Our client is an alloy wheels manufacturer based in China. The client is contemplating entering the US market. At this point of time, the client sells the wheels in the China market. In order to make the wheels for the US market, he will have to expand its production capacity. As a result, whether to enter the US or not is a high-stake decision. He has hired BCG to advise him on this issue.

Case Prompt:

Sample Structure

A good candidate should structure this case along 2 analysis:

- US market attractiveness

- How big is the US market

- How competitive is the US market

- Export feasibility

- Client’s product fitment – advantages and disadvantages

- Export/distribution route

I. Background

Upon request, the following data can be shared with the candidate:

- Our client is an alloy wheels manufacturer. They make alloy wheels that are fitted in passenger cars.

- The client is currently only selling in China. He has no experience in the US market

- The success criteria that the client has in mind – Committed orders of 20% of the annual production of the first year. The production capacity of the manufacturing plant is to make 10 million wheels per year. This means the client wants order worth 2million wheels in the first year in order to take a decision to invest in the new manufacturing plant

A good candidate should ask the following clarification questions:

- Can you tell me a bit more about the product? What kind of wheels does the client produce and where are they used?

- Does the client have any US market experience?

- What is the success criteria that the client has in mind?

II. Part 1 – Market Sizing

Upon the candidate request, the following information can be shared:

- US population – 300m

- People per household – 3

- Cars per household – 2

- Wheels per car - 5

- Typical car life – 20 years

- Typical wheel life – 10 years

- % of cars that are fitted with alloy wheels by Car OEMs – 70%

- % of cars that are fitted with steel wheels by Car OEMs – 30%

- % of owners who switch from steel to alloy wheels at the time of change – 20%

- % of owners who switch from alloy to steel wheels at the time of change – 0%

A good candidate will communicate the structure above and choose US market sizing as the first analysis.

No. of cars in US = 300m/3*2 = 200m

If we take for simplicity that 100 cars are sold in a particular year

- 70 had alloy wheels

- 30 had steel wheels

After 10 years:

- 70 purchased a new set of alloy wheels

- Out of 30, 6 purchased alloy wheels

So over 20 years, out of 100 cars, the number of wheels purchased are:

- 70*5 + 70*5 + 6*5 = 730 alloy wheels

If 100 cars over 20 years require 730 alloy wheels, in 200m cars market, the annual wheel requirement is:

= 200m*7.3/20= 73m

If the US market requires 73m wheels annually and our client wants to have around 2m wheel worth of commitment for the first year, we are talking about targeting almost 3% of the market.

III. Part 2 – Market Competitiveness

Upon questioning, the following data can be shared:

