A wealthy client has recently bought an island in the Caribbean. She has engaged us to identify possible uses for her new island.

Case Prompt:

Sample Structure

RECOMMENDED STRUCTURE

- Instant monetization:

- Resell to make a profit.

- Recurring profit:

- Rent to high-wealth individuals.

- Commercial activities/hospitality.

- Exploitation of natural resources.

- Zoo/natural reserve.

- Personal use:

- Research activities (e.g. on marine species).

- Personal residence.

I. Background

Provide the following information if requested:

- The client invested $50M to buy the island.

- The island is buildable.

Ask clarifying questions you need answers to in order to solve the case.

II. Question 1

Our client is interested in building a luxury villas resort. What is the maximum number of villas to build on the island if every villa must have direct access to the sea?

Provide the following information if requested:

- Island:

- Diameter: 2 km.

- Villa:

- Every villa has a 30 m wide garden.

- Every villa is placed at a distance of 20 m in width from the closest villas.

RECOMMENDED ANSWER

The candidate should realize that:

- As the villas must have direct access to the sea, they must be placed on the coast, i.e. around the circumference of the island.

- Each villa occupies a total of 50 m in width.

Maximum no. of villas = Island’s circumference/Total villa's width = 2 * Pi (≈ 3.14) * 1,000 m / 50 m ≈ 125 villas

III. Question 2

Is this a worthwhile investment?

The additional cost to build the resort amounts to $60M. The candidate should split it into its main components. In case she does not, ask her to provide a segmentation.

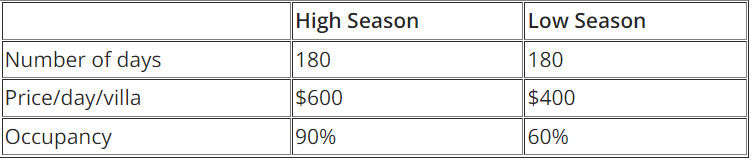

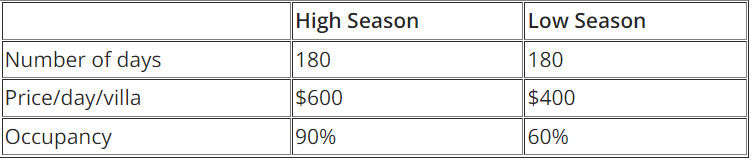

A good candidate should consider the main KPIs that will impact revenues, otherwise, ask for it. Share the data in the table only when asked:

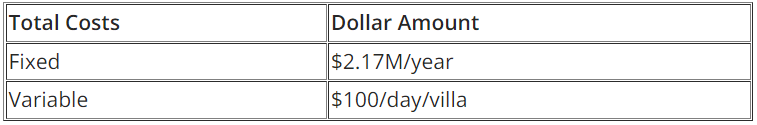

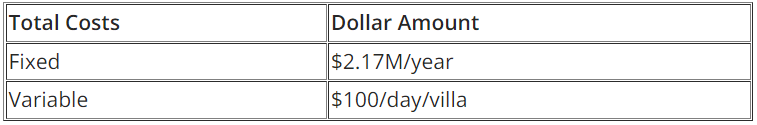

A good candidate should then focus on computing total recurring costs. She should split them into fixed and variable and identify the main cost items. In case she does not, ask her to segment costs. Share the data in the table only when asked:

A good candidate should note that variable costs arise only from occupied villas.

Discount rate: An outstanding candidate should ask for a profit increase forecast to consider potential price increase and introduction of new services or villas. If asked, provide her with an expected yearly growth rate for profits of 2%.

An outstanding candidate will perform a risk assessment, thinking about how to hedge against each of the identified risks. Otherwise, ask for it.

An outstanding candidate should ask whether the investment comprises both the acquisition cost of the island and the construction of the resort. The total investment has to consider both, i.e. the acquisition cost of the island should not be considered as sunk.

A good candidate should structure the proper formula to compute the NPV of the investment considering its 3 main components:

- Additional investment to build the resort (to be added to the initial investment already sustained for the island).

- Recurring profits generated by the management of the resort.

- Discount rate (accounting for the time value of money, cost of capital, and risks).

RECOMMENDED ANSWER

Recommended investment cost segmentation:

- Construction of the villas.

