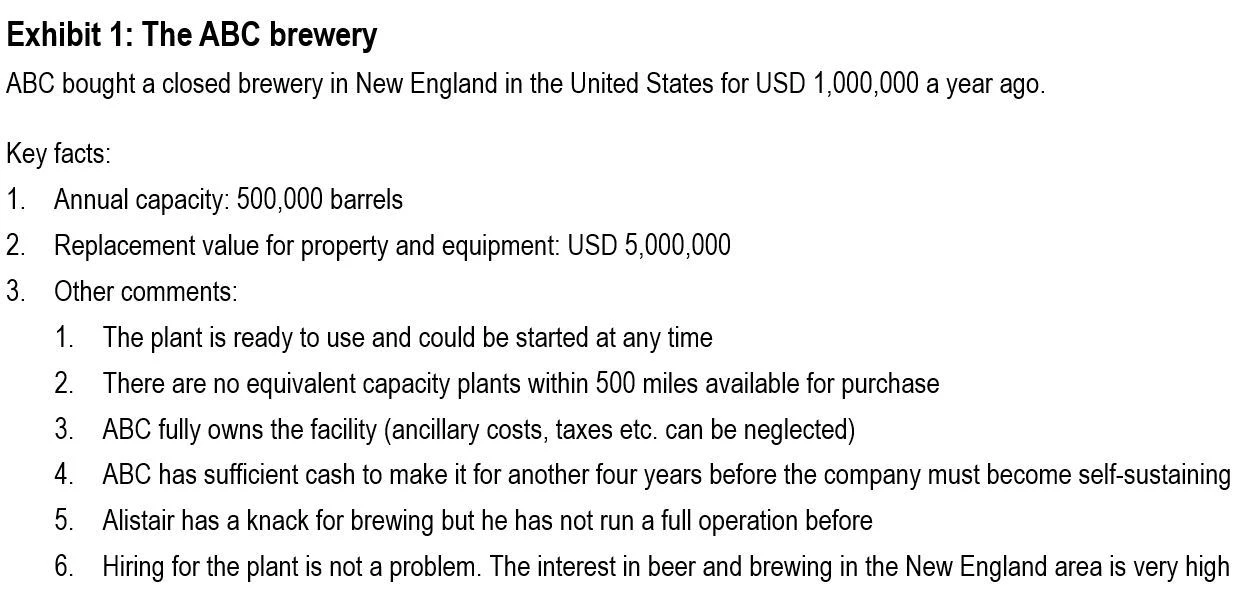

Your client is Alistair, a brew master from the east coast of the United States. He has developed a beer recipe he believes will revolutionize the beer drinking experience in the US. Alistair was able to convince his family and friends to invest in his business idea after letting them taste a sample of his new beer. With the investment money, Alistair founded the Allstar Brewing Company (ABC) and bought himself a mothballed brownfield brewery. This was already one year ago and Alistair has been working on perfecting his recipe since, but he has yet to produce a barrel of beer from the acquired production site. In the meantime, ABC has been approached by two other companies that both submitted a respective offer. Alistair seeks your help in determining the best course of action.

Case Prompt:

