You have successfully completed your trainings for your new role as Consultant at a consulting firm from PrepLounge’s FastTrack Application pool. After a briefing done by the CEO of an internationally known, globally operating industry corporation regarding the upcoming examination of the commercial printer paper subdivision of the organization, you are discussing the project with your project manager during lunch. Specifically, the question at hand is, how to get back on the track of growth. The CEO is willing to invest and has asked your team to provide and evaluate opportunities for growth.

Case Prompt:

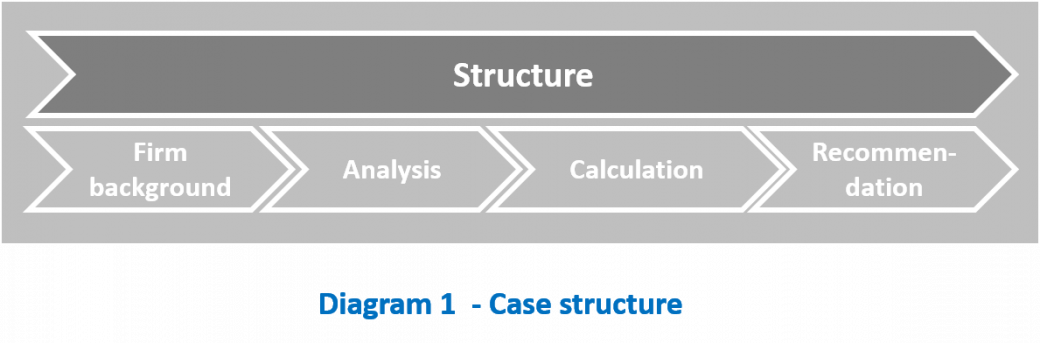

Sample Structure

II. Background on the firm

To give our recommendations, we need a good understanding of our client, its market position and its customers. To tackle these questions, it is important to employ a structured approach and not ask questions “into the blue”.

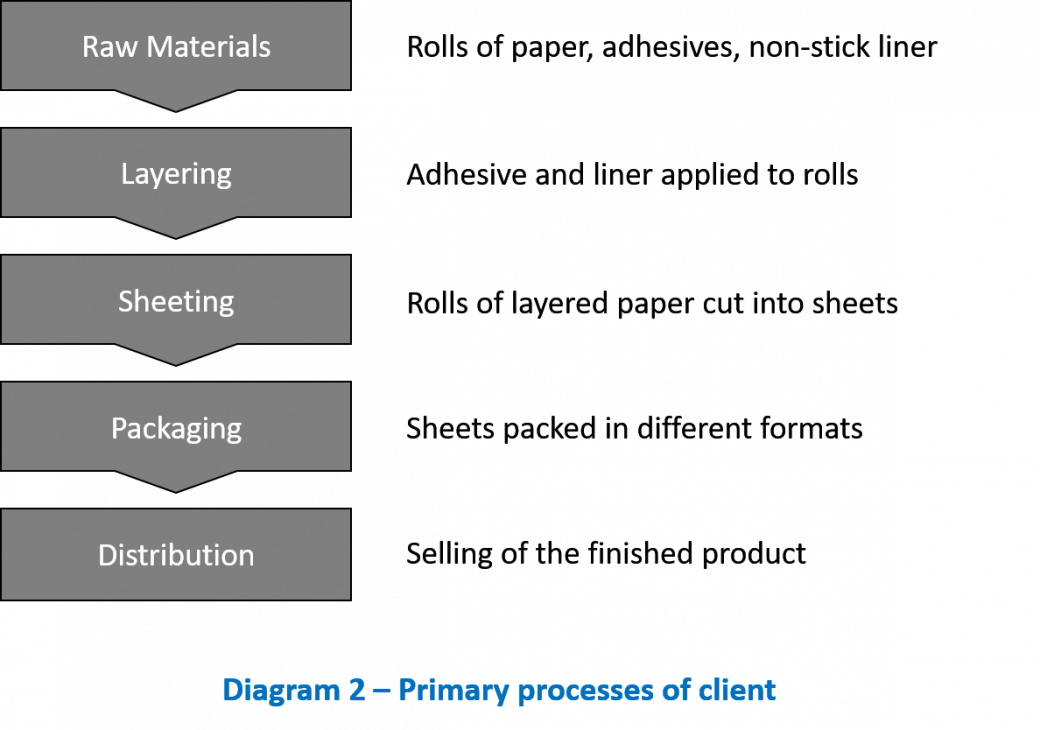

The client produces self-adhesive sheeted papers to be used in several different labelling applications – including the printing of self-adhesive signs and the labelling of consumer goods.

The business is profitable, but growth is low to non-existent.

Refer to diagram 2 for an overview of primary processes.

Independent of the interviewee’s choice of a framework, here is the information available that you can give out. Don’t tell everything at once, but wait for appropriate questions.

Customers:

- 24,000 commercial printers in Europe.

- Three main categories for commercial printers: small, medium, large. They differ in terms of technology and the maximum size of print jobs available.

- Also, small printers prefer specialty paper in boxes, medium printers prefer cartons and large printers palletized shipments.

Client:

- No capacity constraints are to be considered.

- Manufacturing and packaging are currently configured to pack in boxes.

Competitors:

- 10% market share with medium and large printers.

- 20% market share with small printers.

- Management has spoken against price cuts to gain market share as competitors can match these price cuts.

III. Analysis

There are three major ways for growth:

- Expansion of capacity

- Extend product portfolio or other client-facing activities

- Acquire competitor

A good answer would, for example, consider internal and external factors to warrant a potential investment.

Internal:

- No capacity limitations -> extend product portfolio

- Manufacturing & Packaging is configured inflexibly -> invest in new packaging line

- Size and aptitude of R&D department -> invest in internal function

- Sales function in the firm -> professionalize Sales & CRM

- What are the firm’s distribution channels and which ones could we additionally tap into?

External:

- No information on particular customer demands

- No information on the growth of the overall market or market segments

- No information on market consolidation (how many players, is one competitor dominating)

- No information on industry trends

- No information on competitors’ best practices

IV. Back it up with numbers

Now, for the sake of this analysis, tell the interviewee that you want to look into the packaging line expansion to better serve medium and larger printers.

The investment cost will be passed onto the yearly operating costs; hence the operation of a carton packaging line would cost 500,000€ per year and of a palletizing packaging line 3,250,000€ per year. It is for confidential reasons not possible to do both.

Of course, other costs would need to be considered, like taxes, depreciation and selling, general & administrative costs (SG&A.) However, let’s ignore it here.

As we have no data on how our market share or sales will develop, we will have to make an assumption. To capture the same market share as with small printers seems fair.

We know from the available data that we are currently serving customers with a worth of 0.85m € in medium printers and 3.6m in large printers. If we double our market share and subtract the costs, both investments would yield a yearly plus of 350,000 € (revenue increase - cost = 850,000€ - 500,000€ = 350,000€ and 3.6m - 3.25m = 0.35m = 350,000 €)

V. Recommendation

As the investment in the new palletizing packaging, the line is about 5 times bigger than in a packaging line for cartons, the client should favor investment in the carton packaging line, as it is a less risky investment, but brings the same value-add.

This course of action builds on the assumption that the environment is static. Growth in market segments would change this analysis. Also, this investment will have to be compared to other opportunities, i.e. acquisitions and an extension of the portfolio.

PiedPaper