Your client is part of AtoZ Ltd., a diversified multinational company with a health care division that produces medical instruments and related services. Three years ago, AtoZ expanded into health care software industry by acquiring HappyHealth SE, which is selling administrative IT systems to large hospitals in Europe. While they provide strong support systems for back-office processes, their products do not offer physician or technical support nor a patient management system. The software division has continued to disappoint in growth rates, making it hard to justify the premium AtoZ paid to acquire HappyHealth three years ago. As shareholders rally to demand solutions, the devastated Head of Operations of HappyHealth turns to you and asks for potential strategies to increase revenue.

Case Prompt:

Sample Structure

I. Market Analysis

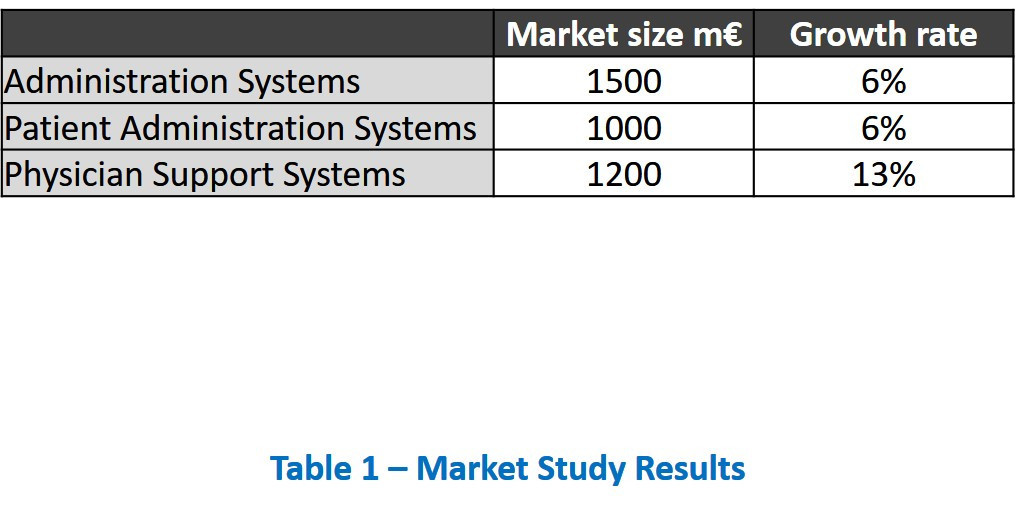

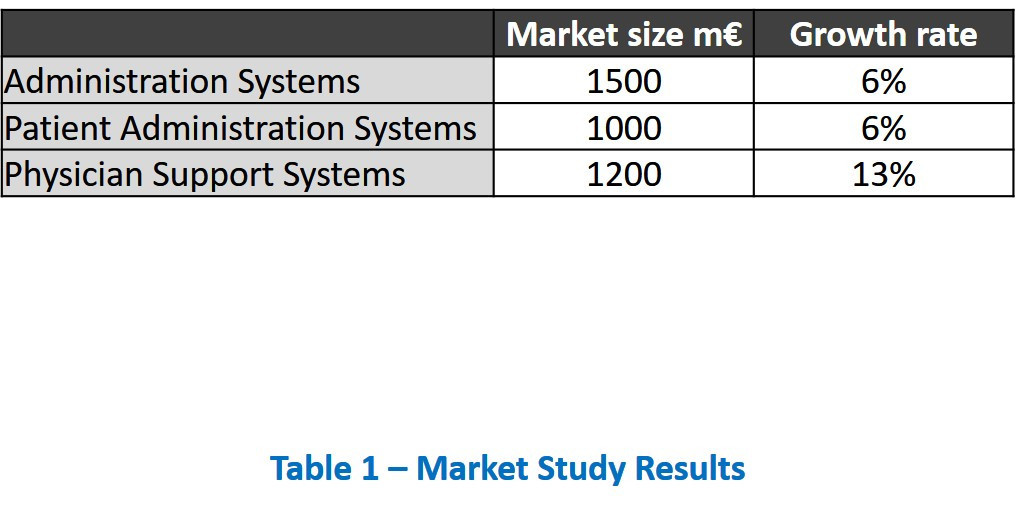

The market can be broken down into administration systems, patient administration and physician support systems.