Conceptual Evaluation of Options

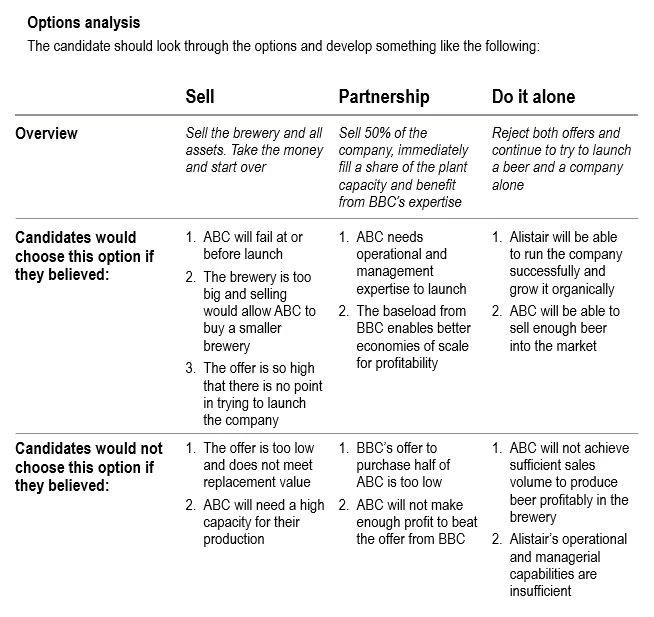

Alistair has asked you to evaluate the two offers ABC received and compare them to the option of ABC launching Alistair's new beer on a standalone basis.

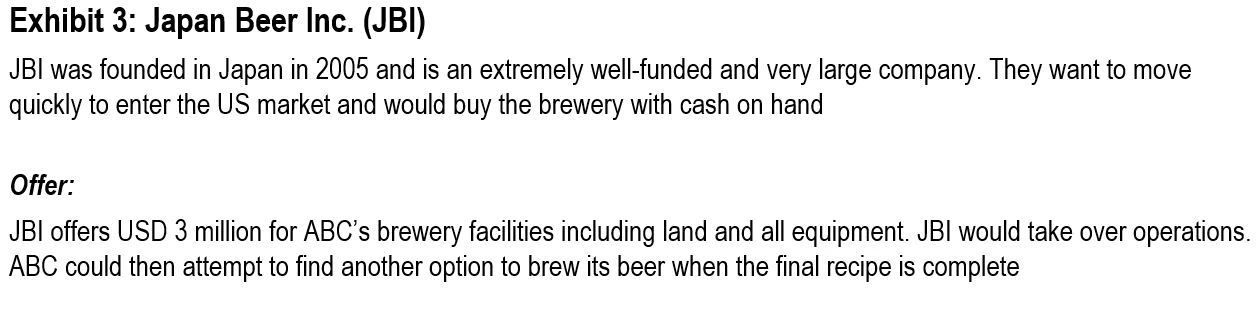

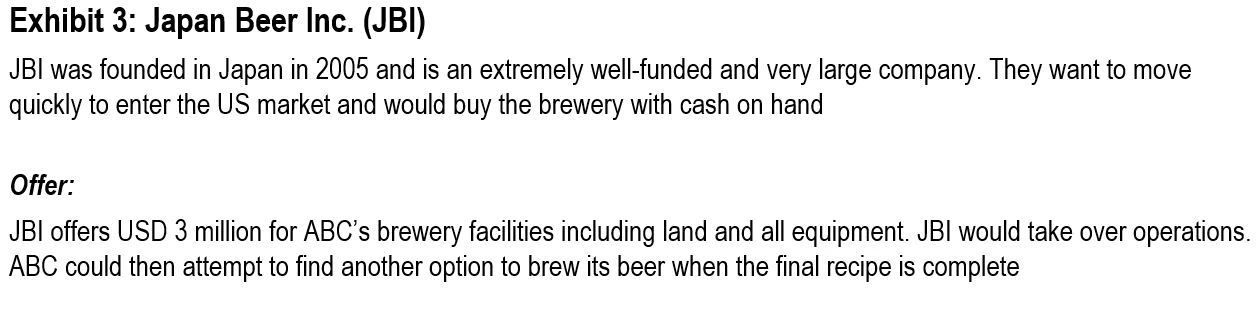

- Sell the plant and all of its assets to Japan Beer Inc. (JBI) that is looking to enter the US market

