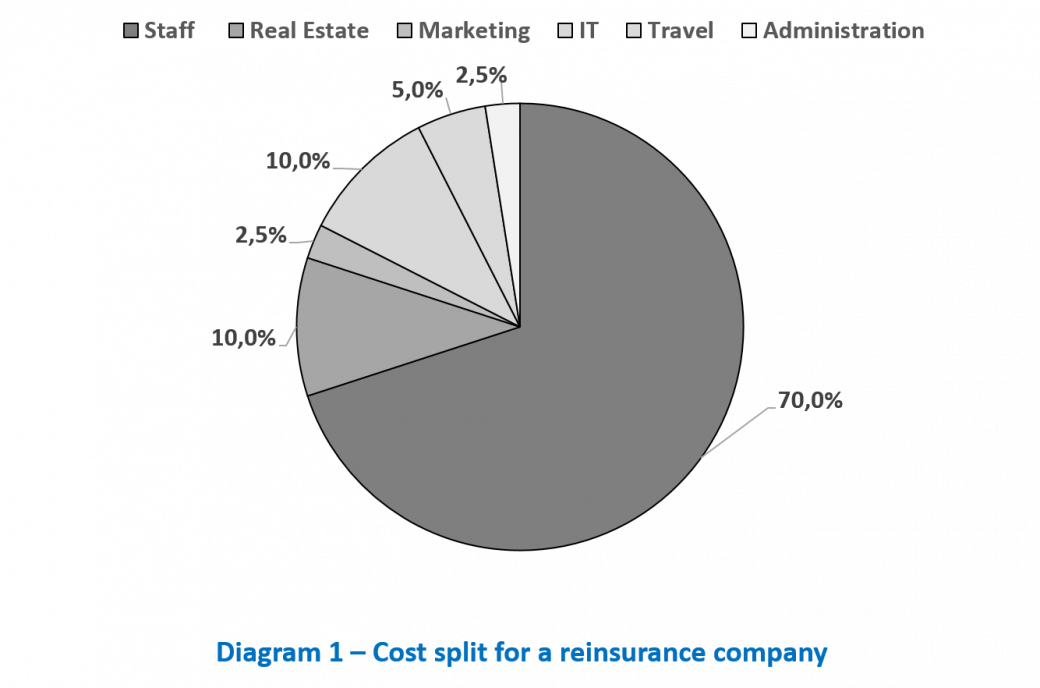

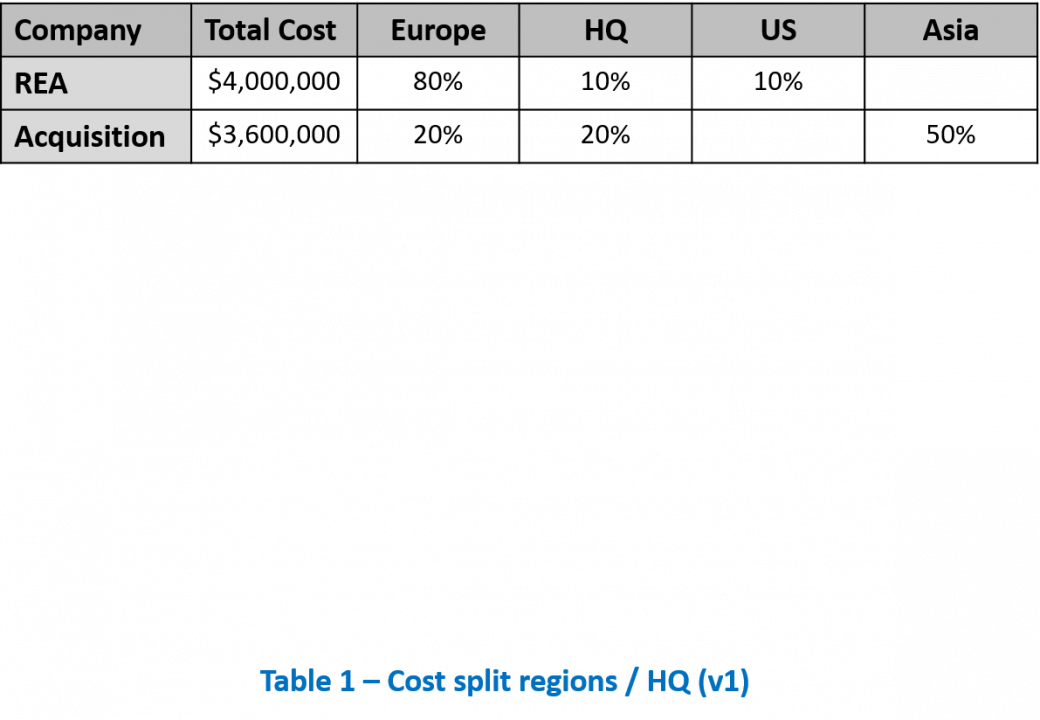

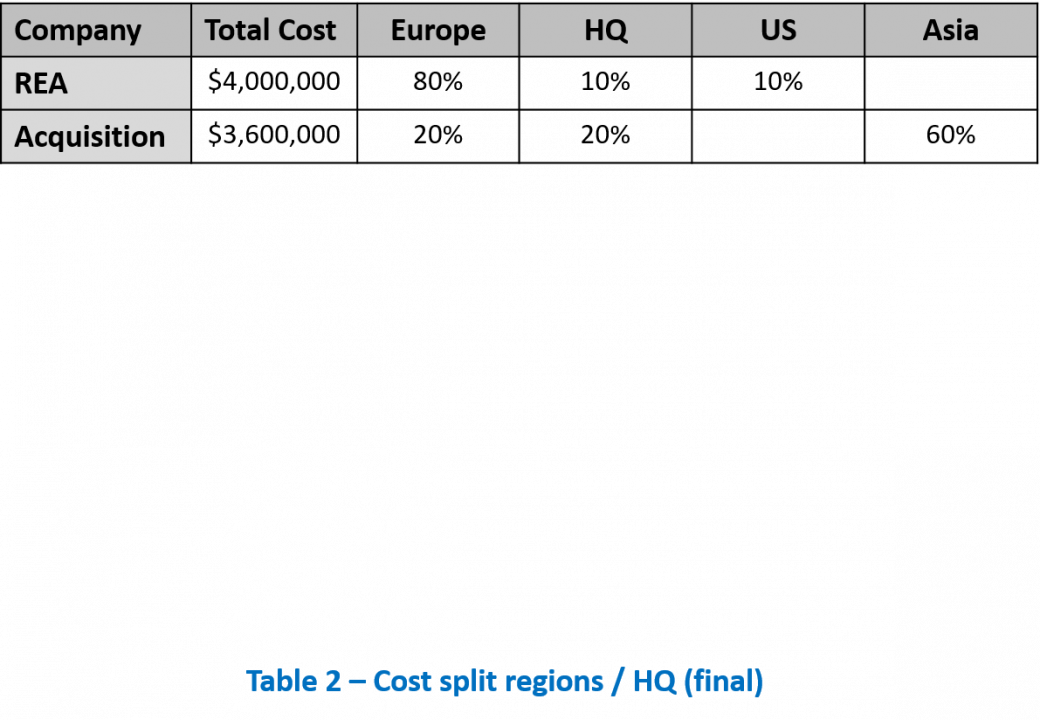

Your client, REA, is a reinsurance company.

REA recently acquired another reinsurance company (approximatively same size): the choice of this company was notably based on its product portfolio as well as its market presence which appeared complement with REA.

However, the acquisition is not well received by the market. The acquisition price is considered too high and the transaction has not been well graded. REA management asks you to evaluate the transaction.

REA Reinsurance

i