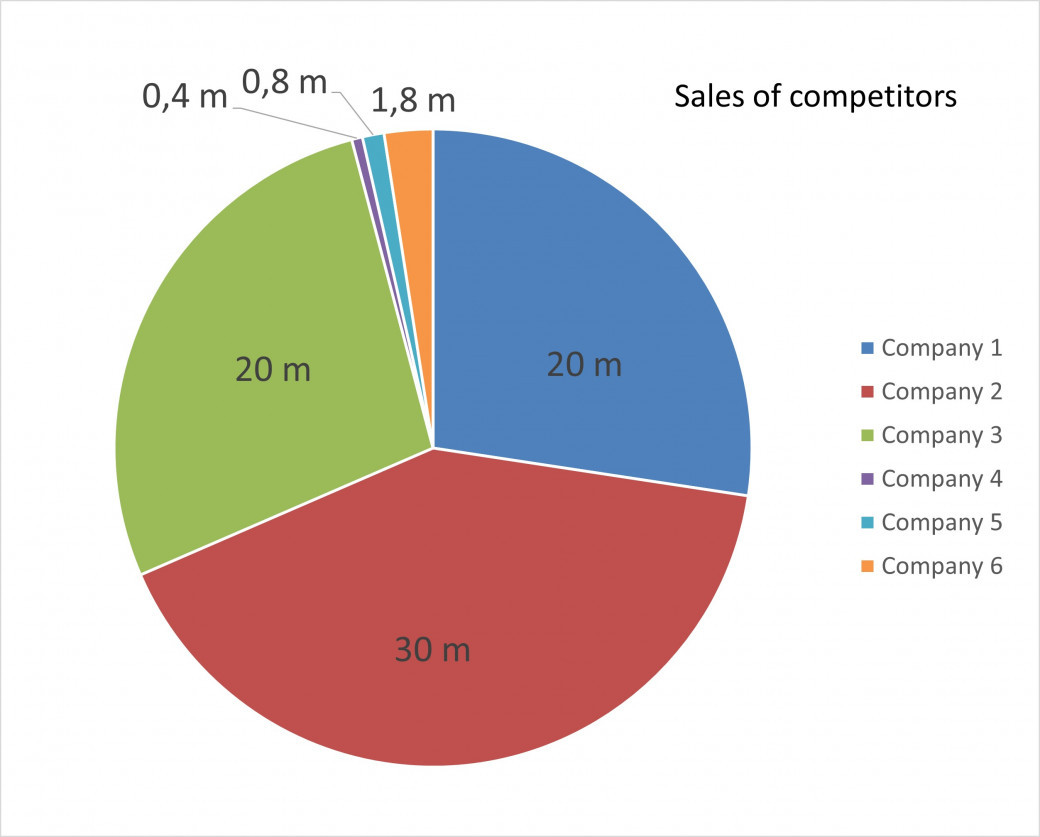

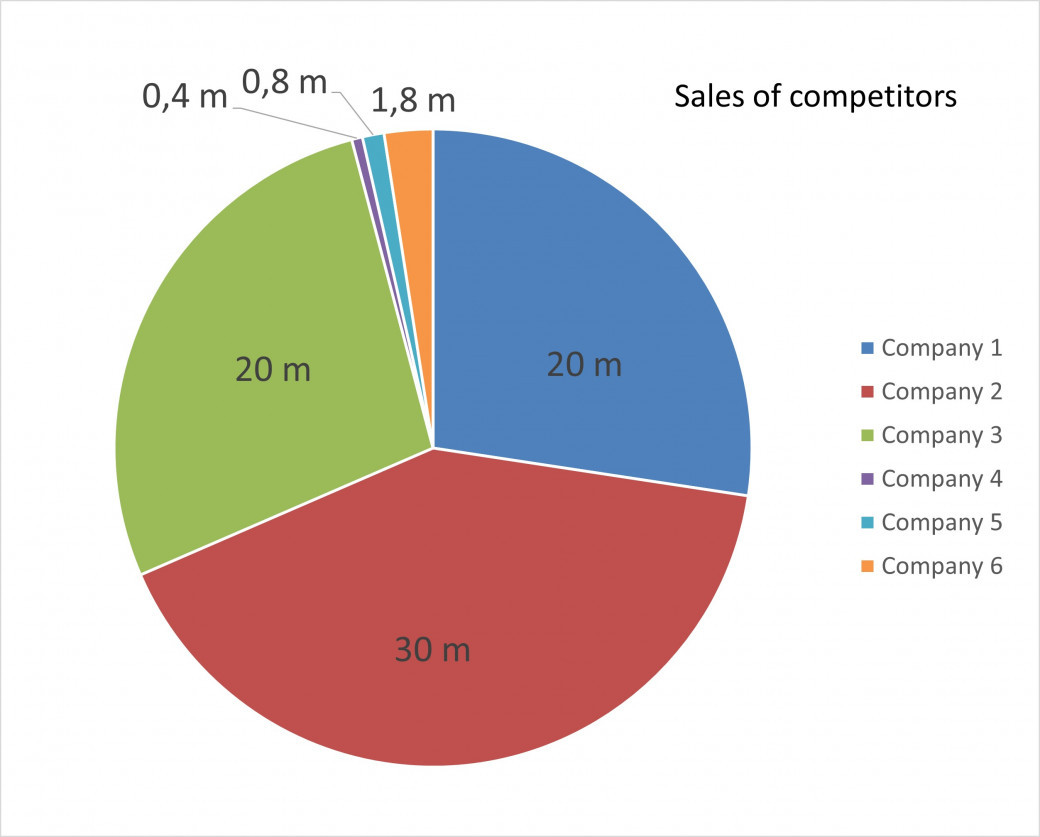

Share Exhibit 1 with the candidate. Currently, the market has 6 companies, and the annual sell in terms of wheels is as follows:

Here a good candidate should sense that there is a huge difference between the top 3 players and the bottom 3 players, and he should probe why?

HERE IS THE TWIST. Upon probing, the interviewer can share that:

Company 1,2 and 3 are OEM empaneled vendors who directly sell to OEMs and Company 4,5,6 sell directly to the consumer.

A good candidate should move to market competitiveness analysis.

A candidate should understand that. 20+30+20 = 70 m wheels is B2B market and 3m is B2C market.

IV. Part 3 – Product Fitment

Upon probing, the interviewer can share:

B2B/OEM companies value:

- Cost

- Reliability of supply

B2C customers value:

- Design options

- The proximity of the retail store

If asked what is the process for getting empaneled with the OEMs, interviewer can share that there are a lot of criteria but the one that is a problem is the empanelment timeline. Big OEMs empanelment process take 2-3 years.

A good candidate should probe what are the success criteria in B2B and B2C segments.

Candidate should conclude that entering through the B2C route is not an option. B2C entry and securing 2m wheels worth of orders in first years (which is 66% of the market size) is almost impossible. Hence the focus should be on the B2B market.

The candidate should ask, what is the process for getting empaneled with the OEMs?

V. Part 4 – Entry Route

The candidate and interviewer can brainstorm the routes of entry for the client and whether it is even possible for the client to enter or not.

A good candidate should structure like this:

- Direct entry – empanelment process is too long

- Acquiring existing supplier – again time-consuming and expensive option

- Becoming a supplier to the currently empaneled supplier – this is a possibility, given that we will produce in China and we can propose the existing suppliers to outsource the production and can give them cost-benefit of low-cost production

Of course, this strategy would have risks:

- None of the existing suppliers might agree due to lack of trust, already having a low-cost production, etc.

- This strategy might close the door on future direct OEM play if suppliers put that clause in the agreement

- Selling through another player means the profitability will be reduced.

VI. Conclusion

Basis the market analysis and entry feasibility study we did, we recommend that our client do not invest in setting up new manufacturing targeted at US export as yet.

- Though the US is a huge market, existing players are already established both in B2C and B2B route.

- The B2B which is a sizable market to target has a major roadblock of empanelment process time, which will not let the client make inroads in the first year.

As a next step, we suggest the client to pilot the US market entry using its existing production. In order to:

- Pitch their low-cost product to the OEM, gain trust, and get empaneled

- Sell the wheels to the B2C market through retailers to understand consumer taste and distribution channels

If the pilot is successful and helps the client win some committed orders, the client can think of setting up a dedicated production capacity to target the US market.

VII. Final Remarks

Thank you for completing my case!

I hope it was useful and helpful for you.

If you have any questions or feedback, please contact me using the link below:

https://www.preplounge.com/en/profile.php?id=54457

Best,

Gaurav

Case with a twist: Chinese Alloy Wheels – US Market Entry

i