Company case by Oliver Wyman

Oliver Wyman Case: Setting up a Wine Cellar

118.0k

Times solved

Beginner

Difficulty

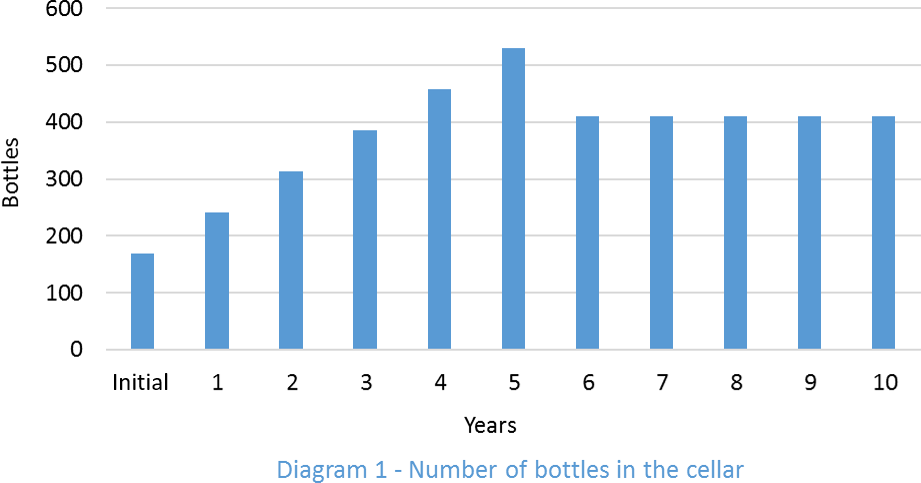

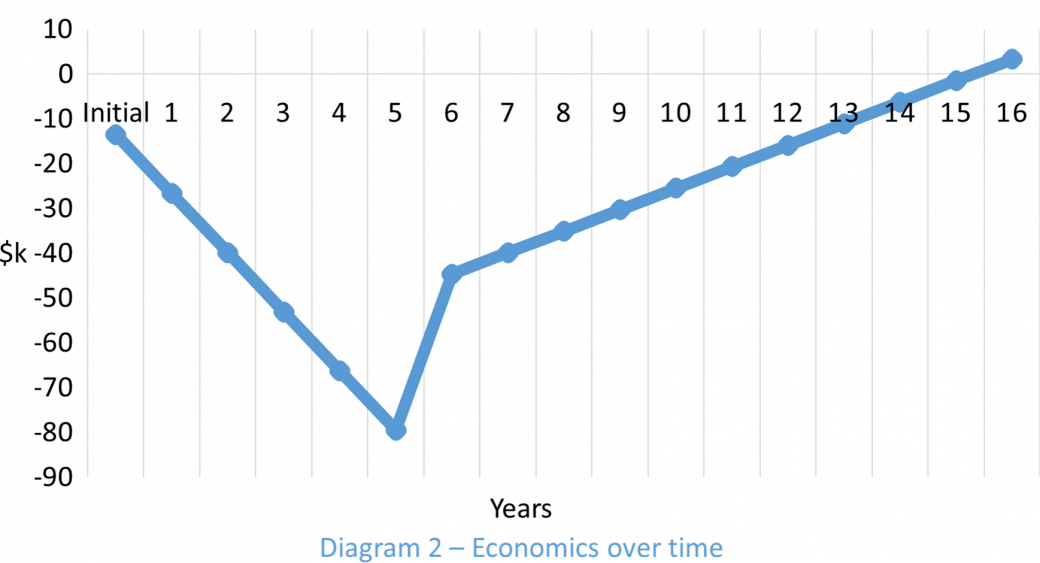

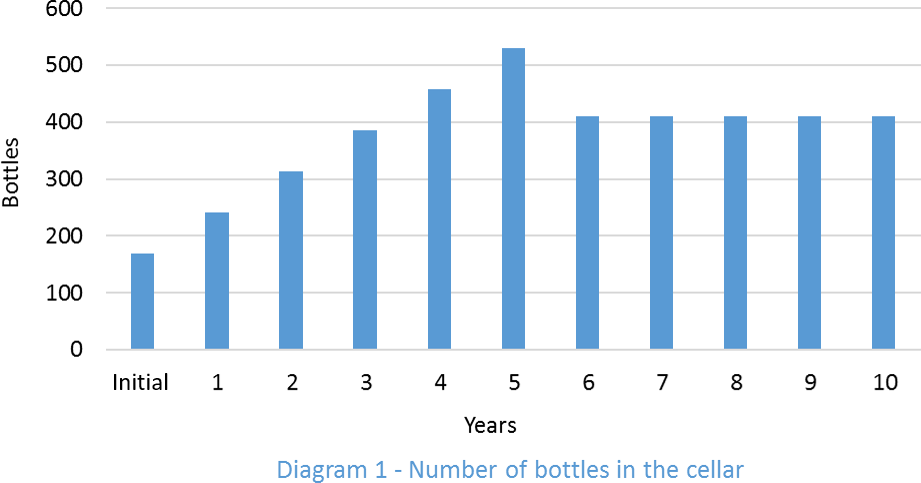

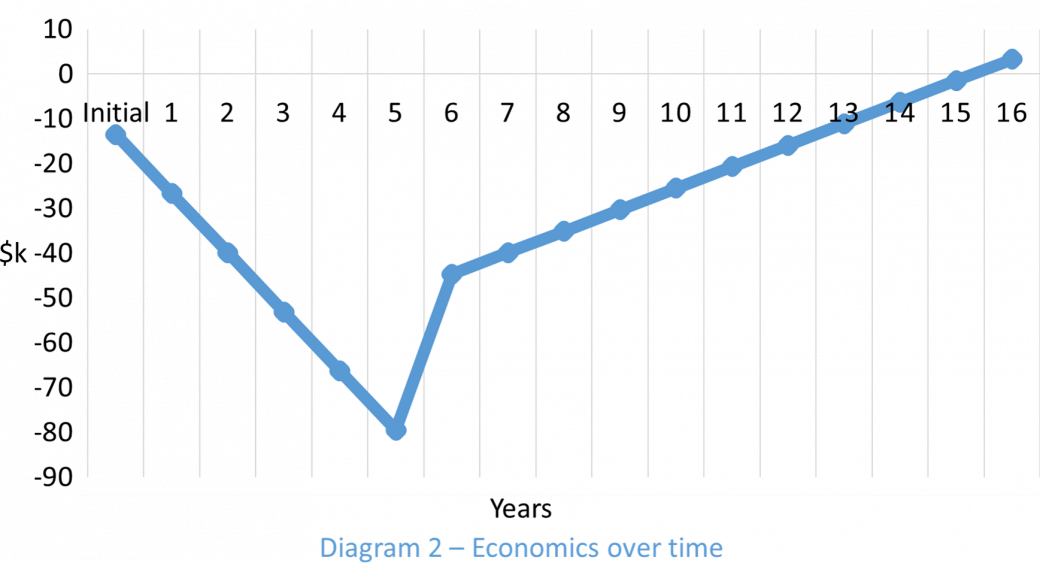

I’m thinking about setting up a wine cellar in my basement. The way I see it, shelf space would be divided into two sections: (1) a “drinking” section where I store bottles for my own consumption and (2) an “investment” section where I store bottles that I intend to sell at a profit after they appreciate in value several years down the line. The idea is to earn enough money with the “investment” section of the cellar in order to subsidize whatever I consume in the “drinking” section over time.

I'm obviously constrained by several things: the amount of money I am able to spend, the amount of wine I can (or want to) drink, the space available for the cellar, and so on.

Case Comments

118.0k

Times solved

Beginner

Difficulty

Do you have questions on this case? Ask our community!