Back to overview

51

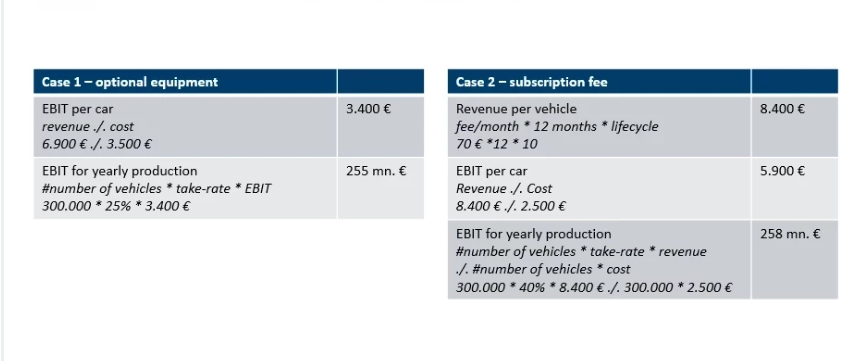

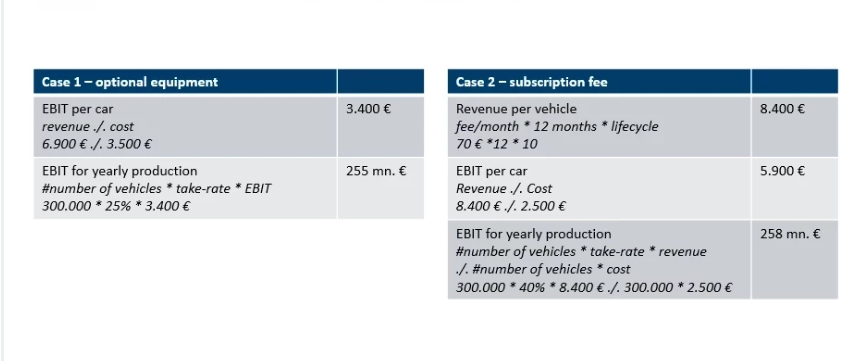

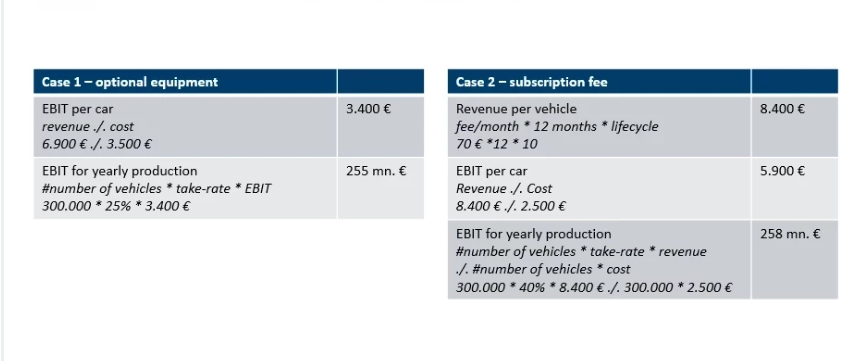

For the EBIT calculation for the subscription when subtracting, why is it 300k x 2500 and not 300k x 40% x 2500?

Anonymous A

on Sep 04, 2024

USA

Question about

Case

MBMC Case: Exploring the future of automotive mobility - MBMC Case: Exploring the future of automotive mobility- under the solution, why was EBIT not used for subscription similar to one time purchase? What is the logic of the calculation?

1

2.0k

Be the first to answer!

Nobody has responded to this question yet.

Top answer

Martha

on Sep 05, 2024

Coach

4 years at Bain & Co | INSEAD MBA | I used PrepLounge to get my offer!

So my interpretation is that both scenarios (optional equipment and subscription fee) calculate EBIT, but they differ in structure due to the nature of each business model:

- Case 1 – Optional Equipment (One-time purchase):

- Here, the EBIT per car is calculated directly as Revenue - Cost, resulting in a straightforward profit per unit (3,400 €).

- For the yearly production, the formula is: EBIT for yearly production=number of vehicles×take-rate×EBIT per vehicle\{EBIT for yearly production} = \{number of vehicles} \times \{take-rate} \times \{EBIT per vehicle}EBIT for yearly production=number of vehicles×take-rate×EBIT per vehicle. This is because with a one-time purchase model, you get the revenue upfront, and it’s simply a matter of how many units you sell and at what margin.

- Case 2 – Subscription Fee:

- In this case, the revenue is not upfront but earned over time, based on a subscription model (fee per month, multiplied by months and lifecycle). The logic for this EBIT per car still follows the formula Revenue - Cost but accounts for revenue over a subscription period, not an immediate lump sum.

- For yearly production, the EBIT calculation is slightly different. It calculates the total revenue per car over the lifecycle, adjusted by the take-rate, and then subtracts the total cost of production for those vehicles: EBIT for yearly production=(number of vehicles×take-rate×Revenue per vehicle)−(number of vehicles×cost per vehicle)\{EBIT for yearly production} = \left( \{number of vehicles} \times \{take-rate} \times \{Revenue per vehicle} \right) - \left( \{number of vehicles} \times \{cost per vehicle} \right)EBIT for yearly production=(number of vehicles×take-rate×Revenue per vehicle)−(number of vehicles×cost per vehicle) The reason it’s structured this way is that revenue accumulates over time in the subscription model, unlike the immediate earnings in a one-time purchase.

So...

- The main difference in calculation stems from the timing of when the revenue is realized. In Case 1, revenue is received upfront, while in Case 2, it’s received incrementally over the subscription period. Therefore, the EBIT for the subscription model reflects this staggered revenue inflow compared to the one-time equipment purchase.

Does this make sense? Let me know if you have any further questions :)

1 comment

C

Chumani

on Mar 08, 2025

Similar Questions

Most Popular Posts

Mck PEI

9

9

on Feb 16, 2026

Global

6

100+

Top answer by

Alessandro

Coach

McKinsey Senior Engagement Manager | Interviewer Lead | 1,000+ real MBB interviews | 2026 Solve, PEI, AI-case specialist

6 Answers

100+ Views

+3

Take home case study for a boutique consulting firm

8

8

on Feb 17, 2026

DACH

6

100+

Top answer by

Mateusz

Coach

Netflix Strategy | Former Altman Solon & Accenture Consultant | Case Interview Coach | Due diligence & private equity

6 Answers

100+ Views

+3

My mind goes blank when I try to brainstorm and come up with a framework

11

11

on Feb 18, 2026

Global

9

100+

Top answer by

Soheil

Coach

INSEAD | EM & Strategy Consultant | 3.5Y Consulting | 5★ Case Coach | 350+ Cases | 50+ Live Interviews | MBB-Level

9 Answers

100+ Views

+6

Would I be considered an experienced hire?

10

10

on Feb 18, 2026

UK

8

100+

Top answer by

Alessandro

Coach

McKinsey Senior Engagement Manager | Interviewer Lead | 1,000+ real MBB interviews | 2026 Solve, PEI, AI-case specialist

8 Answers

100+ Views

+5

Mckinsey Interviews

15

15

on Feb 18, 2026

Middle East

8

200+

Top answer by

Alessandro

Coach

McKinsey Senior Engagement Manager | Interviewer Lead | 1,000+ real MBB interviews | 2026 Solve, PEI, AI-case specialist

8 Answers

200+ Views

E

+5