Your client is a chewing gum manufacturer.

The CEO of the manufacturing company wants you to find out why his company is experiencing a declining profit margin. He then wants you to suggest ways to improve his company’s profit margin.

Your client is a chewing gum manufacturer.

The CEO of the manufacturing company wants you to find out why his company is experiencing a declining profit margin. He then wants you to suggest ways to improve his company’s profit margin.

Information that can be shared if inquired:

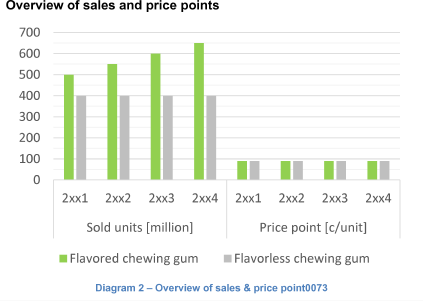

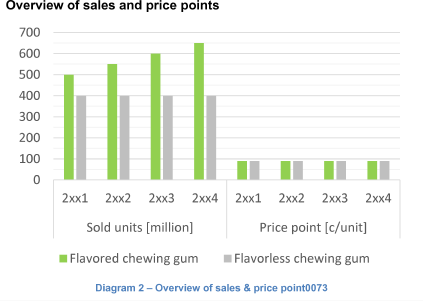

Share Diagram 2 with an overview of the sales by volume and price if inquired.

First we should have a look at the revenue:

Information that can be shared if inquired:

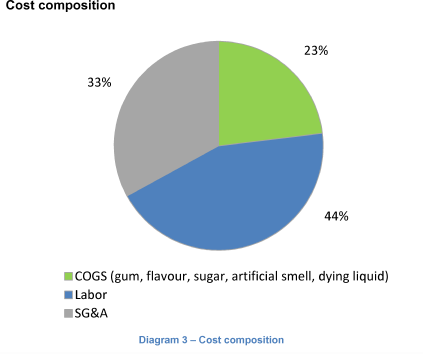

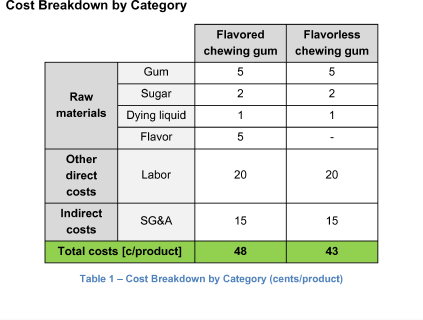

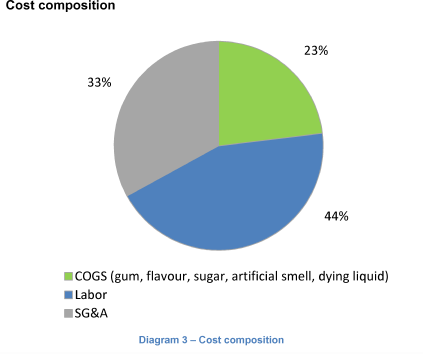

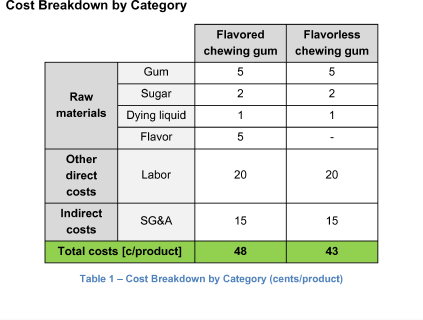

Share Diagram 3 with a cost breakdown by percentage and Table 1 with the cost breakdown by cents if inquired.

Ask the interviewee to calculate the profit margin of the products!

Now, we can analyze the cost side of the business.

The profit margin has declined because sales of flavored chewing gum, the product with a lower profit margin, have increased while sales of flavorless chewing gum have remained constant.

To improve the profit margin, the interviewee can suggest both short-term and long-term solutions.

How would you analyze whether vertical integration can reduce costs?

If our client merged with a competitor, our client could benefit from synergies and economies of scale. How would you analyze this idea?

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

How would you analyze whether vertical integration can reduce costs?

If our client merged with a competitor, our client could benefit from synergies and economies of scale. How would you analyze this idea?

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).

Without your consent we cannot embed YouTube videos. Click the button below and accept the marketing cookies to allow YouTube videos to be embedded.

By allowing this service, you consent, in accordance with article 49 paragraph 1 sentence 1 lit. a GDPR, to your data being processed in the USA. The USA is not considered to have adequate data protection legislation. Your data could be accessed by law enforcement without prior public trial in court. You can change your settings regarding consent to external services at any time in our Cookie and Privacy Settings.

Chewing gum

i