Patient administration mainly handles admissions and tracking of patients. Physician support systems are more specialized ones, for different physician procedures.

Next, the interviewee should ask for data on the mentioned systems. Share table 1 with the interviewee.

When requested by the interviewee to share more information, you can read to him the conclusion of an analysis that was carried out before:

- Consolidation in the whole industry, 5 hospital networks dominating 60% of the market.

- Many, especially smaller, hospitals intend to cut costs through centralization of services.

- Many smaller hospitals acquired by large hospital networks.

- Regarding IT infrastructure, many hospitals currently looking to upgrade their old IT systems.

- Many hospitals have undertaken intents to reduce number of vendors.

Let’s assume that is all the information you have and proceed to next chapter

To identify potential growth opportunities, we are looking into markets that the client could be interested in. Are there sub-categories of the medical software market?

The market can be broken down into administration systems, patient administration and physician support systems.

The latter two systems seem to be fairly good complements to our client's existing product. What do those systems do?

Patient administration mainly handles admissions and tracking of patients. Physician support systems are more specialized ones, for different physician procedures.

From the data, we can conclude that physician support systems seem an attractive opportunity. However, it would help to have more information about the underlying trends and developments that are responsible for the high growth rates.

Since our client is focused on large hospitals, the dominance of few large networks and the centralization trends are both favorable conditions for our client. Also, as our client’s parent organization originally offers medical instruments, the vendor consolidation could be an advantage. Naturally, many hospitals updating their systems is very interesting as well and an opportunity that our client can seize.

Now that we understand the market, let’s move on to look at our client’s main competitors.