- Creation of transportation infrastructure (e.g. airport, harbor, etc.).

- Other: Initial marketing investment, initial training of all employees, legal fees, etc.

Total investment = $50M (island) + $60M = $110M

Total revenues = Total revenues (high season) + Total revenues (low season) = 180 * 125 * ( 600 * 90% + 400 * 60%) = $17.55M

Recommended cost segmentation:

- Fixed:

- Employee salaries.

- Marketing and sales.

- Utilities.

- (Ordinary) maintenance.

- Other: insurance, security, software, legal, etc.

- Variable:

- Food & beverage.

- Villa's housekeeping (i.e. sheets, vanity tray, towels, etc.).

- Sales commissions (i.e. travel agencies, booking platforms, etc.).

- Credit card fees.

Total costs = Total fixed costs + Total variable costs = Total fixed costs + (Total variable costs high season + Total variable costs low season) = $2.17M + $100 * 125 * 180 * ( 90% + 60% ) = $5.55M

Considering its main components, the discount rate for this investment can be assumed to be equal to 12%. The candidate can simplify the NPV analysis by considering the formula for the perpetuity.

An outstanding candidate should ask for a profit increase forecast to consider potential price increase and introduction of new services or villas.

Total recurring profits = Total revenues - Total recurring costs = $17.55M - $5.55M = $12M

NPV = Total recurring profits / ( Discount rate - Growth rate ) - Total investment = $12M / (12% - 2%) - $110M = $10M

A good candidate will note that the NPV of the investment is positive even without considering additional revenues other than the rent of the villas.

An outstanding candidate will perform a risk assessment, thinking about how to hedge against each of the identified risks.

Main risks to consider:

- The revenue estimate is based purely on forecasted information and a 90% occupancy for 6 months a year can be challenging to achieve.

- Travel/hospitality industry disruption (e.g. economic recessions, pandemics, natural disasters, etc.).

Mitigation actions:

- Build a more accurate, month-by-month backup of forecasted revenues, benchmarking with luxury resorts in the Caribbean and similar locations.

- Consider an insurance policy to provide the client with a constant revenue if occupancy is lower than forecasts.

IV. Question 3

The client is concerned about the 90% occupancy to maintain at the highest price for 6 months. What is the breakeven occupancy required?

The candidate should perform a breakeven analysis of the NPV calculation (i.e. NPV = 0 ), using the occupancy during the high season as a variable (let's call it x).

Total recurring profits / ( Discount rate - Growth rate ) - Total investment = 0

Where:

Total recurring profits = High season profits + Low season profits = 180 * x * 125 * ( $600 - $100) + 180 * 60% * 125 * ( $400 - $100) - $2.17M = $11.25M * x + $1.88M

Therefore

Breakeven high-season occupancy = x = ( $110M * 10% - $1.88M ) / $11.25M ≈ 80%

V. Question 4

Can you please provide the client with a recommendation?

RECOMMENDED ANSWER

- Recommendation:

- Our recommendation is to build the resort for an additional investment of $60M which results in a positive NPV of $10+M.

- Risks:

- The revenue estimate is based purely on forecasted information, with the challenging 90% occupancy to be maintained for 6 months a year. However, the forecast is 10 percentage points higher than the breakeven high season occupancy of 80% and the calculation does not include the typical additional revenues of resorts.

- Travel/hospitality industry disruption (e.g. economic recessions, pandemics, natural disasters, etc.).

- Next steps:

- Extra revenues should be considered, e.g. services, food & beverage, activities (sports, tours, cooking classes, ...), private transfers, merchandising, luxury boutiques, events, etc. This will improve our NPV.

- Build a more accurate, month-by-month backup of forecasted revenues.

Further Questions

- Can you estimate the impact of additional revenues on NPV? Please consider also the additional investment costs.

- What are the KPIs you would use to recommend or not the investment?

- How would you conduct a more accurate forecast of the revenues?

Please comment the case with your answers (You can click on "Ask a question" above) and I would be glad to assess them!

- Can you estimate the impact of additional revenues on NPV? Please consider also the additional investment costs.

- What are the KPIs you would use to recommend or not the investment?

- How would you conduct a more accurate forecast of the revenues?

Please comment the case with your answers (You can click on "Ask a question" above) and I would be glad to assess them!

Caribbean Island – MBB Final Round

i