I have been preparing for a few upcoming interviews, and have faced the following two recurring questions frequently during my case prep process. Usually, there is further information which helps me substantiate my choice, but a lot of times the questions below are posed as it is (was asked to me by an MBB interviewer) and I feel like I could have answered it better:

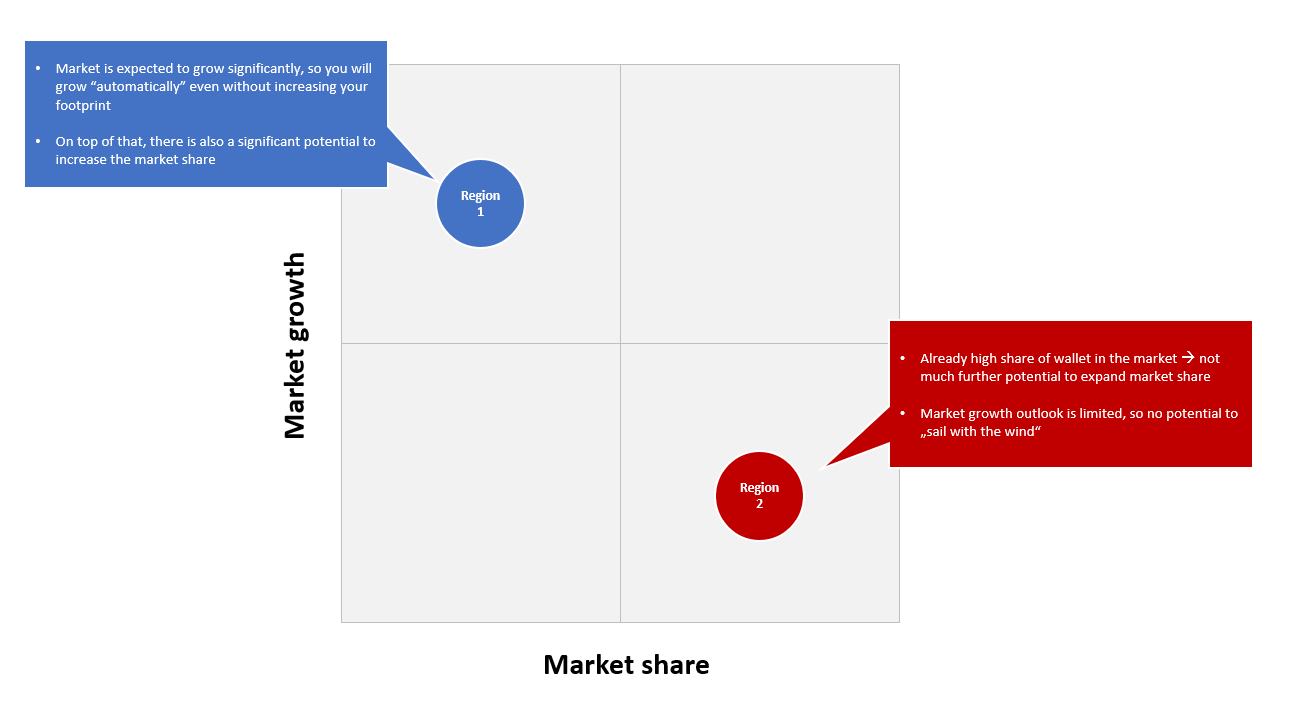

1. If it is a growth case and I am to choose between 2 regions for expansion, one that has a small footprint for the client but high expected market growth rate, and one that has a large existing footprint but low expected growth rate, which is a better market to focus on? (if the answer is 'it depends', what factors does it depend on? Let's take the example of a prototype industry like Healthcare)

2. In a market entry case, if I have to choose between 2 countries to expand into, one of which has a concentrated market with two market leaders and the other which has a fragmented market with multiple smaller companies, which country should I choose? (Again, if the answer is 'it depends', what factors does it depend on? Taking the example of the Healthcare industry for ease of comparison)

Thanks for your help!