III. Competitor Analysis

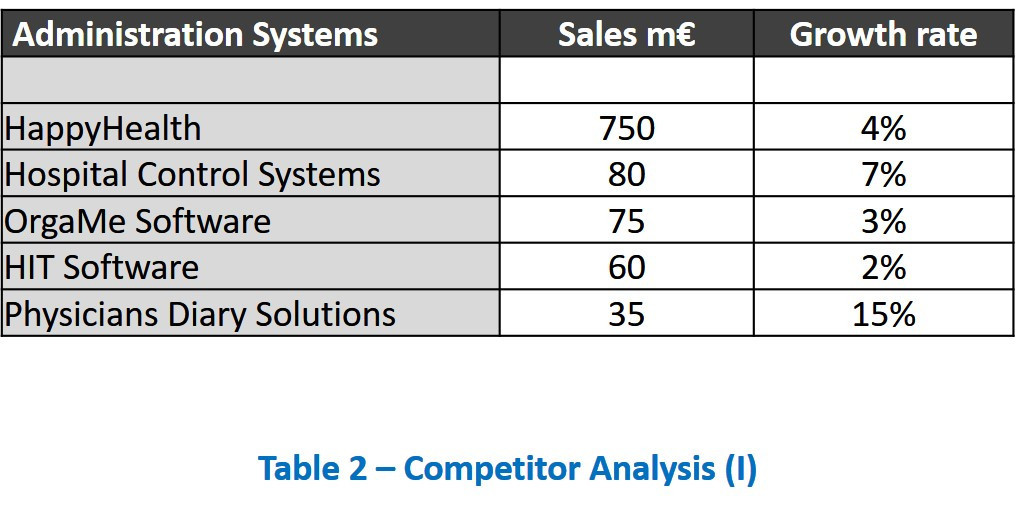

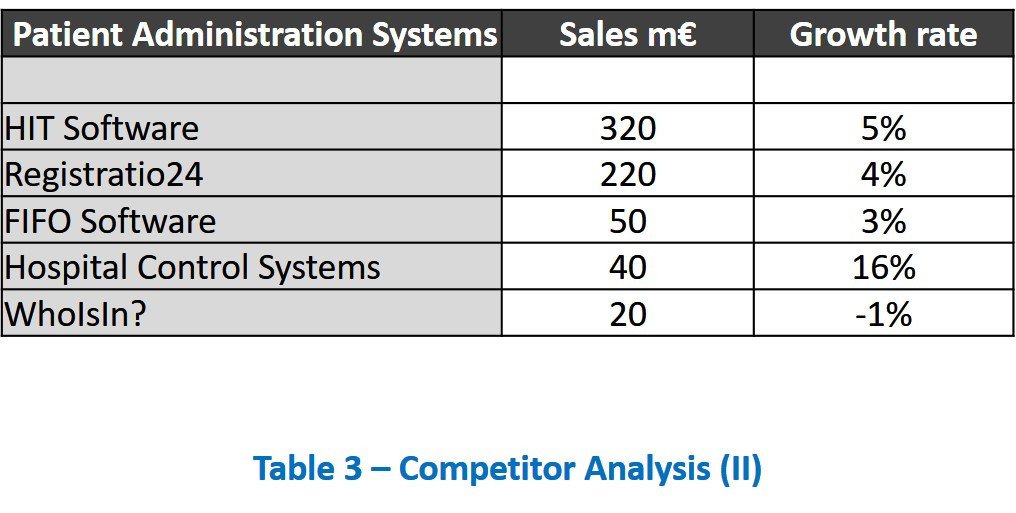

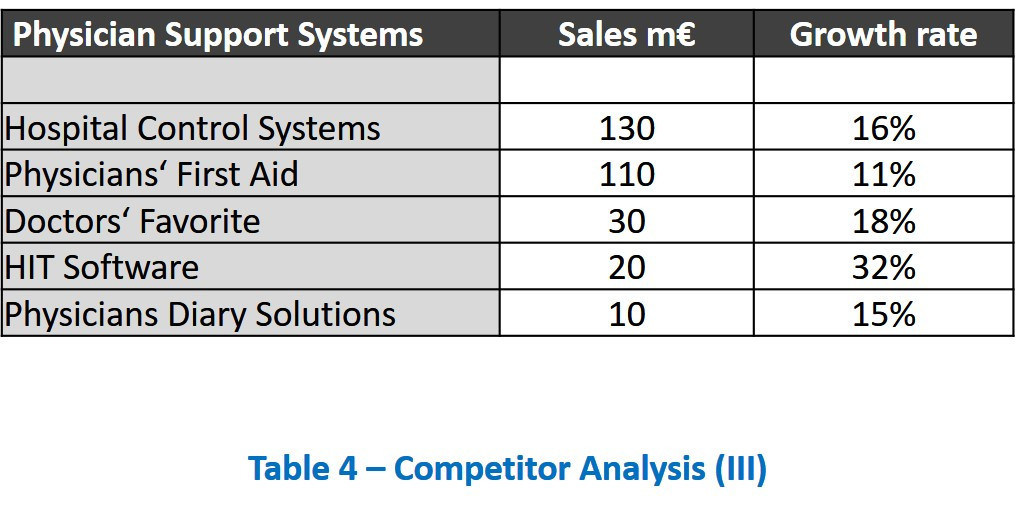

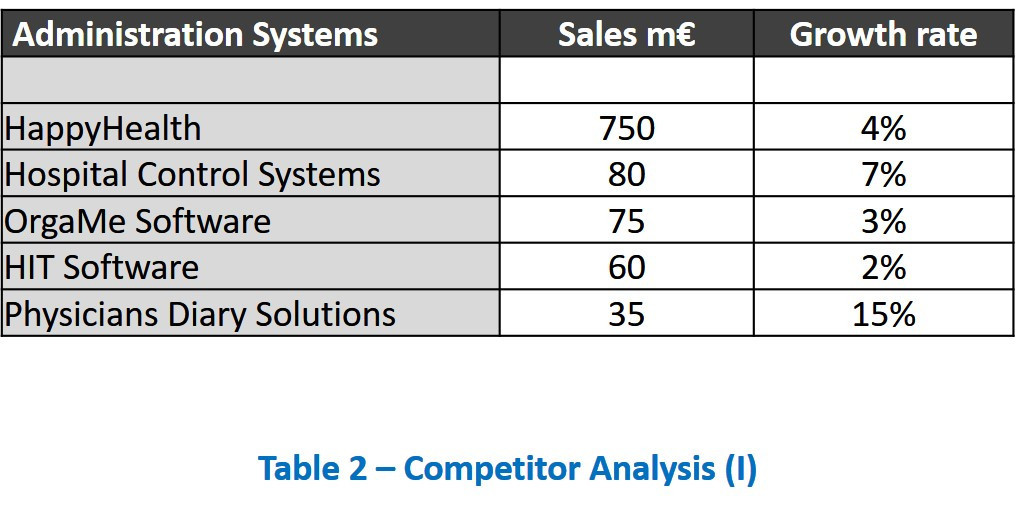

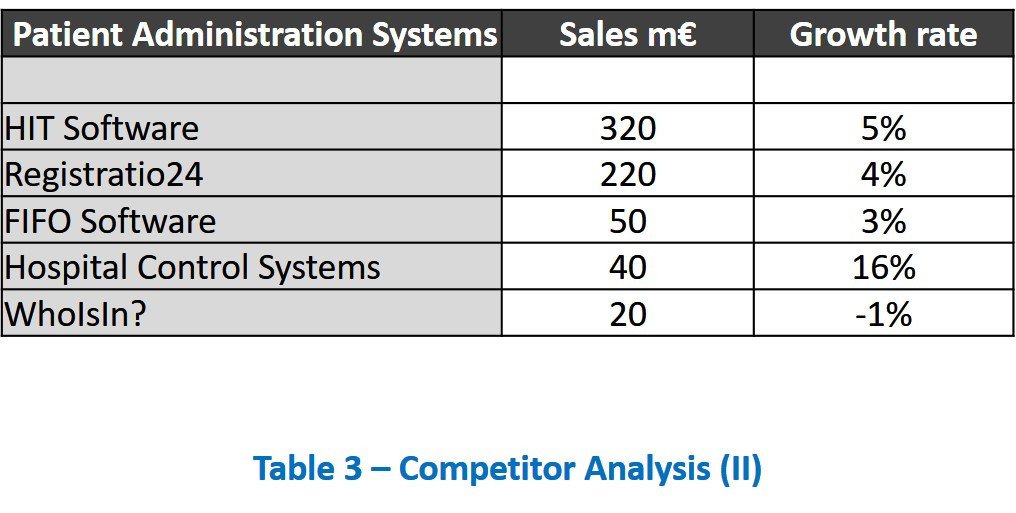

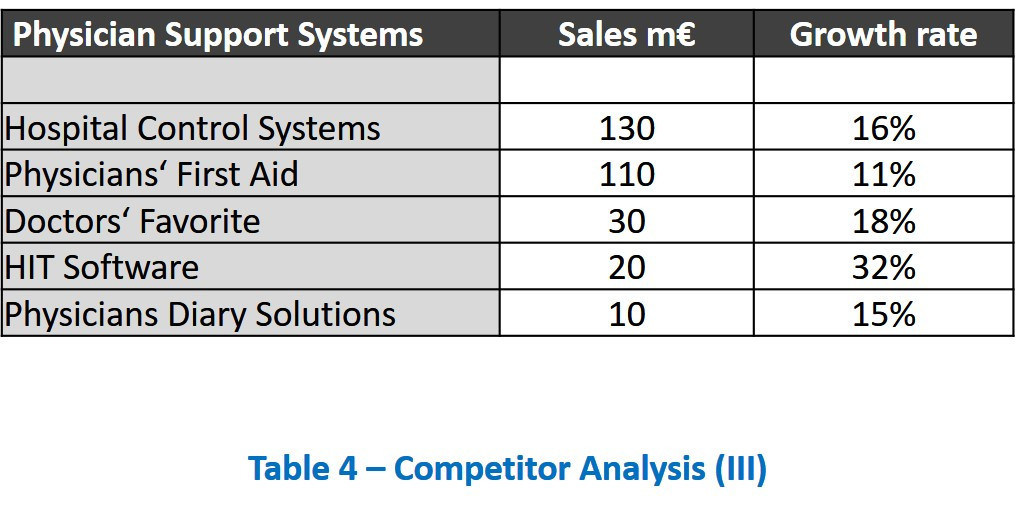

Upon request, share tables 2, 3 and 4 with the interviewee.

Upon request, tell the interviewee that margins in physician support systems are up to 50% and in the other two markets between 20% and 30%.

By investigating a bit deeper the respective leaders of the two potential markets our client may want to tap in, we find that each player dominates one segment and has relatively small sales, but high growth rates in the other.

