A bank based in a developing country in Africa has hired us to find out how it can grow its local retail banking business unit.

What aspects would you investigate?

What would you recommend to our client?

A bank based in a developing country in Africa has hired us to find out how it can grow its local retail banking business unit.

What aspects would you investigate?

What would you recommend to our client?

Information that can be shared on the interviewee’s inquiry:

Charts/tables that can be shared on the interviewee’s inquiry:

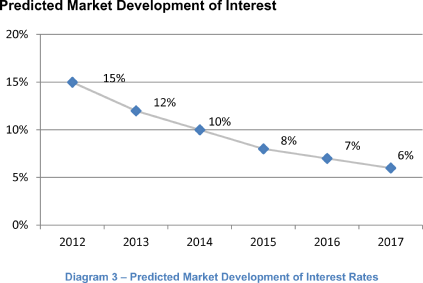

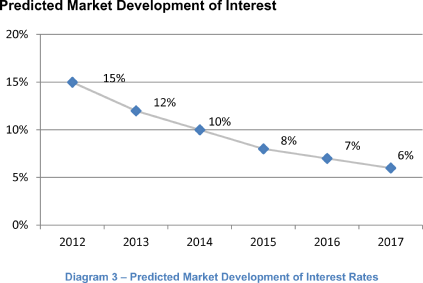

Since the government is trying to control inflation, Interest rates are expected to decline in the next few years

The interviewee should ask about:

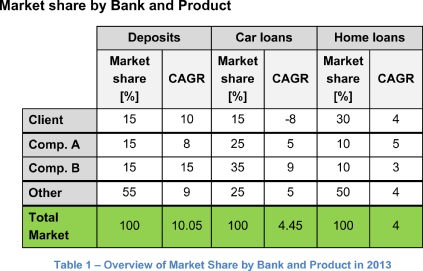

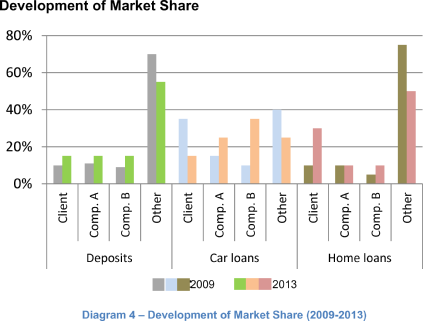

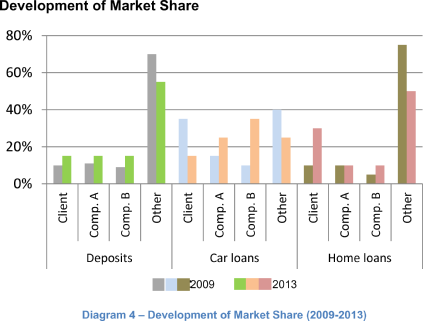

Information that can be shared on the interviewee’s inquiry: There are 3 big companies in the local market. Our client is one of these companies. The remaining market share is fragmented. All products are priced at market rate. Competitor B just implemented a new IT system to improve its Internet-based banking services.

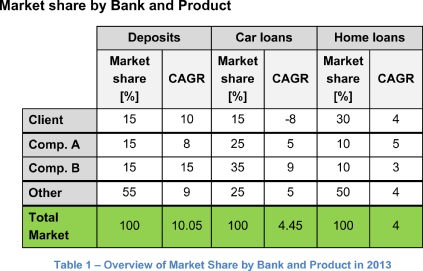

Share Table 1 (market share by bank & product) & Diagram 4 (development of market share) if the interviewee inquires information.

The interviewee should ask about:

KEY element to CRACK the case!

KEY element to CRACK the case!

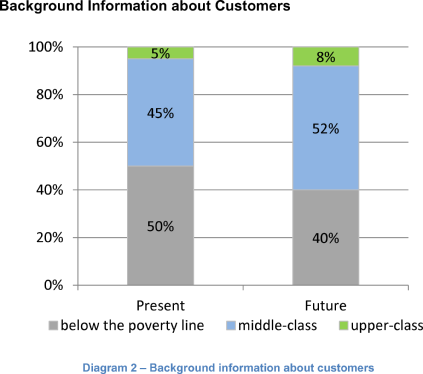

Information that can be shared on the interviewee’s inquiry:

Concerning the competences it should be mentioned that:

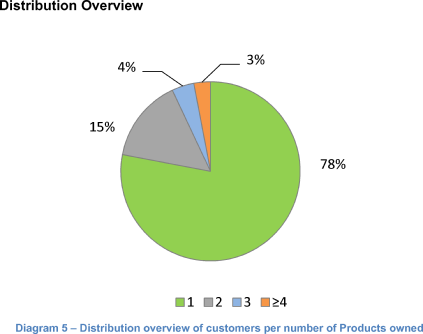

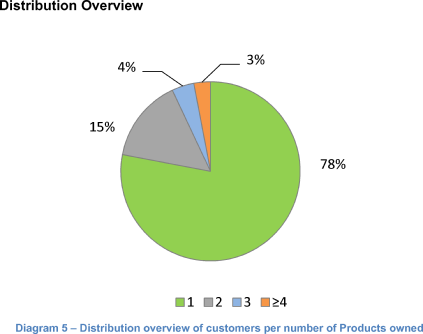

Share Diagram 5 with a distribution overview if the interviewee inquires information.

The candidate should ask about:

KEY element to CRACK the case!

The client can use several methods to grow in the local market. Ideally, the interviewee should categorize these different methods. Possible categories include IT, business strategy, and sales & marketing.

1. To beat Competitor B, should the client propose a merger with Competitor A? How would you analyze this suggestion?

1. To beat Competitor B, should the client propose a merger with Competitor A? How would you analyze this suggestion?

Competitor A has high market share in the car loan segment. (Most profitable segment)

Competitor A also has high market share in the credit cards segment (9.8%). This could diversify the client’s product portfolio, thus spreading risk.

If both companies merge, the new company will become the market leader.

Overall, the merger seems promising. However, before making a final decision, more thorough analysis must be done.

2. Can you think of any new products that the bank could launch?

2. Can you think of any new products that the bank could launch?

Additional questions

If the interviewee solves the case very quickly, you can come up with more challenging questions to ask them.

Additional questions

If the interviewee solves the case very quickly, you can come up with more challenging questions to ask them.

Bank growth strategy

i