Two global chemical companies announced their intent to merge. Senior management of the two companies called your firm the day after the merger was announced. The client needs a more in-depth understanding of the benefits from the merger for its board and would like your firm to help out. In short, 2 questions to solve: (1) what are some of the financial benefits from the merger? (2) how much are these benefits worth?

Case Prompt:

1. Opening of case

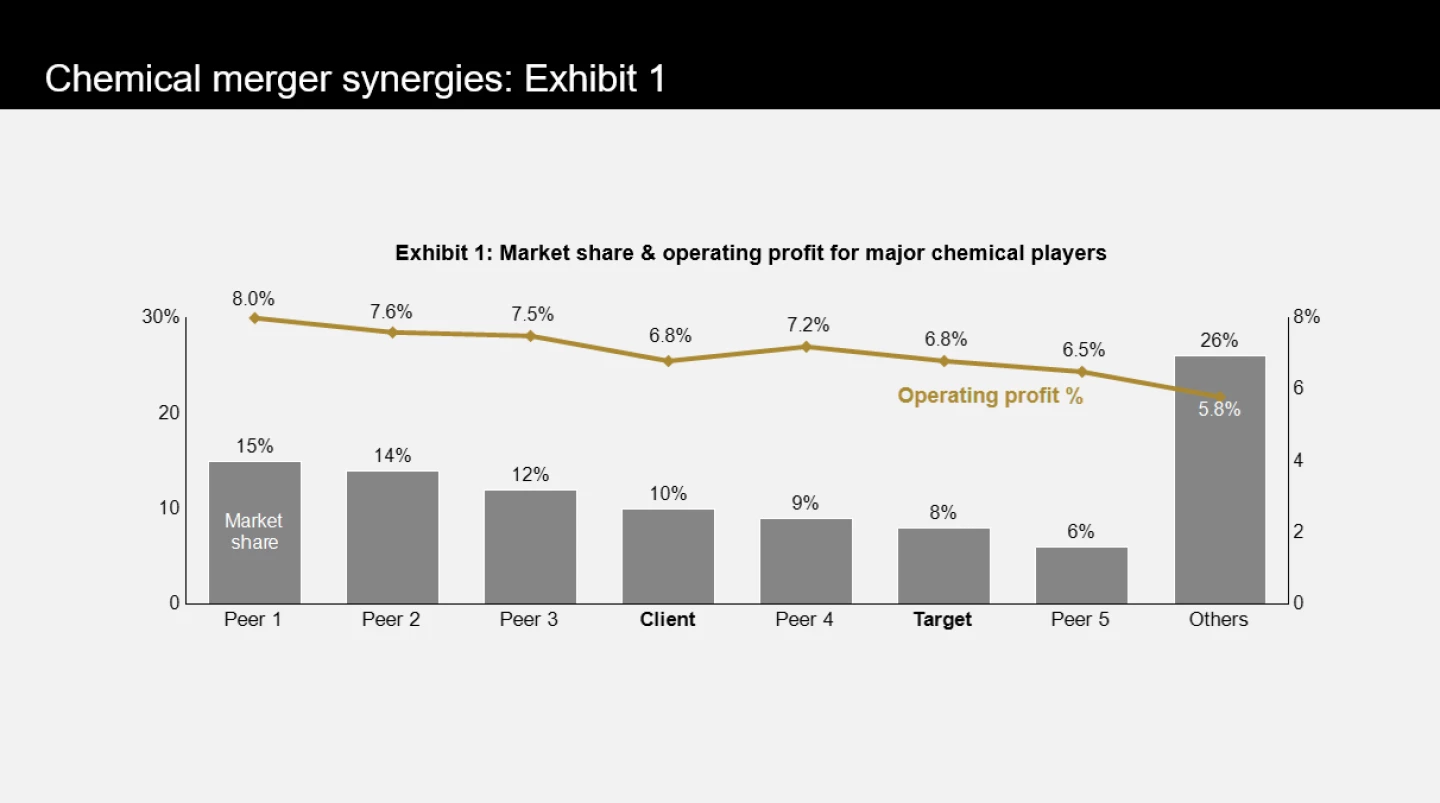

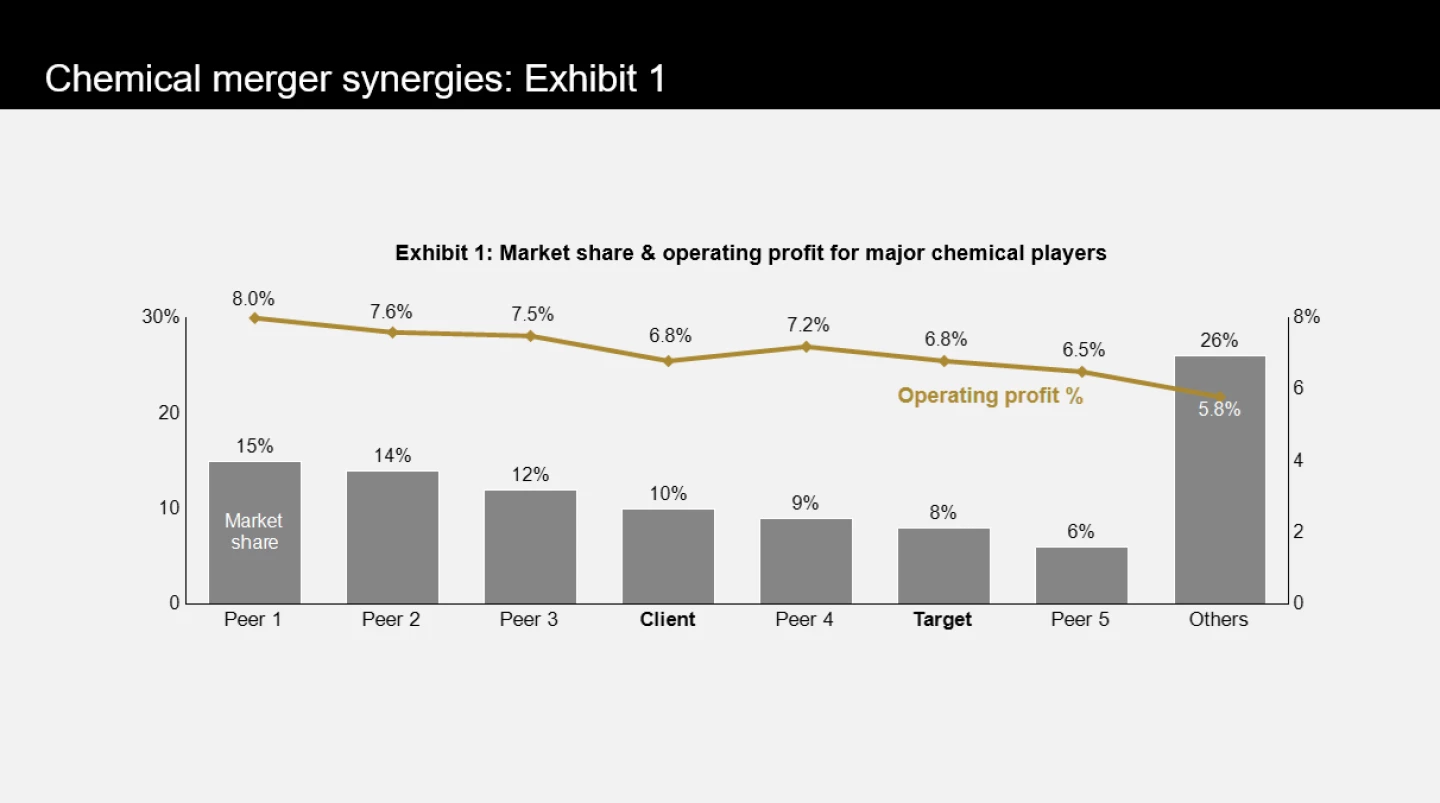

Share Exhibit 1 with candidate BEFORE the candidate proceeds to set up the initial structure. “The client would like us to have a bit more context and shared this graph with us. What are your initial observations?”