This observation is not too obvious. Try to calm down the interviewee here and to direct the interviewee in the right direction

Try to direct the interviewee to a first recommendation. Both markets look attractive, the physician support system market seems to be more promising though. Either the interviewee or you should bring up the question, whether customers prefer full solution providers, i.e. whether it makes more sense to focus on only one market segment or have a product in every of the three. This opens the path for our next section.

We would now first identify the competitors and then select the biggest ones and calculate market shares through a combination of public data and estimates. Do we have any information on our client’s top competitors?

In administration systems and patient administration the top five players control 66 percent and 65 percent of the market, respectively. The physician support market is much more dispersed, only a quarter of sales can be attributed to the top five players.

However, we are only looking at revenue, but do the companies make money?

We are now looking for patterns to identify strong competitors or extraordinary arrays. By investigating a bit deeper the respective leaders of the two potential markets our client may want to tap in, we find that each player dominates one segment and has relatively small sales, but high growth rates in the other.

We could build the hypothesis that they were, too, looking for further growth outside their core market and therefore branched out.

Excellent candidates remember to always set firm KPIs into relation with the corresponding market. Doing so, the interviewee would figure that our client’s growth is smaller than the overall market growth, which means that our client is slowly losing market share in what they consider their core market.

Also, it seems like HIT Software has entered the administration systems market as well. Our client doesn’t seem to be the only one diversifying.

Additionally, entry barriers for the different systems are not the same. A patient management system shouldn't be too hard to build from the architecture our client is using for its current product. For the physician support system, more complex understanding of physicians’ work is required. We could hypothesize that our client’s company has an advantage over other, purely software focused competitors as its parent organization AtoZ is supplying medical instruments and related services.

