Hi there,

somehow i am struggling with understanding whether, for a market entry, it is better to have a concentrated market or a fragmented market. I understand that fragmented markets are often more competitive and many companies might be competing on prices. however, for concentrated markets, it might be harder to steal customers from the incumbents in the market.

What criteria would you recommend to consider here?

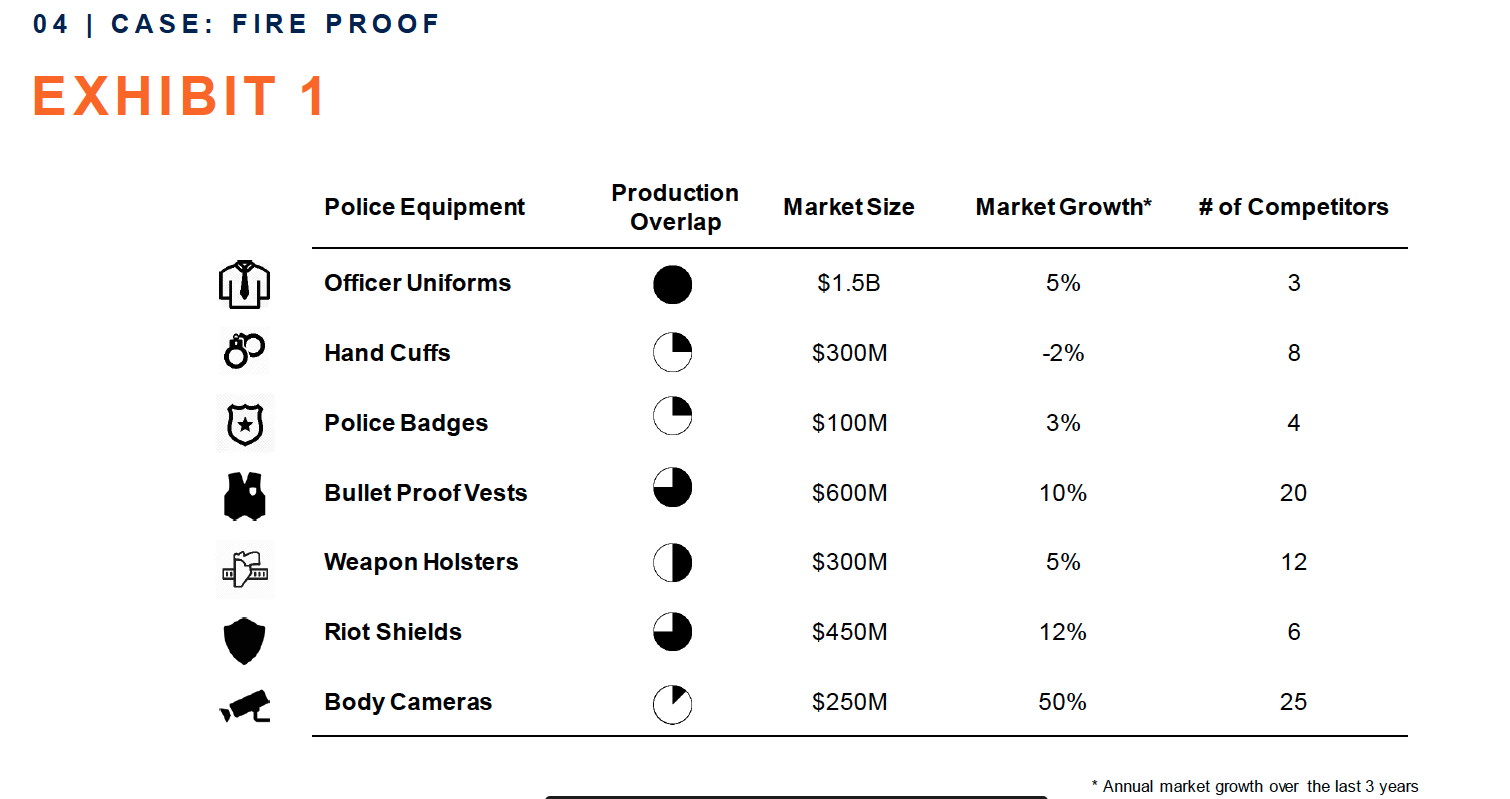

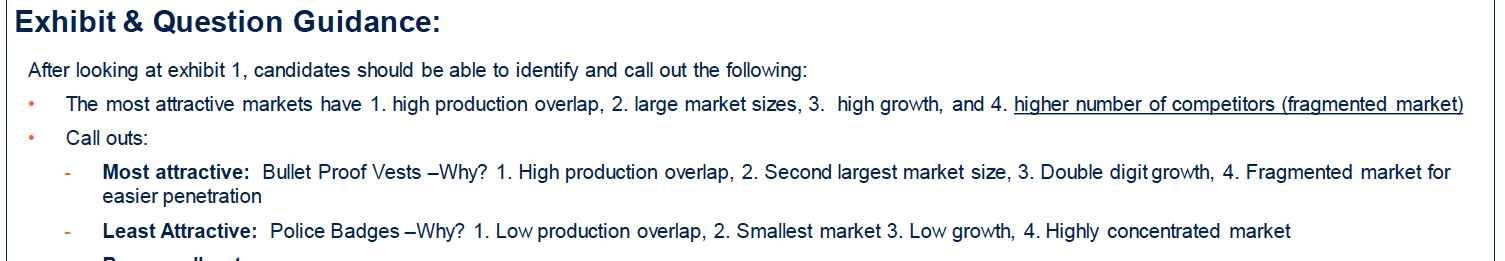

I came across this question due to the following example from a casebook (Darden 2018) in which a company selling equipment/clothing for firemen is looking to grow into adjacent markets. Based on the followin exhibit, one should make a decision.

In the casebook solution they say that the higher the number of competitors, the more attractive the market from a competition stand point. Is this always true?

Thanks in advance! :)