Our client, Ooze, is one of the market leaders in the US spirits market (strong alcohol products).

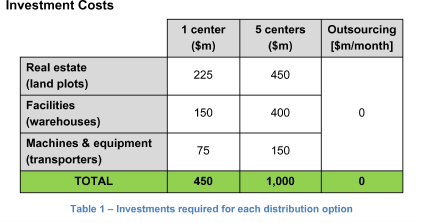

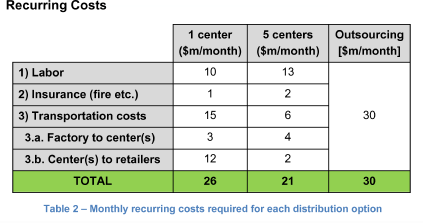

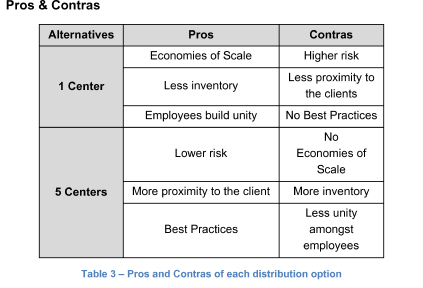

They are thinking of restructuring their distribution strategy and want to know whether they should invest in 1 or 5 distribution centers.

What would you recommend?

Spirits distribution

i