IV. Customer Requirements

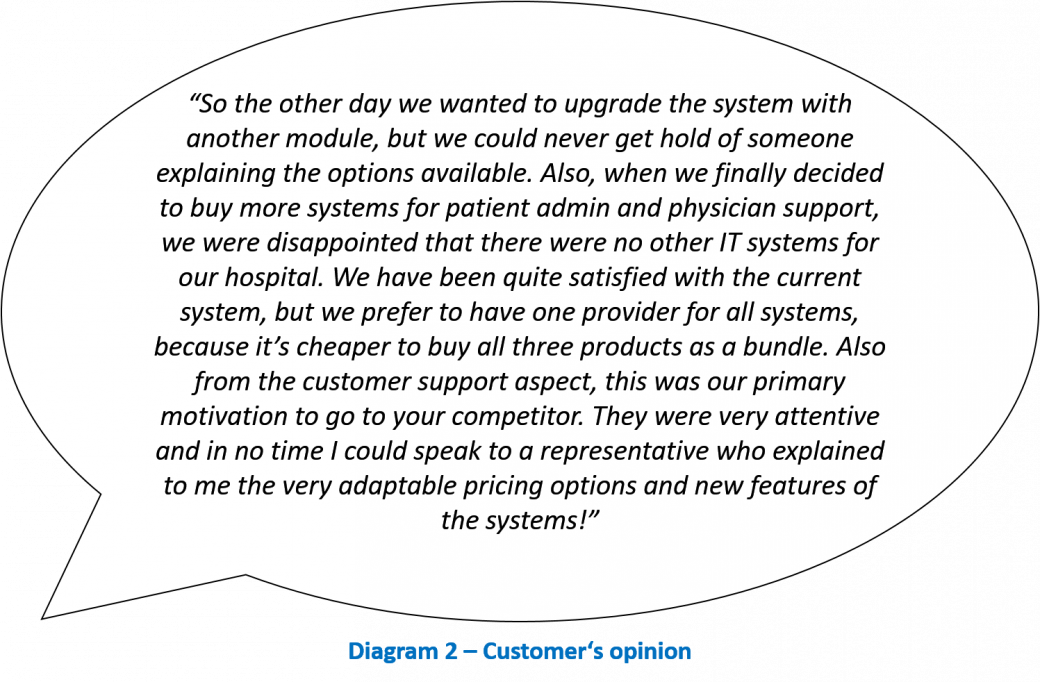

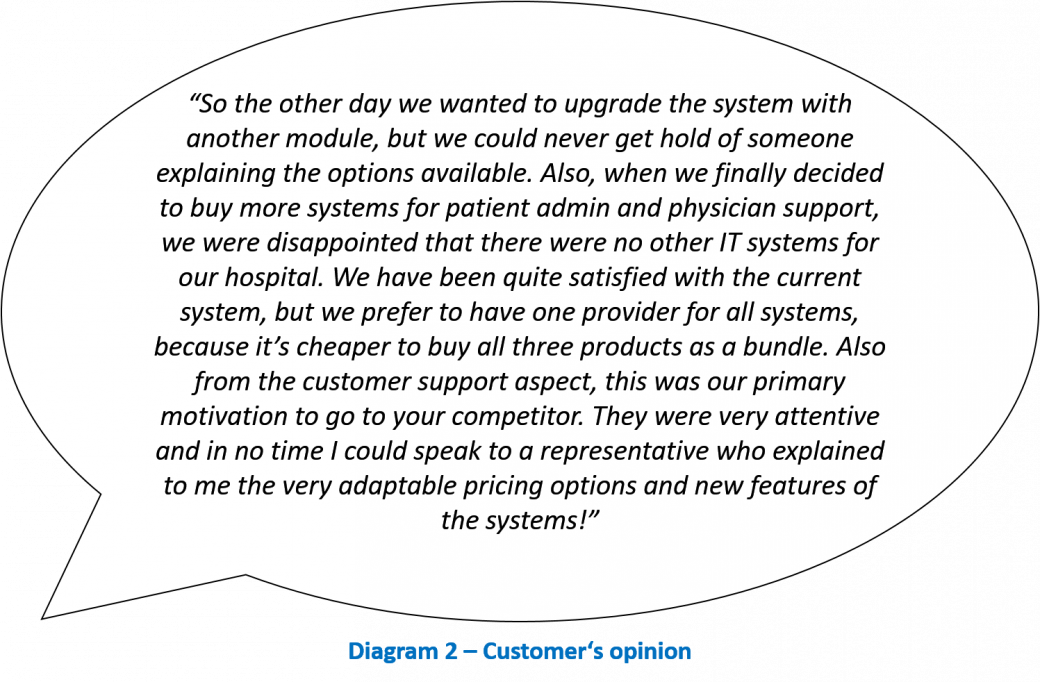

Share diagram 2 with the interviewee.

You can inform the interviewee that this kind of feedback was backed by more calls.

This section offers potential for a more thorough analysis, which will not be done here. One could look at the organization of the marketing & sales department of the client as well as an assessment of the client’s strengths and weaknesses.

We need to think about how to find out, if our competitors offer their products in a bundle. Of course, we cannot ask them directly.

We can, however, ask any non-customer of ours, preferably one that just converted from our system to our competitors’.

This clearly looks like there is high demand for a full solution provider.

Also, our client might want to think of assigning a key account manager to its clients to not only increase sales, but also achieve higher customer satisfaction.

V. Recommendation

To give our final recommendation, let’s begin with the market the client dominates. The growth rate seems to be larger than our client’s growth, although the client’s product is well received by customers.

The reason for this appears to be that customers increasingly favor full solution providers as they are consolidating their vendor base. As more functions get centralized in the hospital networks, there are great opportunities to leverage existing contacts within the organizations.

The markets our client currently is not engaged in look promising. While the patient administration system offers slower growth rates and the market is already dominated by a competitor, it appears that our client could quite easily develop a system using existing capabilities within the company.

The physician support system is growing stronger, but entry barriers are higher due to the nature of the system and the processes it depicts. Building on the capabilities present in the parent organization, our client might have a competitive advantage over other competitors.

Internally, the client should re-organize its marketing and customer relationship management processes. Clear responsibilities and dedicated account managers will allow the client to more accurately assess customer demands and offer the appropriate products from the (then extended) product portfolio.

These recommendations are supported by the overall trend towards consolidation, both in the number of our client’s customers and their aspired vendor base. Further research is necessary regarding intra-firm capabilities and availability of capital.

Further Questions

More questions to be added by you, interviewer!

More questions to be added by you, interviewer!

Diagnosis: Acquisition ache