An online travel agency earns a 10% commission on all of its bookings. Currently, their profits before taxes are $1 m, while the industry average is around $2.5 m. The client wants to know why they're making less than the industry average?

Case Prompt:

Sample Structure

The following framework/structure provides an overview of the case:

I. Background

Information that can be shared if inquired by the candidate:

- Agency books flight tickets for its customers and earn a commission.

- Total revenue per year on average for the agency is $10 m.

- The agency has a similar size and revenue size as its peers.

- Average industry margins are around 43%.

- Costs have stayed the same and are set at $9 per transaction regardless of the traveler type.

The candidate should want to look into revenues first since lower profits could mean that the company isn't turning in as much revenue as its industry peers.

II. Analysis

Information that can be shared if inquired by the candidate:

- The agency has two business segments: business travelers & leisure travelers.

- Business travelers account for 40% of total revenue & leisure travelers account for 60%.

- The agency processes around a million bookings a year.

- 300,000 bookings go to the business traveler & 700,000 go to the leisure traveler.

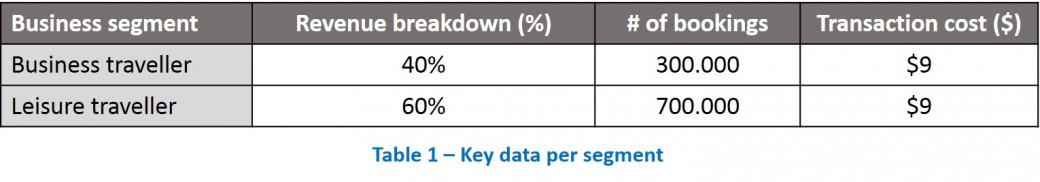

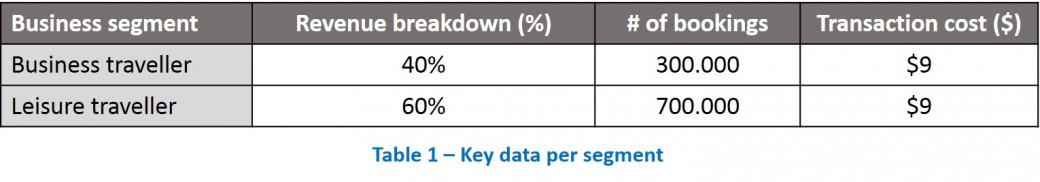

Share Table 1 with the candidate for an overview.

Next, the candidate should want to understand the revenue breakdown and business segments as well as their profit contribution. With the information given, the candidate should calculate the profit contribution for each segment.

The candidate should calculate profit per transaction for both segments to see how profits are structured and where the problem lies.

40%*$10 M=$4 m

$4 m/300,000 bookings=$13.33

$13.33-$9=$4.33

$4.33*300,000 bookings=$1.3 m

60%*$10 M=$6 m

$6 m/700,000 bookings=$8.57

$8.57-$9=$-0.43

$-0.43*700,000 bookings=$-0.3 m

III. Solution

It seems that the agency is earning less in absolute profit from the leisure segment which makes up for the majority of its revenue, whereas the business segment has a higher absolute profit per transaction.

- The agency should benchmark its competitors and mimic them in terms of cost structures & revenue structures.

- The agency should focus more on the business traveler since they make more money on those bookings.

- The agency can also see if they can renegotiate transaction costs for the business traveler since those travelers travel a lot and could thus earn a discount for the agency.

- The agency can also choose to offer the leisure traveler more products to increase the revenue and profit per transaction.

Further Questions

- What are some quick-win & short-term solutions the client can implement to increase profit margins?

- Do you think airlines would offer lower transaction costs to business travellers? How can the agency make that pitch strong?

- What are some quick-win & short-term solutions the client can implement to increase profit margins?

- Do you think airlines would offer lower transaction costs to business travellers? How can the agency make that pitch strong?

Online travel booking

i