Dear all,

I always have problems reading charts. Now, I'm trying to make sense of the first chart - exhibit B payment processing breakdown. Would appreciate your help!

Below is the case prompt.

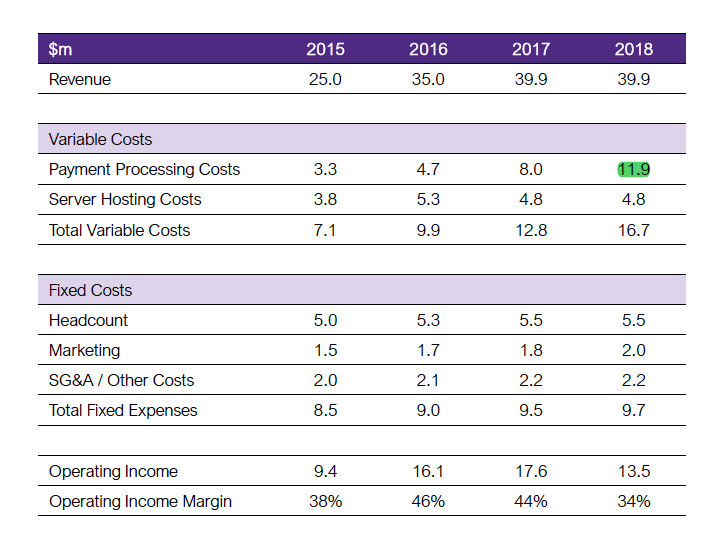

Our client is Prospect Equity Partners (‘Prospect’). They have recently acquired Events.com.

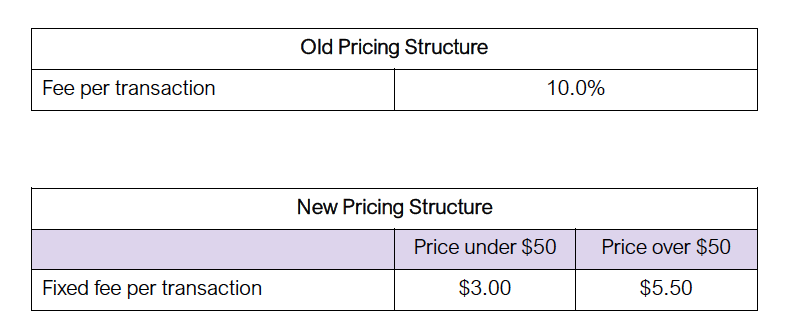

Events.comis a leading SaaS-based registration/ticketing platform for Endurance events (5K runs, Marathons, Triathlons, Mud Runs, etc.). They make money by taking registrations and processing payments for events and charging a fee per transaction (similar to Ticketmaster or Eventbrite) ($100 registration price x 10% Fee = $10 in Revenue for Events.com)

•Events.com has doubled market share since 2015, but in the last two years revenue is flat and profits are down, despite growing share. Prospect wants you to determine what is causing this and come up with a plan to improve profitability

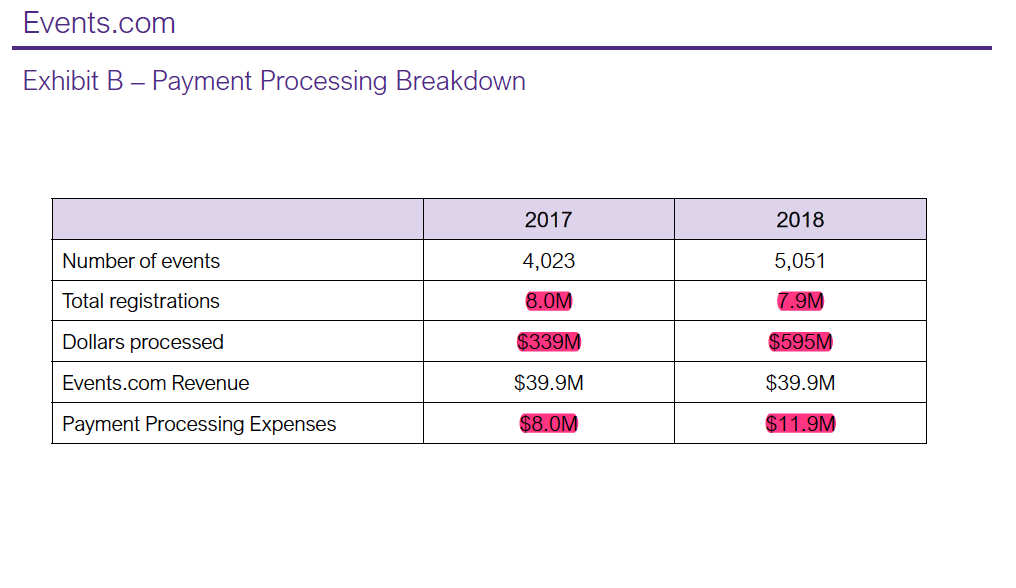

Below is my understanding of chart B

1. I calculated average price per registration for 2017 and 2018

$339M/8M= $42 and $595M/7.9M=75

2. Then I calculated average revenue per registration for 2017 and 2018

$39.9M/8M=$4.9 and $39.9/7.9M= $5

3. Compare those numbers, conclusion is - we used to make more than 10% per registration on average, now is only 6.7%. so the pricing structure is the roots of this problem.

4. payment processing expenses increased is due to the increased money we processed- from 339M to 595M.

Is my interpretation correct?