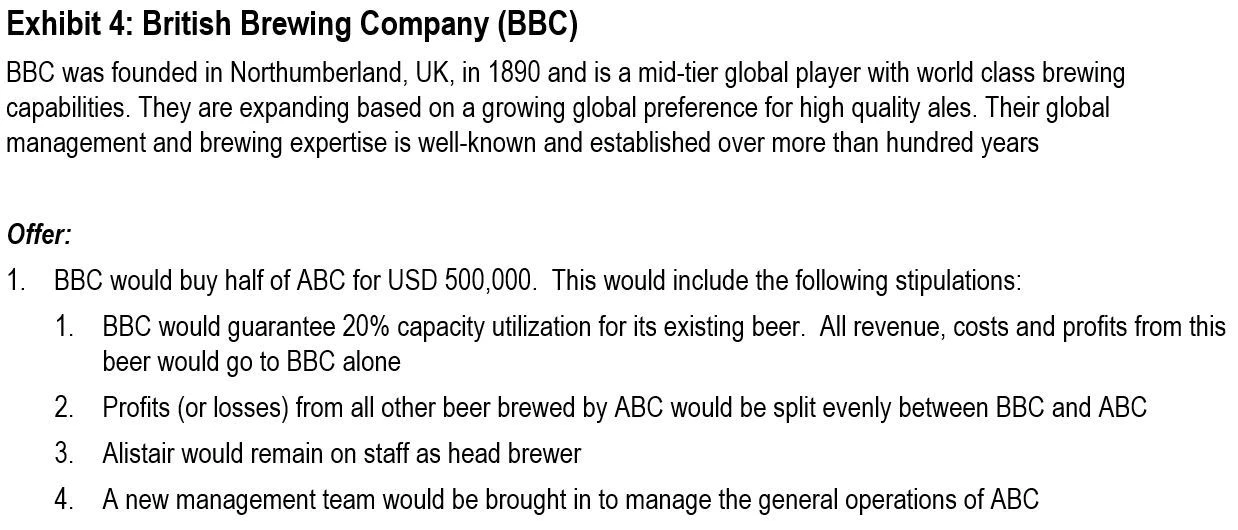

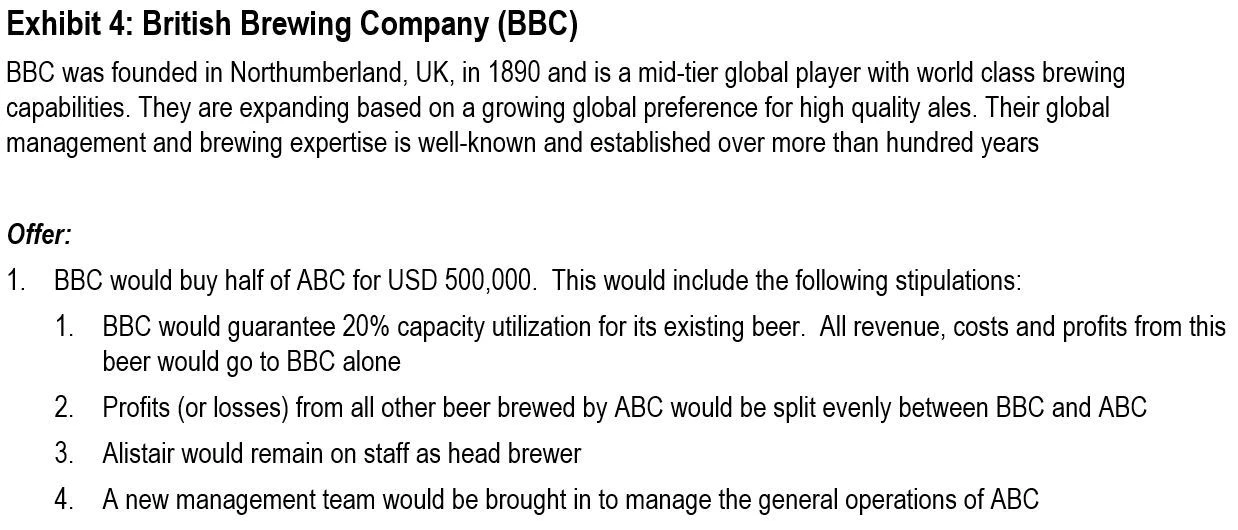

- Partner with British Brewing Company (BBC) who would buy half of the company and use a share of the brewery’s capacity each year to produce their own beer

What are the general factors you would consider for such an evaluation?

