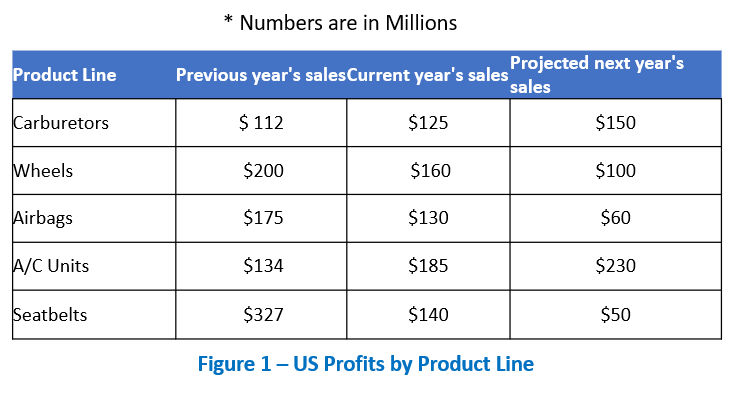

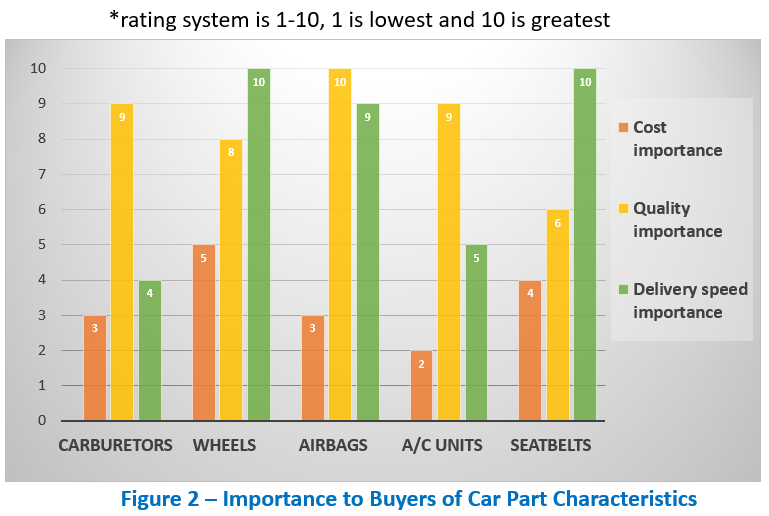

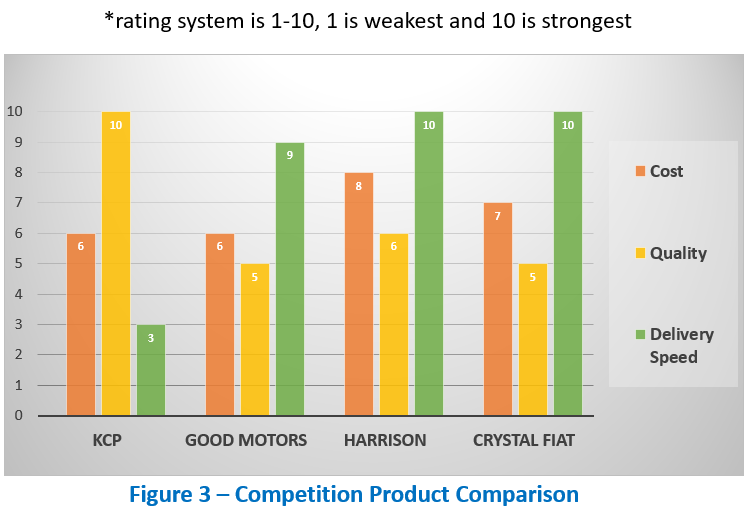

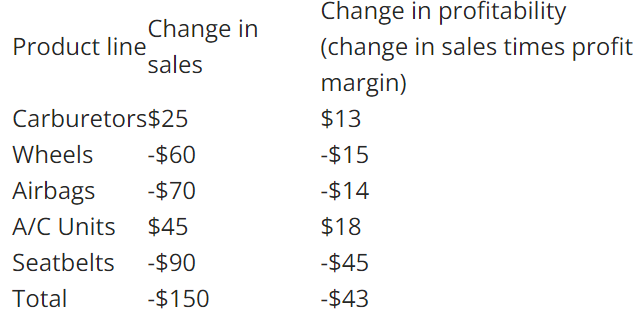

Problem definition: Our client is Korean Car Parts (KCP), a multi-national original equipment manufacturer (OEM) of car parts based in Korea. They've recently seen a decline in profits and have brought us in to understand how to address this falling profitability.

========================================================

To get a deep-dive explanation of the case leadership behind this case, please read this article: Candidate-Led Cases: What to Expect With Example Cases

This case is part one of a series. The goal of this series is to demonstrate how an identical case prompt (and corresponding framework) could lead to multiple different outcomes. The goal is to train you to adjust to case information in an agile and adaptable way.

The 2nd part of the series can be found here:

Bain + BCG - Hot Wheels WITH VIDEO SOLUTION

i