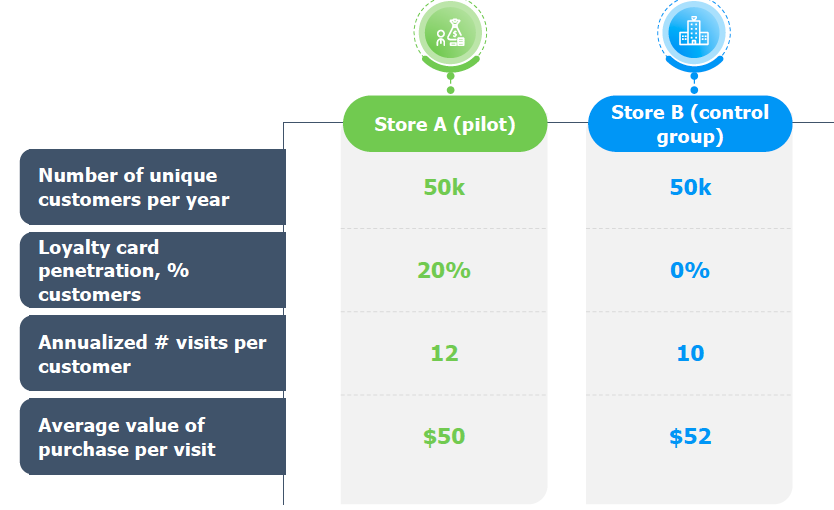

Client has decided to launch loyalty program and wants to calculate what would be a 1-year break-even number of loyalty card members. Answer: 82k members. How do you get this answer? Do we need the control group data? Can't we just work with Store A data?

Profit margins:

– 19% for store A (pilot)

– 20% for store B (control group)

• Expenses on own loyalty card platform:

– $4M in capex to build

– $0.1M in annual opex

Think about it this way. You have a Store with a certain profitability. You are wondering if you should introduce a loyalty card. So you introduce the credit card and look at total profitability. So what is the impact of the loyalty card? Is it a) the total profitability of the store? or b) the additional profit you make? The answer is b) as that's the profit that can be specifically attributed to the loyalty card.