The candidate should approach this part of the case on a conceptual level. Specific numbers and figures are not needed at this point. The objective is to focus on the 3 described options (selling, partnership, standalone launch) to discuss potential criteria under which each option might make sense.

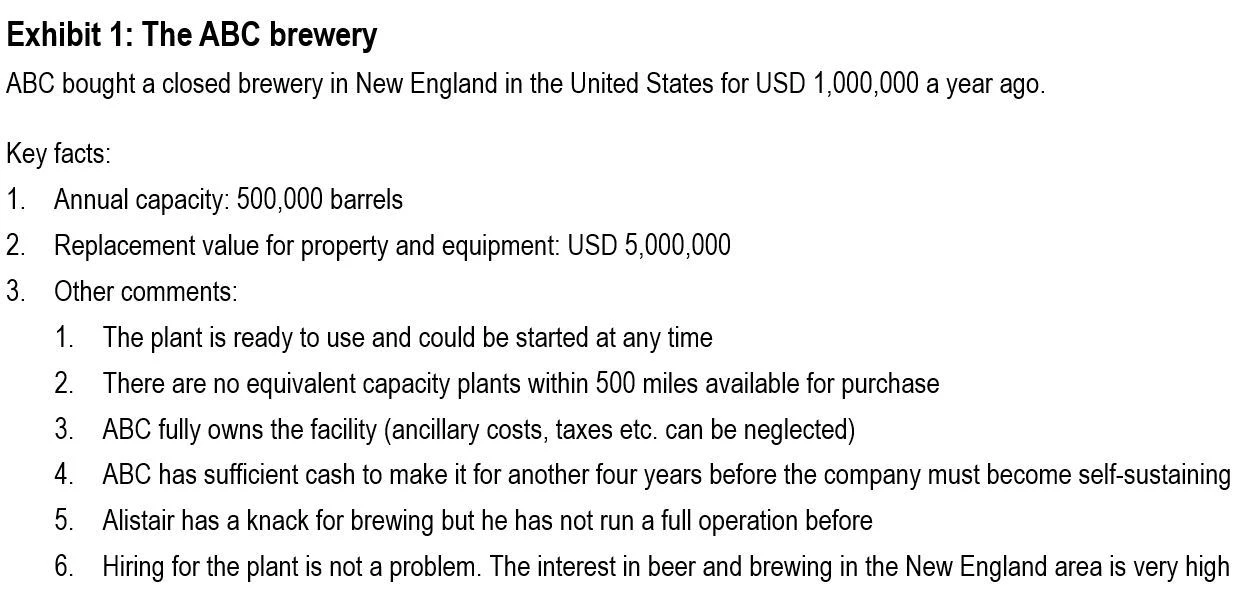

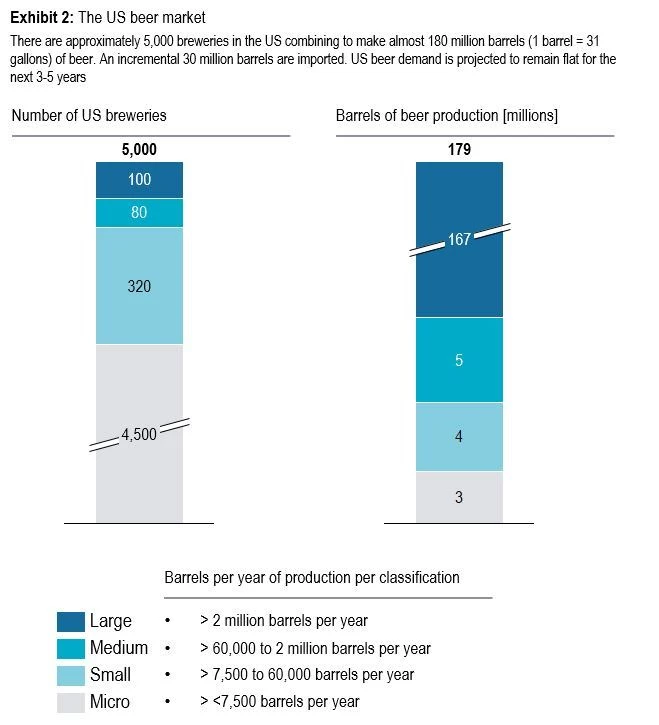

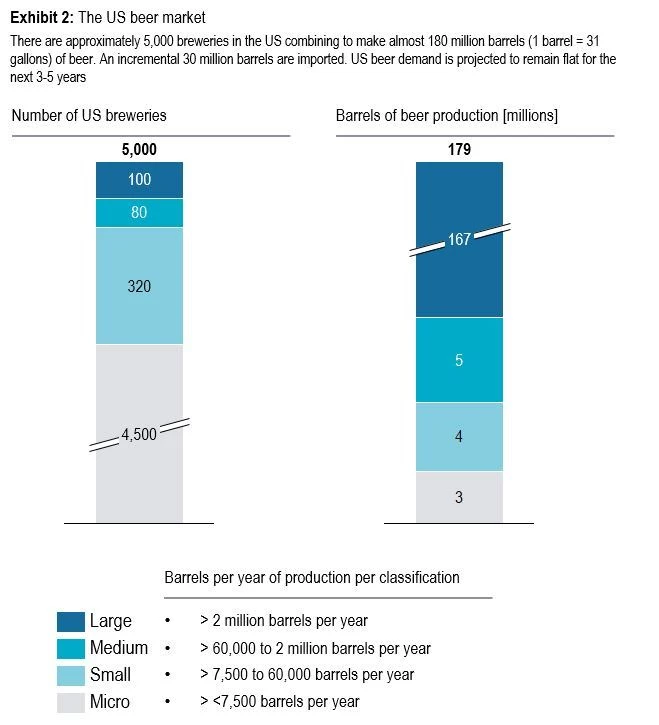

Show Exhibits 1 and 2 to the candidate

Profitability Analysis

Alistair decided to share with you the details of the two offers that ABC has received. He also spent the last weeks putting together a revenue and cost analysis for his brewery plant. Since he is not a consultant, he is looking to you to provide him guidance on which option to choose to achieve the most profitable outcome.

What would you recommend Alistair to do – sell to JBI, partner with BBC or run ABC alone? Why?

The candidate should recognize that a quantitative comparison between the options is needed to make a recommendation.

The following information can be shared if asked

- Time value of money can be ignored - the case should not turn into a DCF evaluation

- A split between fixed and variable costs does not have to be considered - fully loaded cost in Exhibit 5 are sufficient for this exercise

- Details on a demand plan or how fast breweries typically grow are not provided - the candidate will have to make assumptions

- Demand can be considered on the holistic US level - a regional breakdown does not have to be considered

