Does anybody understand how to work with the price elasticity?

Price elasticity

Price elasticities being negative means that an increase in price will lead to a decrease in volume and vice versa. Ex. a 1% increase in price leads to a 1% decrease in demand (elasticity of -1)

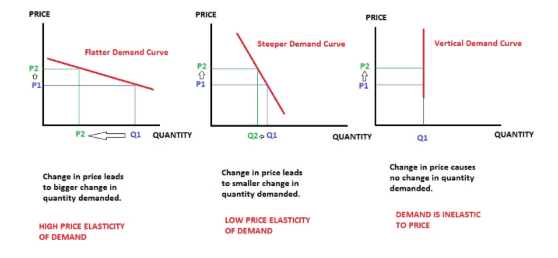

This is what happens with different elasticity values:

- 0 mens its inelastic (a change in price does not change demand)

- Between -1 and 0, the impact in demand is smaller than the change in price → increase in price leads to higher revenues

- -1 means you have similar effects (of opposite direction) in price and demand

- Lower than -1 (e.g. -2) means it will lead to a even bigger change in demand → decrease in price leads to higher revenues

Elasticities in the case are of -0.5 and -2:

- As the frequent travellers are slightly inelastic (-0.5), demand changes slowly with changes in price. To raise demand to 990 you will have to reduce significantly the price. You'll have max demand at 120 price but lower revenue (42.76 million). It's not a good decision.

- Explorers have -2 elasticity, so it's of larger magnitude, so a small change in price allows for a great gain in clients. So you get less per client, but much more revenue.

Hi there,

I highly recommend you do a bit of googling here as it's a bit of a tricky concept to grasp.

Essentially, price elasticity is saying “If I charge $1 more, how many fewer people will buy” (And vice-versa).

I like this exhibit from socratic:

Hello!

To add on top of the great answers by the previous coaches, elasticity is a quite niche concept to find in consulting interviews. Apart from SK interviews, given their focus in Pricing, I am sure you won´t use it in 99% of the cases.

Cheers,

Clara

Hi there,

the theory is well explained below by Ian and Pedro, if you would like to understand how elasticity works it in practice, feel free to reach out, I am BCG expert in Pricing competence center.

Lucie

Was this answer helpful?