Hello,

What should i expect from a technical interview with PwC - Deals Line of Service for a senior manager position? How to prepare for it? I am considering taking a few sessions with a coach who was some experience in that sector.

Hello,

What should i expect from a technical interview with PwC - Deals Line of Service for a senior manager position? How to prepare for it? I am considering taking a few sessions with a coach who was some experience in that sector.

Hey there,

Would you mind sharing some more details please:

Feel free to send me personal message if you wish to discuss. I don't directly work in Deals area but as part of Operations Consulting Lead hat at Accenture & Strategy Consulting at Deloitte, have good experience & exposure of evaluating candidates for Restructuring & M&A specifically within Telco, Media & Hi-Tech industry.

And obvs wait for other coaches to reply as well.

Good luck

Hello!

Can you clarify whether it is a consulting position?

Best,

Clara

Hi there,

Quite a few elements here to break down!

What to expect in general

You should absolutely expect cases/questions to be much more deal focused. As such, you should practice M&A/DD cases.

Furthermore, they would absolutely expect you to leverage your existing experience in your answers.

Finally, I interviewed with PwC in their Technology practice and I can tell you that it felt much less "case-y" than the pure strategy firms. As such, just be prepared to not be taken through a whole case. As an example, off the bat I was asked "How would you organize a backlog of IT enhancements". Of course, I used my judgement to not treat it like a case and just went through the classifications/process I would use and why. Make sure to read the cues here!

How to Prepare

1) Search on M&A/Acquisitions/Valuation here (already done): https://www.preplounge.com/en/management-consulting-cases?language=en&topic[]=1&topic[]=19&sort=real-case-desc&page=1&perPage=20

2) Google and casebooks are your friend. For example (https://managementconsulted.com/case-interview/case-interview-examples-master-list/)...go to the various company sections to find M&A cases

Fit / Behavioral Preparation

Step 1 - Categorize the main stories

There are 5-10 "themes" you need to prepare for. i.e. Leadership, teamwork, challenge, etc. Figure out this list and make sure your stories cover this range (PM me and I can provide you with a template for this list)

Step 2 - Create FLEXIBLE stories that cover a range of categories

You need to create 4-6 stories that each cover a range of topics. They need to be powerful stories that can be adjusted and adapted based on the question asked.

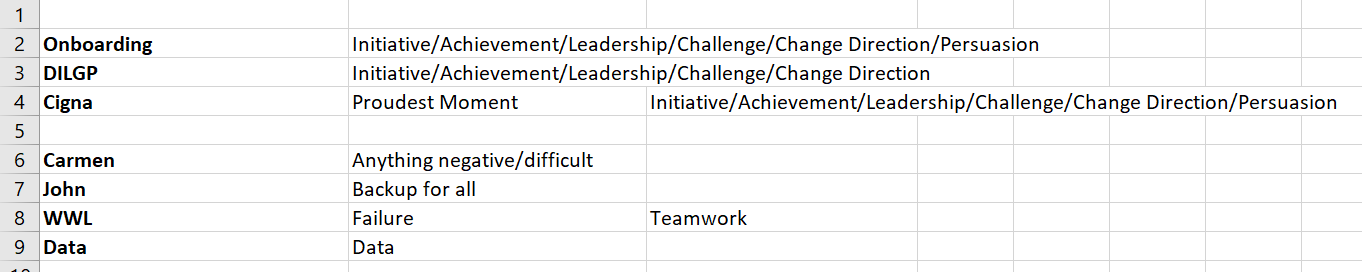

One of my "core" or "killer" stories was usable for Initiative, Achievement, Leadership, Challenge, Change of direction, AND Persuasion.

Write down these stories along STAR or similar format...use bullet points

Step 3 - Organize these stories so you know which ones can be used for what and PRACTICE

Make sure you cover the whole gambit. Then, practice getting asked a question and thinking of which stories apply. I can assure you, no-one is coming up with full stories in a few seconds. Rather, they have practiced how to adapt an existing story to the question asked.

Good luck!