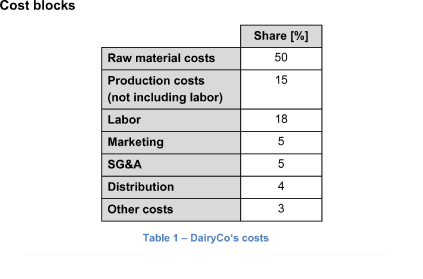

DairyCo, a mid-sized CPG manufacturer (consumer packaged goods) which sells dairy products (derived from milk), has turned to you to ask for your advice.

The firm has been facing declining profits in the last few years and does not know what it should do to change this trend.

How would you help them out?

DairyCo

i