From the information provided in chart, the candidate should be able to observe the following:

Client is 4th biggest player, and the target is the 6th biggest, with 10% and 8% market share; merger would make our client the largest player with 18% share

Both have operating margins of 6.8%, which is in the range, but on the lower end of competition

An exceptional candidate would also notice:

The merged company will become the largest player. It’d have major advantages in buying power and efficiencies of scale

The data suggested that operating profits are roughly correlated with size in this market

From the information provided in chart, the candidate should be able to observe the following:

Client is 4th biggest player, and the target is the 6th biggest, with 10% and 8% market share; merger would make our client the largest player with 18% share

Both have operating margins of 6.8%, which is in the range, but on the lower end of competition

An exceptional candidate would also notice:

The merged company will become the largest player. It’d have major advantages in buying power and efficiencies of scale

The data suggested that operating profits are roughly correlated with size in this market

2. Structuring of case

Ask the candidate – “Now that we have a bit more context, how would you approach the client’s question?” This is the time for candidate to develop a structure.

Minimal adequate answer:

“Given the increased size of the merged company, I would expect cost savings. I would like to look at a detailed breakdown of each company’s costs to look for potential opportunities to save”. Candidate should mention at least a few buckets of cost (e.g., COGS, logistics and distribution, advertising, corporate overheads)

“There may also be opportunities to increase revenue. I would like to look at the breakdown of each company’s revenue. Perhaps there is opportunity to leverage each other’s strength”

Additional and exceptional answer:

The candidate offers 1-2 ideas of costs savings, e.g. use size to negotiate better procurement prices, eliminate redundancies in corporate functions / overheads / facilities; suggest benchmarking vs. competitors

Offer ideas on potential revenue synergies from leveraging best practice, e.g., cross-sell to customers from both companies, up-sell more premium products to customers where applicable, pricing optimization to reduce leakage etc.

Offer ideas on potential cash synergies, e.g., adopt best practice in cash management (AR, AP, Inventory), eliminate duplicate Capex spend (new plant / facilities)

