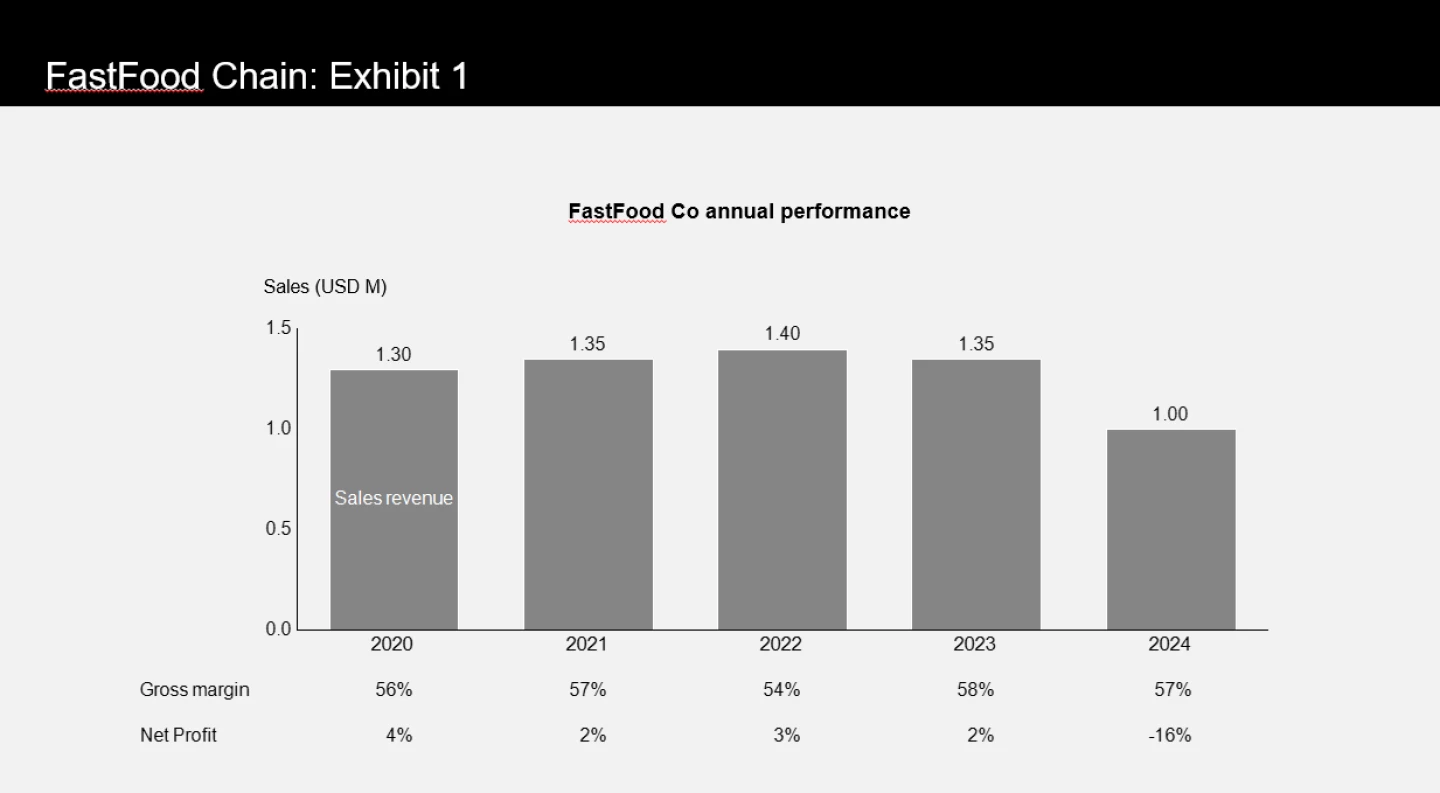

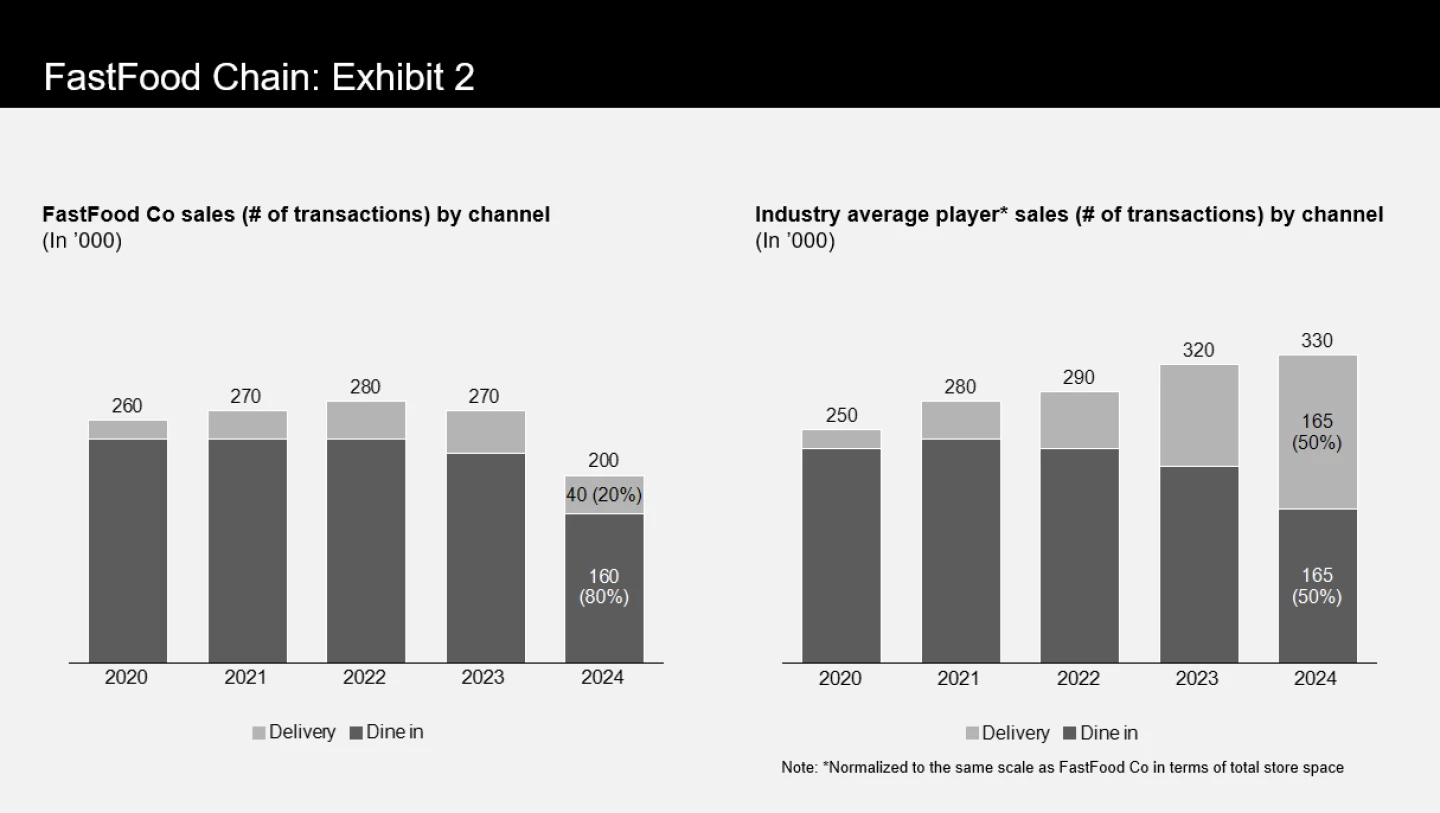

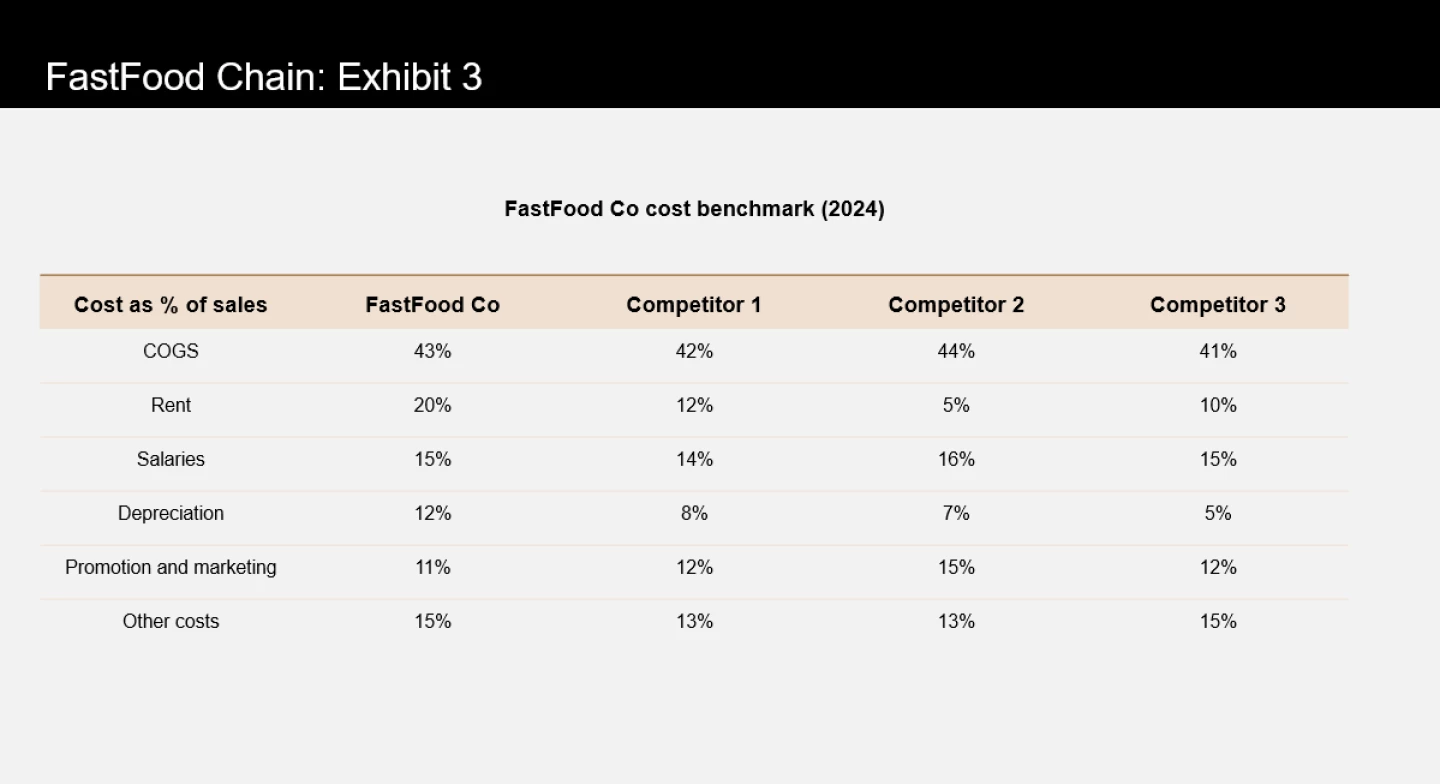

Our client (FastFood Co) is a fast-food company that has > 20 restaurants in the city. Recently, the business has encountered significant challenges, with net profit drops to negative.

The client wants us to help them turn around the business. How would you help them?

FastFood Chain Turnaround