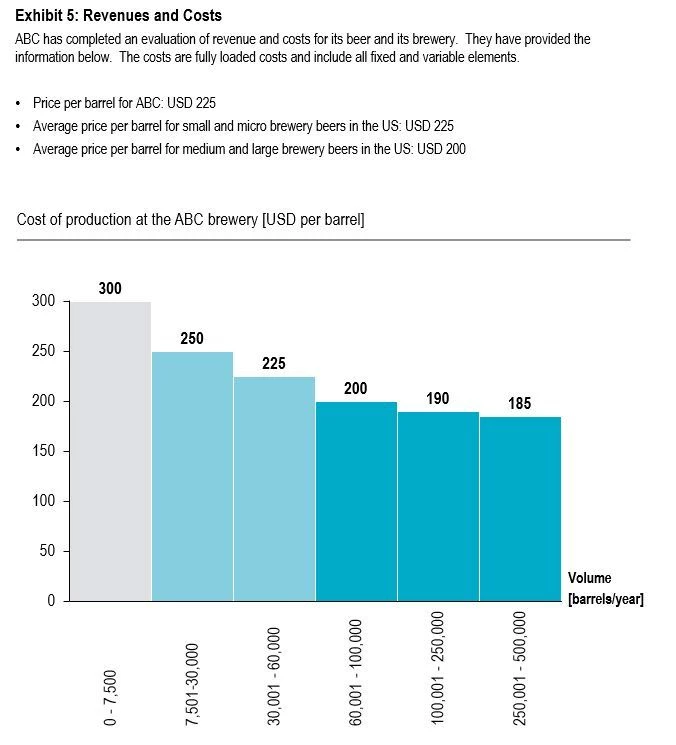

Show Exhibits 3, 4 and 5 to the candidate

Areas to test the candidate:

The option selected hinges largely on how confident the candidate is on ABC producing a significant volume of beer. A few areas to probe:

- How has the candidate considered volume of production? Poor candidates will assume ABC can sell 500k barrels. Good candidates will recognize that it is likely that ABC will sell a fraction of that

- How has the candidate treated the fact that ABC has never produced anything? Poor candidates will assume success for the company. Good candidates will consider some reasonable likelihood of failure

- How has the candidate matched size with capabilities? Poor candidates will assume large production volume and ignore how to get there. Good candidates will match the likelihood of success with the volume of production with the capabilities required to run the business

- Has the candidate noticed that ABC has purchased a brewery much larger than needed? Poor candidates will discard the sell option because the offer is lower than the replacement value of assets. Poor candidates will also miss that the brewery is over-sized which creates the need to produce high volumes to achieve profitability. Good candidates will acknowledge that the brewery is likely over-sized and work their answer around how to fix that

The candidate should be able to provide some quantitative context to why one option is preferential to another.

Some of the potential analysis:

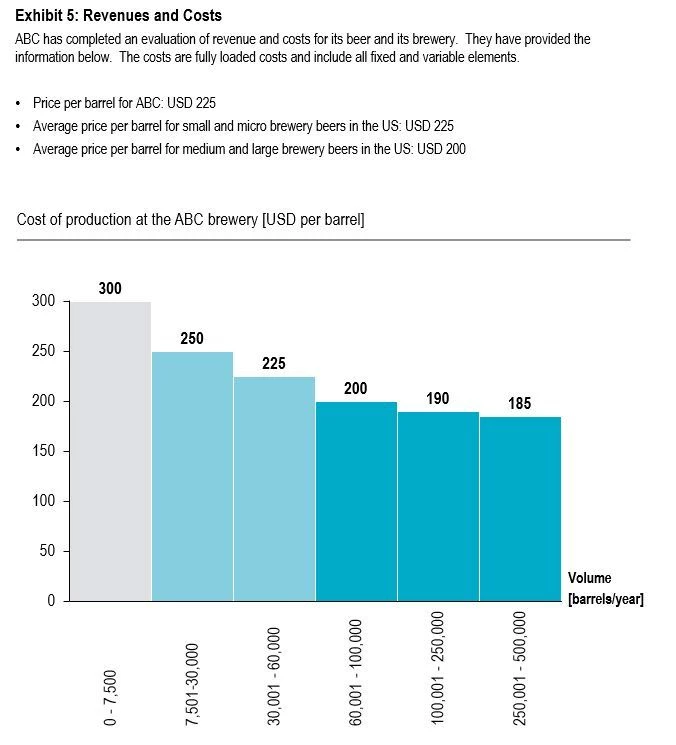

1.Minimum volume to make a profit: candidates should use Exhibit 5 to confirm that the brewery needs to produce at least 60,000 barrels before ABC makes a profit on a barrel. Any assumption, therefore, of ABC going it alone and selling fewer than 60,000 barrels per year is unreasonable