3. Synergy estimation (part 1)

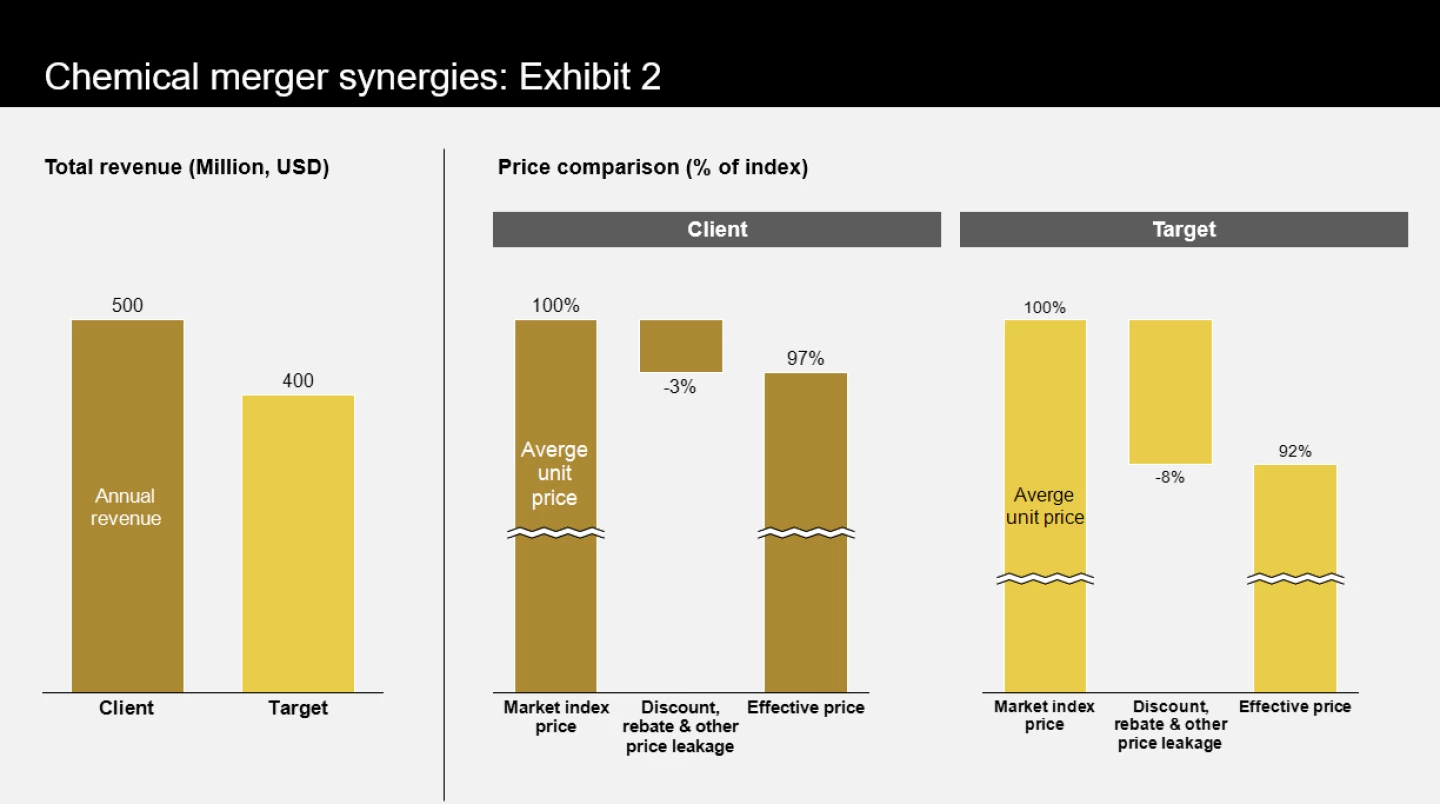

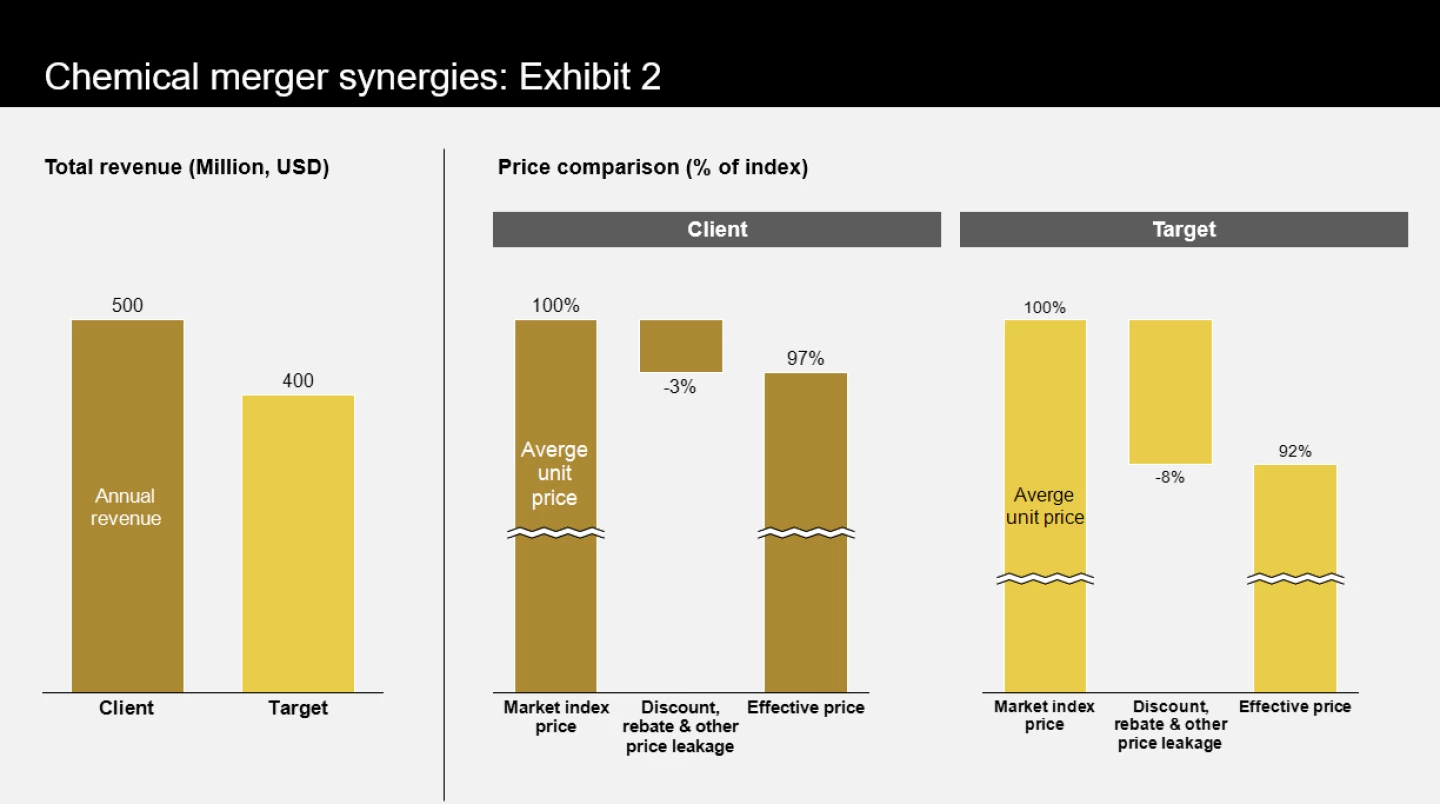

Push more on candidate’s thinking if the structure is not in-depth enough. Once done, proceed to share Exhibit 2 with candidate - “Let’s look at the pricing data our client shared. What do you think the potential value creation / synergy could be? And how much?”

The answer is provided in the Solution section.

The candidate should notice that the target company is experiencing a higher pricing leakage from discounts, rebates etc. If the target company can adopt best practice from the client and reduce the pricing leakage from 8% to 3%, that translates to a revenue uplift of $400M x (8% - 3%) = $20M in pricing synergy.