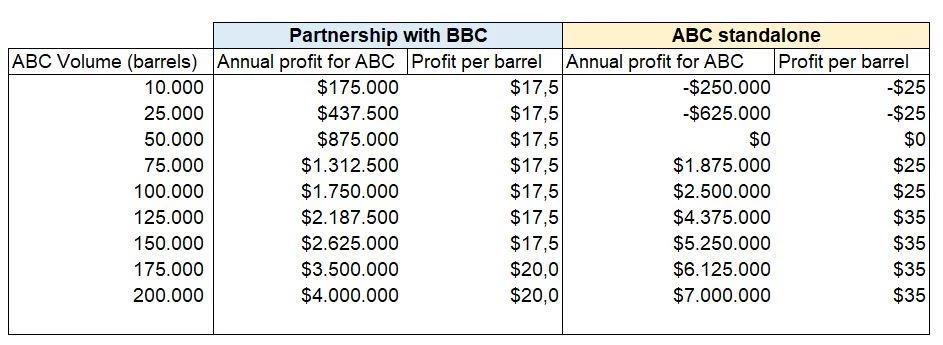

2.Breakeven between selling the plant to JBI and partnering with BBC (ignoring time value of money) = USD (3.0m – 0.5m) / ((USD 225/barrel - $190 / barrel)/2) = 143,000 barrels.

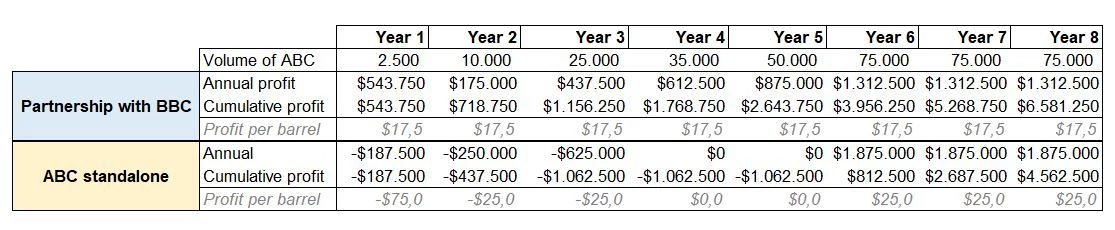

If ABC produces volumes within the small brewery range but partners with BBC (leveraging their baseload to produce at a lower cost) it should take about 5-6 years to achieve the cumulative sales volume to reach USD 3m in profit (which JBI would pay right away). Good candidates should see that if the goal of ABC was to be a microbrewery, they should sell

3.Breakeven between partnering with BBC and going it alone hinges on the fact that with BBC each barrel is profitable but that 50% of the profit goes to BBC. BBC will also pay USD 500k up front. On an annual basis, ABC must be able to produce over 60,000 barrels. Over 60,000 barrels would put ABC in the top 3.5% of breweries in the country. With any reasonable ramp-up in production assumptions it becomes clear that partnering with BBC will be a preferred option unless ABC is confident it can get to at least 75-100k barrels per year.

Sample calculations (not necessary for the candidate to have performed) are shown in the screenshots

Further Questions

Under which circumstances would your recommendation change?

Under which circumstances would your recommendation change?

Candidates should explore the sensitivities around their proposed option and discuss respective implications

Potential sensitivities impacting the recommendation could be:

- Change in the production volume ramp-up – if ABC were to struggle with their volume plan, breakeven and subsequent profitability would take longer to achieve (ABC only has 4 years of financial runway)

- Market penetration poses a challenge – ABC might be able to produce the required volumes from an operational standpoint but they cannot sell that amount of beer given that they are a new market entrant trying to compete with established medium-sized players

- Fluctuations in raw material and energy cost – the key cost drivers for beer are water, barley, hops and electricity. A change in prices could impact ABC’s cost curve making production more costly. In that case, selling the business might become more attractive

- ABC manages to re-negotiate offer terms with JBI – if Alistair were able to sell ABC for more than USD 3m, it would take longer to break even in the partnership and standalone scenarios

Options Evaluation: Profitability of Brewing Company Startup