4. Synergy estimation (part 2)

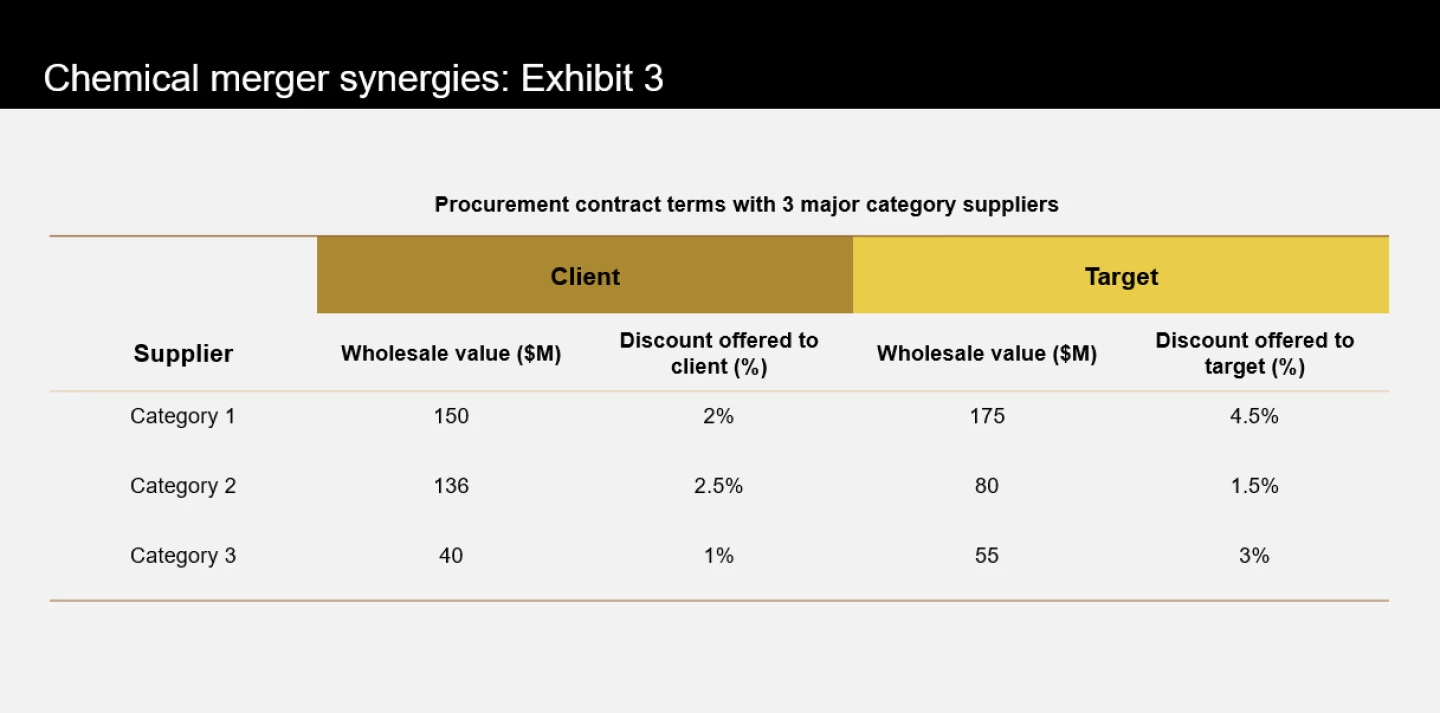

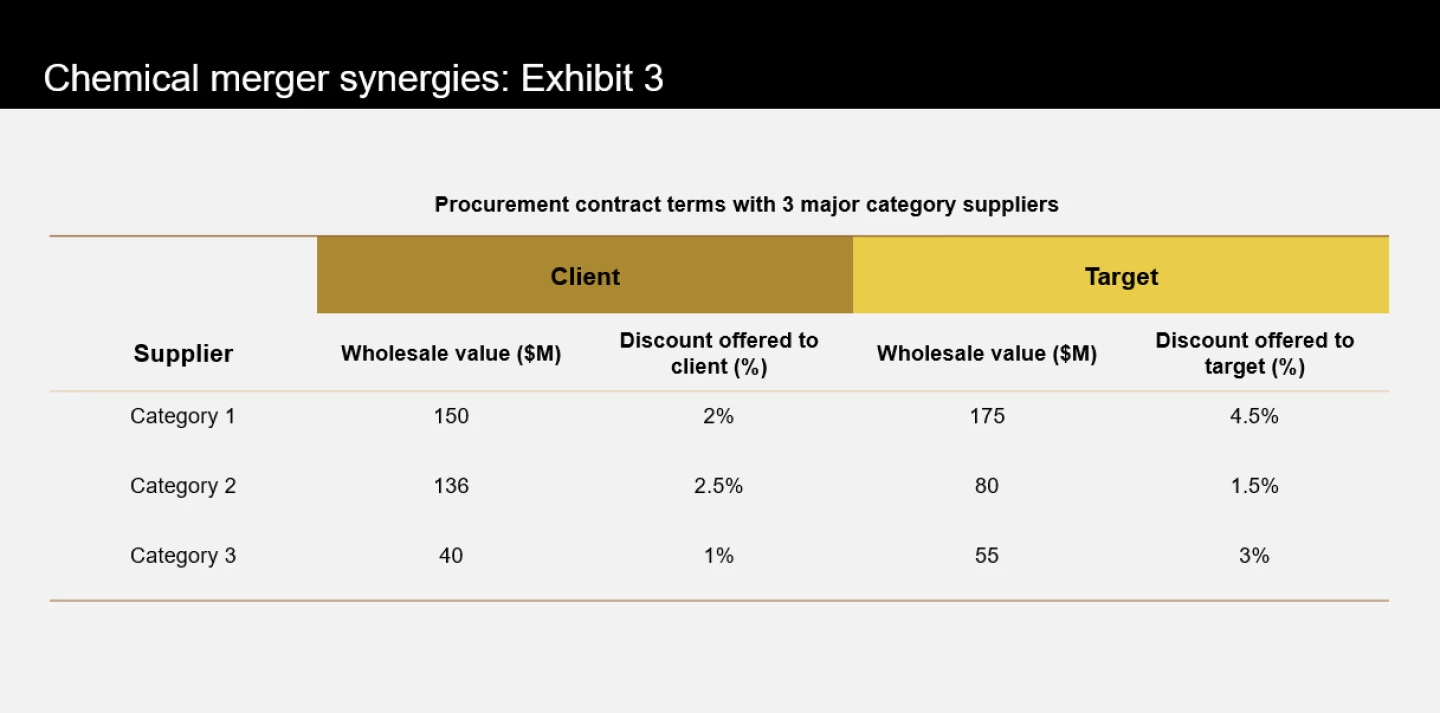

Once done with the pricing synergy calculation, share Exhibit 3 with the candidate – “The client also gave us some of the contract terms that the client and the target have with some of their large suppliers. While this exhibit only represents 3 of the procurement categories, we can use it to extrapolate to overall procurement spend. Where do you think the value creation can come from? And how much saving can we expect from the 3 categories?”

The candidate should notice that there is opportunity to save by harmonizing the procurement contract terms. On some categories the client is currently getting a better discount and on others the target is. Upon merger, the merged company should be able to secure the lower discount for the total combined spend in each category (“buy cheaper”). The candidate might point out that there could be additional saving opportunity by reducing the spend (“buy less”), which is a valid point for next steps. For simplicity of the calculation, instruct the candidate to focus on estimating the saving from “buy cheaper”.

Total saving from 3 categories is $5.35M, with breakdown below.

Category 1: $150M x (4.5% - 2%) = $3.75M

Category 2: $80M x (2.5%-1.5%) = $0.8M

Category 3: $40M x (3% - 1%) = $0.8M

Ask the candidate – “If these categories represent 20% of the combined company’s procurement, how much can the combined company expect to save from contract term harmonization on all their procurement spends?” Answer = $5.35M / 20% = $26.75M

The candidate should notice that there is opportunity to save by harmonizing the procurement contract terms. On some categories the client is currently getting a better discount and on others the target is. Upon merger, the merged company should be able to secure the lower discount for the total combined spend in each category (“buy cheaper”).

Total saving from 3 categories is $5.35M, with breakdown below.

Category 1: $150M x (4.5% - 2%) = $3.75M

Category 2: $80M x (2.5%-1.5%) = $0.8M

Category 3: $40M x (3% - 1%) = $0.8M

If these categories represent 20% of the combined company’s procurement, a quick extrapolation renders $5.35M / 20% = $26.75M saving potentially.

5. Conclusion

Ask the candidate to conclude - “Assuming the client has walked in and wanted an update on your progress, what would you share? What would you recommend as next steps?”

A good answer should include:

Combined company would be the market leader with 18% share and could likely improve operating margins to above 7%

We identified opportunities of value creation from (1) pricing optimization which brings $20M upside, and (2) procurement contract harmonization which brings another $26.75M saving.

These are just 2 synergy levers. For next steps, we should continue to explore other potential synergies, including (1) dig into potential revenue synergies from best practices, (2) explore other options to further reduce cost such as overhead etc., (3) look into cash levers as well.

Chemical Merger Synergies